Module for Managers_Mod II_Operations–Retail Management

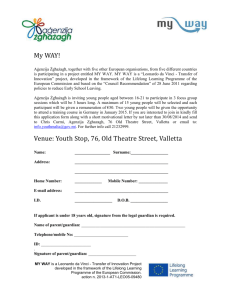

advertisement