Note: As from 1 July 2006, all tariffs are taxable. The... TARIFF RULES

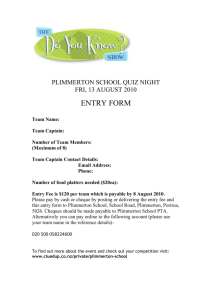

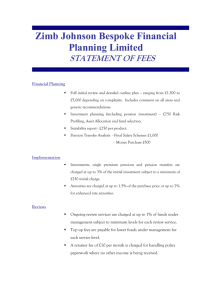

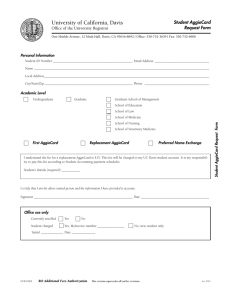

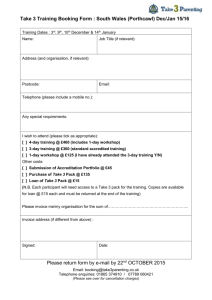

advertisement

TARIFF RULES LAND USE MANAGEMENT TARIFF STRUCTURE FOR 2013/2014 Note: As from 1 July 2006, all tariffs are taxable. The tariffs listed in the Land Use Management 2013/14 tariffs table therefore include 14% VAT. Kindly consult the relevant 2013/14 LUM Tariff table for the correct updated (VAT included) amount. 1 GENERAL Period applicable 1.1 Fees are effective from 1 July 2013 to 30 June 2014. 1.2 The tariffs replace all previous tariffs charged by the Land Use Management Branch of the Planning & Building Development Management Department of Council. Method of payment 1.3 Fees can only be paid in cash or by cheque at any cash office. Internet payment is not yet available as an option for the payment of land use management fees. 1.4 Cheques must be made payable to the City of Cape Town. No post-dated cheques will be accepted. No cash may be handled at any District Planning office. Time of payment 1.5 All fees are due at the time of submission of an application, except where the need for additional applications, impact statements / assessments or advertising only becomes apparent at a later stage, at which time such fees are then payable. In such a case, the applicant must be notified in writing of the further payment required and processing of the application may only resume once such payment is made. This must be clearly stipulated in the notification. 1.6 Applications are only processed upon payment of all prescribed fees. Proof of payment 1.7 A receipt must be issued to the applicant for all fees received. A copy of the receipt must be filed on the relevant application file. Refunds 1.8 All fees payable are set tariffs and not deposits. 1.9 In the case of withdrawal or closure of applications, and subject to the approval of the Director: Planning & Building Development Management, refunds are payable on request by the owner or applicant as follows: Before advertising takes place – the full advertising fee and 50% of the total of all the other application and complexity fees. After advertising has taken place – no refund. Land Use Management Tariff Rules 2013_14 1 1.10 Where an exemption or reduction of fees is granted in terms of the provisions of paragraph 2.16, the refund is payable as per the decision. 1.11 In the case of errors or incorrect charging and subsequent correction thereof by the department, and subject to the approval of the Director: Planning & Building Development Management, all fees paid in relation to such an error or correction are refundable. Subject to change 1.12 All fees and tariff rules are subject to change. 1.13 Fees payable are those applicable at the time of submission of an application. 2 BASIC APPLICATION FEES Description 2.1 All fees are payable per item applied for (e.g. each consent, departure, rezoning, etc., as well as departures from street and other building lines, coverage, height, etc., charged separately) in the case of multiple applications, subject to the provisions in paragraph 2.3. Amendment of conditions of approval are charged per condition amended and site development plans are charged per plan (or set of plans) submitted or amended. 2.2 Areas rezoned to Subdivisional area, multiple zones or split zones are calculated separately for each area rezoned to residential, industrial, business / commercial or any other zone. Regulation departures (including departure / consent / waiving as a result of a title deed restriction) 2.3 The fee must be charged for each departure separately, i.e. if a building departs from the street and lateral building lines and coverage, as well as from height, then the applicable fee must be charged for each of the abovementioned four departures, except for single residential properties occupied by a single dwelling house, or double (2) dwellings, or a main dwelling and a second dwelling, or a property used exclusively for the aforegoing purposes regardless of its zoning. In the case of 2 residential properties (larger than 200m ) occupied by a single dwelling house, or double (2) dwellings, or a main dwelling and a second dwelling, or a property used exclusively for the aforegoing purposes regardless of its zoning, an application for departures from building lines, coverage, building height, boundary wall height and for a second dwelling unit would require only a single fee for the building line, coverage and boundary wall height (first fee) and a single fee for the departure from building height and a second dwelling unit (second fee), if applicable. In the case of 2 residential erven 200m or less, as well as subsidised housing schemes, no departure fee at all would be required in either of the above two examples. These Regulation departure fees and related tariff rules equally apply in cases where a zoning scheme permits structures in or the encroachment of building lines with Council’s and/or an affected neighbour’s consent or approval. 2.4 Consents, temporary departures, rezonings, etc for properties occupied by single and double dwelling buildings are charged separately and in addition to any (regulation) departures applied for. 2.5 Where a departure from a development rule is required as a result of a restrictive title condition, the same method to calculate the fee for a regulation departure will apply. Land Use Management Tariff Rules 2013_14 2 Only the regulation departure fee (single fee payable) will be levied in cases where a departure is required in terms of both the scheme regulations and the title deed restriction. Subdivision 2.6 The number of erven include the remainder (“parent erf”), i.e. if an erf is subdivided into two portions (the remainder and the new erf), this is counted as two erven. In addition, any intermediate portions that are created and which may later be consolidated again are also counted. Public roads and public open spaces are excluded from the calculation. Removal of restrictions 2.7 This fee includes applications for amendment, suspension, relaxation or removal of restrictive title deed conditions. Where Council’s consent is required in terms of a restriction, or where the competent authority permits a shortened procedure by means of a so-called “soft title restriction relaxation / waiver”, a specific fee is charged for this. Site development plan / Sketch plan / Package of plans 2.8 If a Site development plan or Sketch plan is made up of a set of more than one plan or drawing, the applicable fee is charged for a single Site development plan or Sketch plan only. A Site development plan or Sketch plan fee is not payable if a Site development plan or Sketch plan is approved at the same time that it is imposed as a condition of approval. These rules also apply to other components of a package of plans. Rezoning 2.9 In the case of rezoning to Subdivisional area, any area of land rezoned to Subdivisional area which retains the same zone after the Subdivisional area comes into effect, is excluded in the calculation of the rezoning fee, ie no fee charged in respect if rezoning for such area(s). Exemptions 2.10 All applications submitted by or on behalf of Council are exempt from all the application, advertising and other fees in the attached table. This exemption only applies to applications made by or on behalf of Council or where Council is the developer. All other government institutions must pay the normal fees. 2.11 No application or advertising fee is payable by an applicant where re-application or re-advertising is required due to error or failure on account of the department or its staff. 2.12 Applications for the establishment of state, provincial and/or Council (directly) subsidised housing schemes are exempt from all the application, advertising and other fees in the attached table. This includes fees payable in respect of subsequent subdivision clearance. Application fees are, however applicable in subsidised housing areas after the initial establishment of the area is completed; subject to the conditions in the establishment of any such townships, as well as for GAP housing projects. 2.13 All applications required to address / give effect to successful resettlement claims in terms of the Restitution of Land Rights Act, as well as in cases where land has been allocated to a successful Land Use Management Tariff Rules 2013_14 3 claimant, such claimant is allowed to submit only one application, for residential development only (but including subdivision, removal of restrictions, departures etc, related to such residential development), which application(s) are exempt from all the application, advertising and other fees in the attached table. If a successful land claimant submits a mixed use development application (which includes non-residential development) on land so obtained, such non-residential development is charged the normal fees as specified for such application, including advertising and serving of notice fees, as if the non-residential part of the application is a separate application from the residential part of the development. In cases where a successful land claimant submits a purely non-residential development application (which does not include any residential development) on land so obtained, such non-residential development application is subject to all the fees applicable to any other similar development or land which wasn’t acquired by way of the Restitution of Land Rights Act. 2.14 All applications for places of instruction (or similar use as per the applicable zoning scheme) for the purposes of Early Childhood Development (ECD) centres only, are exempt from all application fees including the fee for serving notices, but excluding the fee in cases where an application is advertised in the press. 2.15 No basic application or complexity fees are payable in respect of any application made in response to a previous refusal (including closure or withdrawal) of the same or a materially similar (as per the District manager's opinion) application on the same premises, if submitted within a period of 12 months from the date of final notification of the previous decision or withdrawal / closure thereof and with the express intent to address the previous reasons for refusal / closure / withdrawal. The department's interpretation in this regard is final, and advertising / public consultation fees, if applicable, remain payable. 2.16 Applications in respect of any building to be erected or altered or additions thereto in the Atlantis Industrial Area as defined in the Cape Town Zoning Scheme. 2.17 The Director : Planning & Building Development Management may grant or refuse applications for exemption of some or all the applicable fees for a particular application which are necessitated due to changes made to developments at the request of the Environmental Resource Management department of the City in the interest of environmental or heritage conservation. 2.18 The fees in the attached table, if not specifically exempted, also apply to applications in the former Black Communities Development Act (BCDA) areas where Council is the commenting authority. 3 COMPLEXITY FEES Description 3.1 An additional complexity fee is charged on top of the basic application fee when a Heritage Impact Assessment (HIA), Environmental Impact Assessment (EIA), Traffic Impact Statement / Assessment (TIA/S) and/or Major Hazard Installation Assessment (MHI) are required, since such applications are more complex and involve more work. The complexity fees are charged to cover additional expenses due to the processing of complex applications, resulting from the fact that such applications normally are more complicated to process and due to the fact that it requires input from specialised staff which would not normally be involved in the assessment of applications which Land Use Management Tariff Rules 2013_14 4 doesn’t require such impact statements / assessments. The EIA and HIA fees are charged up front like all other fees if the application requires assessment in terms of the NEMA and/or NHRA. The regulations promulgated in terms of Chapter 5 of the NEMA distinguish between listed activities subject to “Basic Assessments” and listed activities subject to “Scoping and Environmental Impact Assessment”. The NEMA therefore separates listed activities into two groups and stipulates different assessments for each group based on difference in scale, predictability and risk impacts. The complexity of assessing applications involving the listed activities within these two groups will therefore differ and this approach is therefore also reflected in the Complexity fees structure. If an EIA and/or HIA fee has been paid when the LUPO application was submitted and it turns out in the end that it did not lead to a full EIA / HIA, the EIA / HIA fee is not refundable. 3.2 The difference between a Transport or Traffic Impact Statement (TIS) and a Transport or Traffic Impact Assessment (TIA) is that the TIS complexity fee is payable where the proposed development will result in 50 to 150 peak hour vehicle trips being generated (calculated in terms of the Department of Transport : SA Trip Generation Rates), while the TIA complexity fee is payable where the proposed development will result in more than 150 peak hour vehicle trips being generated (calculated in terms of the Department of Transport : SA Trip Generation Rates) – consult with your in-house traffic specialist in this regard. Multiple impact statements / assessments 3.3 When both a HIA and EIA is required and the HIA and EIA is combined into a single investigation / report, only one additional complexity fee (the higher of the applicable fees) is payable. 3.4 The impact statement / assessment fees described above are charged per application. If an applicant for instance submits an application which includes a subdivision, rezoning and departure, the relevant high impact fees will be charged only once, not three times. 3.5 In all cases except for 3.3 and 3.4 above, the complexity fees for a HIA, EIA and TIS / TIA are charged separately. 4 ADVERTISING / PUBLIC CONSULTATION FEES Advertising framework 4.1 The need for and extent of advertising or public consultation is prescribed in terms of the City’s Notification Policy for land use and development applications, the Land Use Planning Ordinance, Removal of Restrictions Act and Promotion of Administrative Justice Act (in some instances), as well as in terms of some zoning schemes. Advertising fees are thus charged accordingly. 4.2 Advertising in the press and advertising which consists of the serving of notices to interested and affected parties are charged independently (with different fees being applicable). No ‘serving of notice’ fee is applicable when notifying the applicant of the outcome of an application or notifying any objectors of any of the rights of appeal or lodgement of subsequent appeal. Advertising in the press 4.3 The fee for advertising in the press is applicable whenever press advertising is required in a community or metropolitan newspaper and/or Provincial Gazette. Land Use Management Tariff Rules 2013_14 5 4.4 Multiple applications in respect of the same subject property when advertised collectively in the press attract a single advertising fee. If such multiple application includes the advertising of a Removal of restrictions application, then the higher advertising fee for Removal of restrictions is charged. Serving of notices 4.5 The fee for serving of notices is payable when Council conducts the serving of notices. This fee is not applicable when the applicant conducts the advertising. 4.7 The fee applicable for different amounts of notices requiring to be served by Council is based on the following sliding scale (see tariff table for amounts): 1-2 letters 3-5 letters 6-10 letters 11-25 letters 26-50 letters An additional amount will be charged for every 50 letters (or part thereof) after the first 50 letters. 4.8 The ‘serving of notices’ fee is also applicable when notices are delivered by Council to interested and affected parties. 5 PRINTING, COPIES & INFORMATION PRODUCT FEES Printing fees 5.1 Printing fees are charged per page according to size, and whether colour or monochrome, unless otherwise specified. Copies are only made in the sizes that are available at a particular office. Information products 5.2 The Customised product compilation fee is charged per hour or part thereof, where the product takes more than half an hour to produce. 5.3 Both the fee for standard off-the-shelf and customised information products include the relevant delivery media, eg CD or DVD. There is therefore no extra charge for such media. 5.4 Where information is specifically requested in terms of the Access to Information Act, the requester is invoiced directly by the Legal Services department (where the application is also lodged) in accordance with the relevant tariffs specified in the regulations to the Act. Search fees 5.5 Search fees are charged per hour or part thereof when the requested information takes more than 30 minutes to find or produce. 27 June 2013 These tariff rules must be read in conjunction with the “LAND USE Land Use Management Tariff Rules 2013_14 6 MANAGEMENT TARIFFS 2013/2014”.