Balance of Payments I

advertisement

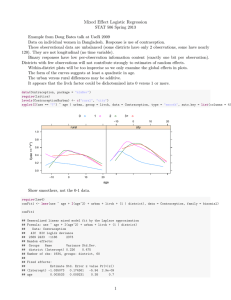

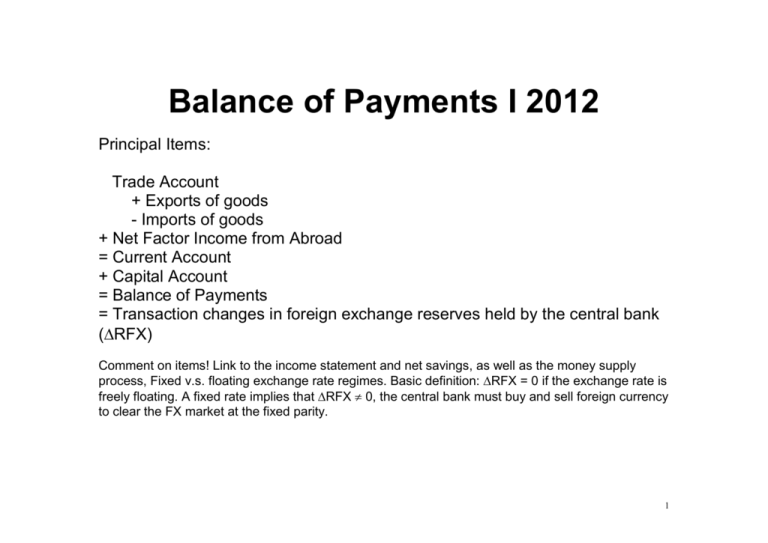

Balance of Payments I 2012 Principal Items: Trade Account + Exports of goods - Imports of goods + Net Factor Income from Abroad = Current Account + Capital Account = Balance of Payments = Transaction changes in foreign exchange reserves held by the central bank (RFX) Comment on items! Link to the income statement and net savings, as well as the money supply process, Fixed v.s. floating exchange rate regimes. Basic definition: RFX = 0 if the exchange rate is freely floating. A fixed rate implies that RFX 0, the central bank must buy and sell foreign currency to clear the FX market at the fixed parity. 1 Income and Balance of Payments The basic income equation in terms of spending: Y=C+I+G+X-M If X-M = Trade Balance/account GDP = C + I + G + Trade Balance If X-M = current account (trade account + net factor income) GNI = Gross Domestic Income GNI = C + I + G + Trade Balance + Net Factor Income From Abroad GNI = Y = C + I +G + X - M 2 Balance of Payments and Net Savings Y=C+I+G+X-M Use Y – C - G = S (savings by definition). Thus we have S - I = X – M (Net savings equal the current account) Current account surplus implies that the country is a net saver (invests abroad). A positive current account implies that the country is saving more than it consumes and buys foreign assets. A negative current account implies that the country is sending more and is borrowing from the rest of the world. Or, that the rest of the world is investing in the country. 2004: US current account deficit >6% with respect to GDP, big deficit. China on the other hand has surplus, and is investing in the US. 3 Balance of Payments and the Money Supply Process Money Demand is a function of income (+) and interest rates (-) : Md = f(y,P,i) = Pye-1 Money supply is a function of the monetary base MB and the kreditmultiplier (a): Ms = a(MB) Money market equilibrium: Md = Ms MB = Monetary base = Domestic Credit + Foreign Exchange Reserves = DC + RFX Under fixed exchange rates RFX change as a function of keeping the exchange rate fixed. => The central bank cannot control the money supply process and in the end not the inflation. If the central bank accommodates inflation => balance of payment crisis and devaluations. Under floating rates, RFX = 0, the central bank control the money supply and can chose the inflation rate. 4 How central banks (try to) control the money supply, the interest rate, and inflation? Central banks intervene in domestic money market to change DC DC = Government papers + Bank sector net position in Central Bank (Repos) By changing DC central banks affect short-term money market interest rates (and the money supply). Given the slope of the yield curve changes in the short-term interest rates are transmitted to medium and long-run interest rates. But, with fixed rates (dirty float) foreign exchange reserves changes through RFXt = RFXt + RFXt-1 RFXt-1 = Exchange rate * Value of Reserves in foreign currency 5 Fixed v.s. Floating Exchange Rates Principle differences Exchange rate : Demand and Supply of foreign exchange Fixed rates: The price of foreign exchange is fixed Quantity changes CB adds net demand for foreign currency to guarantee the price. Floating rates: The price of foreign exchange (the exchange rate) adjust to clear market D = S This has implications for monetary policy, especially under fixed rates. Money supply must ‘control’ or support the fixed parity. 6 The Balance of Payments II Current Account Capital Account = Transaction changes in foreign exchange reserves (RFXt) Fixed rates : RFXt ( 0) changes to clear the market at S = D Floating rates : RFXt = 0 exchange rates changes to clear the market Between the two : various forms of managed foreign exchange rate systems RFXt 0 CB intervention in FX markets 7 The Balance of Payments III - Details Current account Goods export – Goods import Trade Account + Capital account Foreign Direct Investment Portfolio Investments Equity (no control posts) Debt Financial Derivatives Other Investment Monetary Authorities Government Banks Other sectors Errors and Omissions = RFX Change in foreign exchange reserves. RFX is known! Zero if freely floating 8 Notice the Error and Omissions Term Current account + Capital account = RFX - Errors and Omissions It can be big!! Or, Currenct account +Capital account + Errors and Omissions (The errors and omissions are added here to make the identity hold) + RFX =0 From where comes the EO - term? What can be done? 9 Official Balance of Payment Statistics IFS recommendations Current Account +Trade Balance + Exports f.o.b. - Imports f.o.b. + Service Balance + Credit - Debit + Income + Credit - Debit + Current Transfers + Credit - Debit = Current account + Capital Account (WARNING: This is a Central Bank item, not the Capital Account from above) 10 + Financial Account + Errors and Omissions = Overall balance [= - Official settlement balance ( - Change in foreign exchange reserves)] = - Financing - Change in foreign exchange reserves Use of fund credit and loans Exceptional financing Current Account + Capital Account + Financial Account +Financing = 0 Notice that a positive BoP, positive overall balance leads to a negative sign on Financing (and change in foreign exchange reserves) Overall balance - Financing = 0 A surplus or a deficit is financed. This is accounting only. For our purposes, (-1) x "Changing in foreign exchange reserves" = Transaction changes in foreign exchange reserves! This item will go up when the overall balance is positive (sum of exports, or sum of inflows of money is larger than sum of imports, sum of outflows of money). 11 The Financial Account is Split into: Direct investment (Abroad + Domestic) - Portfolio Investment : Assets = Equity + Debt + Portfolio Investment : Liabilities = Equity + Debt - Financial Derivatives Assets + Financial Derivatives Liabilities - Other Investments Assets Monetary authorities Government Banks Others + Other Investments Liabilities Monetary authorities Government Banks Others Plus or minus refers to inflow or outflow of money 12