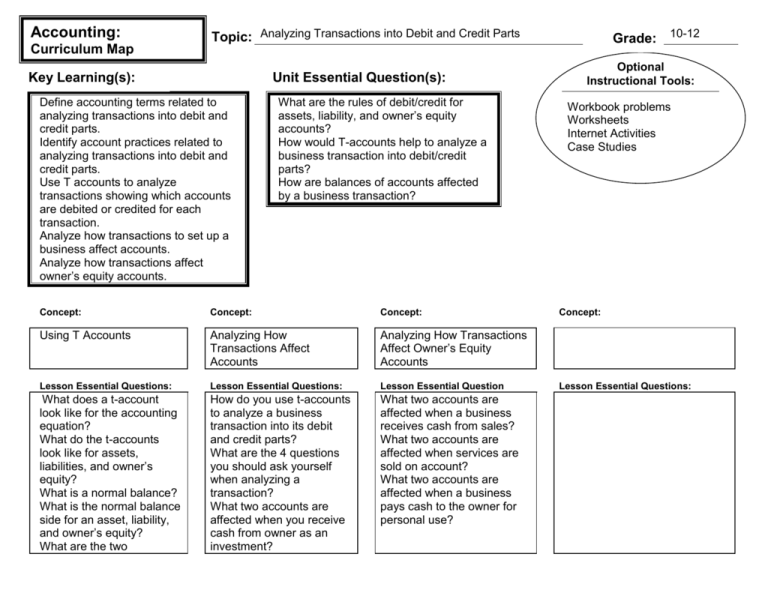

Content Map of Unit

advertisement

Accounting: Us Curriculum Map Topic: Analyzing Transactions into Debit and Credit Parts Key Learning(s): Unit Essential Question(s): Define accounting terms related to analyzing transactions into debit and credit parts. Identify account practices related to analyzing transactions into debit and credit parts. Use T accounts to analyze transactions showing which accounts are debited or credited for each transaction. Analyze how transactions to set up a business affect accounts. Analyze how transactions affect owner’s equity accounts. What are the rules of debit/credit for assets, liability, and owner’s equity accounts? How would T-accounts help to analyze a business transaction into debit/credit parts? How are balances of accounts affected by a business transaction? Concept: Concept: Concept: Using T Accounts Analyzing How Transactions Affect Accounts Analyzing How Transactions Affect Owner’s Equity Accounts Lesson Essential Questions: Lesson Essential Questions: Lesson Essential Question What does a t-account look like for the accounting equation? What do the t-accounts look like for assets, liabilities, and owner’s equity? What is a normal balance? What is the normal balance side for an asset, liability, and owner’s equity? What are the two How do you use t-accounts to analyze a business transaction into its debit and credit parts? What are the 4 questions you should ask yourself when analyzing a transaction? What two accounts are affected when you receive cash from owner as an investment? What two accounts are affected when a business receives cash from sales? What two accounts are affected when services are sold on account? What two accounts are affected when a business pays cash to the owner for personal use? Grade: 10-12 Optional Instructional Tools: Workbook problems Worksheets Internet Activities Case Studies Concept: Lesson Essential Questions: accounting rules that regulate increases and decreases in account balances? Vocabulary: T account Debit Credit Normal balance Other Information: What two accounts are affected when cash is paid for supplies? What two accounts are affected when cash is paid for insurance? What two accounts are affected when you buys supplies on account? Vocabulary: Chart of accounts Vocabulary: Vocabulary: