Wales Economic Growth Fund - Business Wales

advertisement

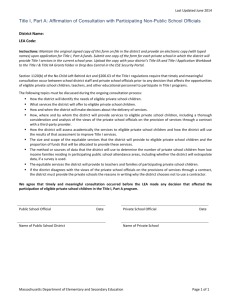

Wales Economic Growth Fund 2 Phase 2 Frequently Asked Questions I am not sure that my business or project are eligible for the scheme – how can I get advice? The Welsh Government Business Information Helpline will be pleased to assist. They can be contacted on 03000 6 03000. When do projects have to be completed by? All projects should be complete by March 2015 to enable claims to be paid within the financial year April 2014 to March 2015. What is the maximum intervention rate available? The Scheme is subject to the European State Aid limits. The level of support will depend on the project location and the size of the business involved. What is the minimum/maximum level of grant payable? For this round of funding the minimum grant requirement is £100,000. There is no maximum for this round but the level of grant will be limited by the State Aid intervention ceiling, the value for money criteria and will be the minimum necessary for the project to proceed. Do I have to create jobs to be eligible for the scheme? The main focus of the initiative will be the creation and safeguarding of jobs. It will be a competitive scheme and each project will be assessed against value for money criteria and will focus on the number and quality of the jobs created/ safeguarded as a result of the project. How do you define a safeguarded job? A safeguarded job is one which will be at risk in the short to medium term should the project not go ahead. You will need to provide a robust explanation of why the job is at risk and this will be tested at appraisal stage. What costs are considered eligible for support? Eligible expenditure can include new investment in capital assets such as plant and machinery, IT equipment, fixtures and fittings, buildings, capitalised lease costs ver a minimum of 8 years for new leases. Intellectual property purchased from a third party and one off professional fees associated with the project can also be eligible. Revenue costs associated with the day to day running of the business are not normally eligible for support. However, some one off costs, such as training on new equipment, can be considered on a case by case basis. Should Project costs include VAT? The costs should exclude VAT as this is not considered eligible for support. Can the fund be used to support the purchase of vehicles? Some specialist vehicles considered essential to the project could be eligible for support, provided they are part of a much larger overall capital investment project. Vehicles in isolation are not normally considered eligible. Support for mobile assets in general has to be justified on a case by case basis, as the level of support available is dependant on where the asset/vehicle is based, or its operational territory. Is the purchase of land or buildings eligible for support? The purchase of land and buildings can be eligible for support provided it is associated with a wider project involving investment in productive assets and job creation/safeguarding. The purchase of land or a building in isolation is not regarded as a project. Any WEGF support for new build projects will also be subject to BREEAM accreditations depending on the size of the buildings. It should also be noted that the funds will need to be spent before March 2015 The building would have to be completed and paid for within these timescales to be eligible for support. What is defrayed expenditure? Defrayed expenditure is costs which are discharged by payment or otherwise settled by the applicant, e.g. by cash payments, entering into a HP agreement, mortgage agreement or lease finance agreement. It should be noted that, any assets purchased under a HP or Lease Finance agreement, must ultimately be owned by the business. Lease hire for example is not an eligible source of finance for this scheme. In addition, the amount of grant support paid out will not exceed the amount physically defrayed by the applicant. Under a HP agreement for example, this would consist of the initial deposit plus the monthly instalments actually paid to the finance company. Are salary costs eligible for support? In projects with relatively low levels of capital expenditure compared to the salary costs of new jobs created by the project, the salary costs of the new jobs over 2 years can be considered as eligible for support on the basis of ‘Aid for Job Creation’. It should be noted that there still needs to be an element of capital investment involved that the creation of the new jobs can be linked to. Are revenue costs eligible for support? Revenue costs associated with the day to day running of the business are not normally eligible for support. However, some one off costs, such as training on new equipment, can be considered on a case by case basis. Can you give me a list of eligible sectors? The Wales Economic Growth Fund operates across the economy. Almost all manufacturing (ICT, Manufacturing, Aerospace, Defence etc) sectors are eligible, as are many service sectors that serve more than just the local market (e.g Environmental goods and services). However, local retail businesses and local services are not eligible as they have the potential to cause displacement. The European Commission (EC) also restricts the availability of grants in certain sectors, including fisheries and aquaculture, shipbuilding, coal, steel synthetic fibres and activities linked to the production of certain agricultural products. Businesses in the transport sector may be eligible for support, but not for transport equipment. Grant is not available to assist businesses that are experiencing financial difficulties with cash flow and/or balance sheet problems. Why does the fund not support retail businesses? An eligible project must have national and regional benefits. Retail by its very nature tends to be a local service with limited national benefits. If an applicant can prove that the business serves a wider/national area then they may be eligible for support from this fund. Are Social Enterprises Eligible? Businesses set up as a Social Enterprise can be eligible for support, providing the project is profitable and the profits are reinvested in the business. In addition, the majority of project funding must originate from the Private Sector and the business must be self sustaining after initial grant support. Does the Fund support franchises? Most franchises will not be eligible for support as, by their very nature, they are restricted to a particular territory with limited national benefits. There are also issues with regard to the overall control/ownership of the business which would prove problematic under WEGF criteria. How should the funding package for my project be structured? The funding package for each project will be judged on a case by case basis. However, as an absolute minimum, the majority of the overall funding should originate from the Private Sector. In an ideal scenario, there should be an even spread of risk across the Directors/Shareholders of the business, Private Sector and WEGF. Existing reserves already generated from profitable trading are regarded as an acceptable contribution to the project costs, as opposed to future trading profits which are regarded as speculative and not immediately available. However, future forecasted profits will, of course, be taken into account when reviewing the future viability of the project. I have completed my Expression of Interest form – what happens next? Your form will be checked for eligibility by a member of the Wales Economic Growth Fund team. Should your project be deemed eligible for support, an application form will be sent to you no later than 13 January 2014. Should your project be deemed ineligible, we will write to you with a full explanation of why this decision was reached. It should be noted that the earlier an Expression of Interest form is received, the sooner a decision can be made on eligibility and the sooner an application form can be issued.