Solanke's paper - Pison Housing Company

advertisement

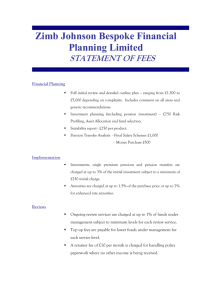

MANAGING DIRECTOR / CEO, ASSET & RETIREMENT MANAGEMENT COMPANY (ARMCO) - MR DAPO SOLANKE SPEAKING AT AN INTERNATIONAL HOUSING FINANCE WORKSHOP ON “N25 BILLION RECAPITALISATION: A BLUE OCEAN OF OPPORTUNITIES FOR MORTGAGE & HOUSING FINANCE BUSINESSES IN NIGERIA” ORGANISED BY PISON HOUSING COMPANY, A HOUSING FINANCE ADVISORY AND CONSULTANCY FIRM BASED IN LAGOS. THE WORKSHOP HELD ON OCTOBER 13TH & 14TH 2005 AT LAGOON RESTAURANT TOPIC: PENSION REFORMS AND ITS EFFECT ON THE EMERGING MORTGAGE MARKET IN NIGERIA Before the Pension Act 2004, there has been an endemic pension crisis in the economy with unfunded arrears of about =N=3 trillion?, pensioners not being paid entitlements regularly, existence of Ghost pensioners in the Public Service, pensioners dying on verification queues, unstructured and unfunded private sector schemes, diversion and mismanagement of existing Pension Fund by the Board of Trustees and Managers of the fund. As a result of this, the government started work on developing a contributory pension scheme The key objectives of the scheme is to To ensure that every person who has worked in either the public or private sector receives his retirement benefits as and when due; To assist improvident individuals by ensuring that they save to cater for their livelihood during old age; To establish a uniform set of rules and regulations for the administration and payment of retirement benefits in both the public and private sectors; Mandatory Retirement Savings Account to be put in place by employer for all employees in Public and Private Sectors; To provide death- in- Service benefit of a minimum of three times the annual emolument of a staff that dies in service. Investment windows for pension funds includes using The Money Market Instruments and Government Securities as a Tool for Pension Fund Investments and using The Mortgage Market Instruments (Real Estate Investment) as a Tool for Pension Fund Investments. With Pension Reform expected to take off fully in Nigeria by 2006. This means an estimated 30 million Nigerian Workers will be making contributions to Pension Funds and such funds will be invested in long - term investments in Mortgage Market and other investment windows approved by the reform act. There will be a huge pool of long-term funds available for investments, which will form a good foundation for economic development most especially in Mortgage Market Investment. Expected amount available for Mortgage businesses is put at N3.6 Trillion. Mr. Solanke also highlighted some of the constraints facing the mortgage markets which include; Long term nature of project and funding, Need for clean title documents, Maintenance of well finished structures by professional managers that will attract revenue, Multiple title problems, Long period break-even point, small market and developing at a low pace, Regular liquidity crisis, Poor capitalization of Primary Mortgage Institutions (PMI), Inadequate experience of Practitioners, Lack of Focus-concentration on non-mortgage transactions, Lack of support by Govt. in providing infrastructure, Poor quality housing schemes/uncompleted projects, Politically motivated projects, Inability of PMI to compete with big banks and Poor management and outright diversion of funds. However, the good news is that with the Pension Reforms Act 2004, the impact of the reform is enormous on the mortgage market and it includes; Availability of huge long term investable funds to finance Mortgage Market, Job creation for all Professionals who have business in the sector-Estate Valuers and Surveyors, Architects, Builders, Engineers, Accountants, Lawyers, Bankers, Portfolio Managers, Advertising Companies etc., Competition amongst Operators-PMI, Builders, Architects, Surveyors etc., Mortgage Credit will be available to credible Nigerians and Contributors at a reasonable cost, Availability of data base of activities for planning and investment will be developed for the nation, New and stronger mortgage Institutions will be established with hybrid Mortgage Market products, Securitisation of mortgage transaction to allow for further investments (Unitisation, Mutual funds, Equities) to further develop the capital market, Attraction of foreign investors, Review and reform of Mortgage laws and practice in Nigeria, Request for increase in capitalization of PMI to about =N=1-2bn or above to enforce stability, profitability and confidence in the sector, Encouragement of Merger to enhance mega mortgage institutions to make the market vibrant, Representation of consortium to make presentation to Government and relevant authorities on capacity building of the market, Provision of affordable houses for all Nigerians, and Contribution of the market to the nation’s GDP. Challenges of the Act The Pension Reform Act 2004 did not specify the percentage of the total fund that should be invested in mortgage market, No mention was made of the type of mortgage institutions that can benefit from the fund unlike as stated in the capital market investment, Preference for areas of mortgage investment that will benefit contributors were not stated in the law, Extent of responsibilities of practitioners were not defined in the law, Development of mortgage products that will absorb the anticipated large long term funds is lacking, Knowledge gap in the industry and poor quality jobs, Inconsistent Government policies and Political Crisis. Proffered Solutions Some of the solutions proffered by Mr. Solanke includes; Professionals should form a consortium that will produce a blue print of how the long term fund should be applied by PMI and other relevant operators to enhance economic development, to avoid loss of pension fund, benefit contributors and operators, Such Consortium to make representation to PenCom to facilitate their roles under the new pension reform. While thanking PISON HOUSING COMPANY, the organizers of the workshop, Mr. Solanke proffered Regular and updated training, seminars, workshops and exhibitions that can boost the capacity level of drivers and operators of the business. He further stated that Investment in this sector is recommended for good returns, storage of value, Capital appreciation, a hedge against inflation and as a perfect match for long term pension fund. He also mentioned that The supervisory authority should state clearly the proportion of the fund that should go into Mortgage market investment to enhance adequate planning in the sector. In concluding, Mr. Solanke stated that considering the large sum of funds expected when this new pension law is in full operation, coupled with other government polices to amass investable fund in the nation’s economy, there is no doubt that the mortgage market will witness unprecedented growth in the next few years of take-off of the PRA 2004. PMI and other relevant institutions should stand up for the challenges and opportunities available to them for optimum growth.