Procedure #

advertisement

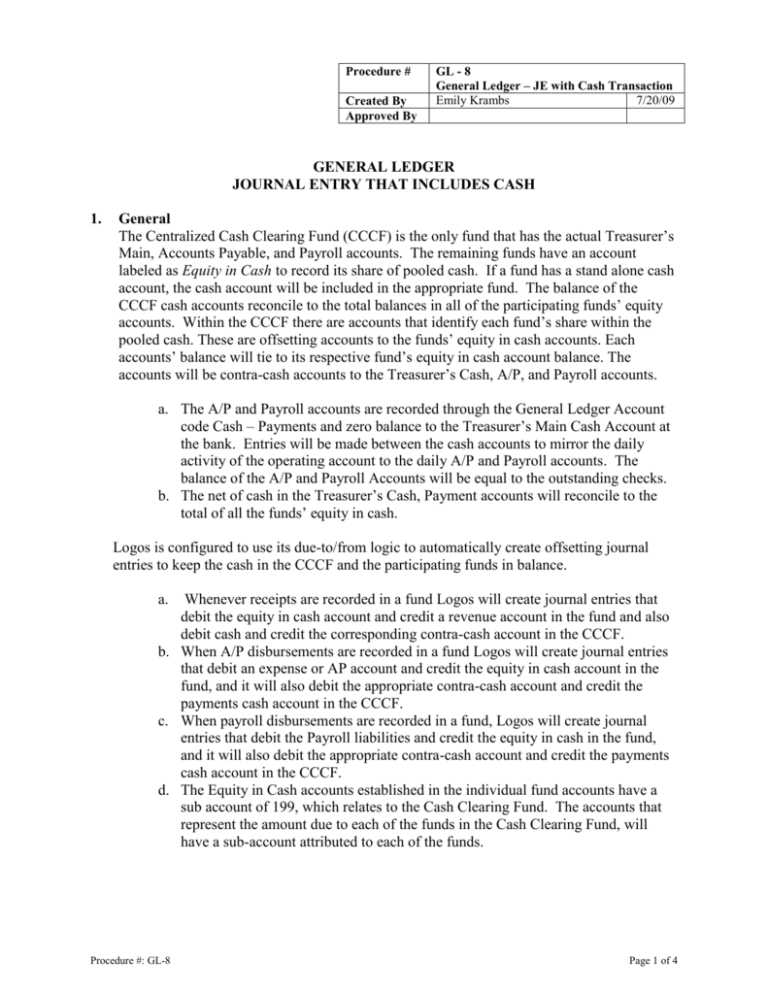

Procedure # Created By Approved By GL - 8 General Ledger – JE with Cash Transaction Emily Krambs 7/20/09 GENERAL LEDGER JOURNAL ENTRY THAT INCLUDES CASH 1. General The Centralized Cash Clearing Fund (CCCF) is the only fund that has the actual Treasurer’s Main, Accounts Payable, and Payroll accounts. The remaining funds have an account labeled as Equity in Cash to record its share of pooled cash. If a fund has a stand alone cash account, the cash account will be included in the appropriate fund. The balance of the CCCF cash accounts reconcile to the total balances in all of the participating funds’ equity accounts. Within the CCCF there are accounts that identify each fund’s share within the pooled cash. These are offsetting accounts to the funds’ equity in cash accounts. Each accounts’ balance will tie to its respective fund’s equity in cash account balance. The accounts will be contra-cash accounts to the Treasurer’s Cash, A/P, and Payroll accounts. a. The A/P and Payroll accounts are recorded through the General Ledger Account code Cash – Payments and zero balance to the Treasurer’s Main Cash Account at the bank. Entries will be made between the cash accounts to mirror the daily activity of the operating account to the daily A/P and Payroll accounts. The balance of the A/P and Payroll Accounts will be equal to the outstanding checks. b. The net of cash in the Treasurer’s Cash, Payment accounts will reconcile to the total of all the funds’ equity in cash. Logos is configured to use its due-to/from logic to automatically create offsetting journal entries to keep the cash in the CCCF and the participating funds in balance. a. Whenever receipts are recorded in a fund Logos will create journal entries that debit the equity in cash account and credit a revenue account in the fund and also debit cash and credit the corresponding contra-cash account in the CCCF. b. When A/P disbursements are recorded in a fund Logos will create journal entries that debit an expense or AP account and credit the equity in cash account in the fund, and it will also debit the appropriate contra-cash account and credit the payments cash account in the CCCF. c. When payroll disbursements are recorded in a fund, Logos will create journal entries that debit the Payroll liabilities and credit the equity in cash in the fund, and it will also debit the appropriate contra-cash account and credit the payments cash account in the CCCF. d. The Equity in Cash accounts established in the individual fund accounts have a sub account of 199, which relates to the Cash Clearing Fund. The accounts that represent the amount due to each of the funds in the Cash Clearing Fund, will have a sub-account attributed to each of the funds. Procedure #: GL-8 Page 1 of 4 2. Definitions N/A 3. Procedure NOTE: For full explanations regarding the journal entry functions and workflow buttons, please refer to the “Standard Journal Entry” procedure. When a journal entry includes a transaction that needs to hit a cash account, use the General Ledger account 199.1000 to record this debit or credit. Enter all other account numbers normally. This action will cause the funds within your journal entry to be out of balance. Therefore, if you try to validate the journal entry, you will get the following error: In order to balance each fund, they system can auto-create Due To/Due From entries. To complete this function, click on the Due To/Due From button. Procedure #: GL-8 Page 2 of 4 A pop-up browser window will appear. Click the Create button to preview the auto-created transactions. Review the auto-created transactions, and click Accept to include them in your journal entry. Procedure #: GL-8 Page 3 of 4 The auto-created Due To/Due From transactions will now be included in your journal entry. You can now continue to process the journal entry as you would any standard entry. Procedure #: GL-8 Page 4 of 4