I. What is Finance? - TMC Business

advertisement

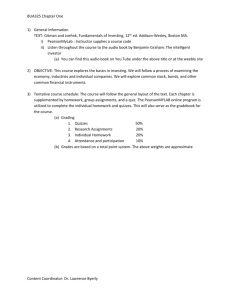

Notes for BUA321 Chapter 1 I. Course Description A. Business Finance is an examination of the principles, theory and techniques of modern corporate financial management. Topics such as risk, return, valuation of securities and projects, long-term financing and the financial environment are explored. B. C. Course Topics: 1. Introduction to finance and decision making 2. What should we buy? 3. Where do we get the money to buy the stuff we want? 4. Short-term Financial Management Course Objectives 1. Explain the corporate financial goal of maximizing shareholder value. 2. Critique how investors, especially common stock investors, make "Buy" - "Hold" - "Sell" investment decisions. D. 3. Discuss the risk return trade-off and the implications for investor value. 4. Utilize and describe the process of valuing assets and the investment decision. 5. Discuss the financing function within the firm 6. Analyze the financial statements of a company. 7. Describe the basics of short term money management in a corporation Late assignments 1. Late assignments will receive a 10% penalty. 2. Improperly named files will receive a 5% penalty Chapter One I. What is Finance? A. Finance can be defined as the science and art of managing money. B. At the personal level, finance is concerned with individuals’ decisions about how much of their earnings they spend, how much they save, and how they invest their savings. C. In a business context, finance involves the same types of decisions: how firms raise money from investors, how firms invest money in an attempt to earn a profit, and how they decide whether to reinvest profits in the business or distribute them back to investors. Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 D. Why finance? What financial managers need to know video. http://www.youtube.com/watch?feature=player_detailpage&v=aJsmJsd6GIw What does Joe say is the least a person needs to know about finance? II. Career Opportunities in Finance: Managerial Finance A. Many career options 1. Corporate finance entry level in short term financial management 2. 3. 4. B. Banking a) Entry level branch management b) Investment management Personal finance a) Investments and portfolio management b) Insurance and risk management Misc areas a) Entrepreneurship b) Real estate Managerial finance is concerned with the duties of the financial manager working in a business. 1. Financial managers administer the financial affairs of all types of businesses—private and public, large and small, profit-seeking and not-for-profit. 2. They perform such varied tasks as developing a financial plan or budget, extending credit to customers, evaluating proposed large expenditures, and raising money to fund the firm’s operations. 3. C. Very involved with strategic planning and implementation Globalization 1. The recent global financial crisis and subsequent responses by governmental regulators, increased global competition, and rapid technological change also increase the importance and complexity of the financial manager’s duties. 2. Increasing globalization has increased demand for financial experts who can manage cash flows in different currencies and protect against the risks that naturally arise from international transactions. Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 III. Legal Forms of Business Organization A. A sole proprietorship is a business owned by one person and operated for his or her own profit. B. A partnership is a business owned by two or more people and operated for profit. C. A corporation is an entity created by law. Corporations have the legal powers of an individual in that it can sue and be sued, make and be party to contracts, and acquire property in its own name. D. Finance theories and techniques apply to all. Video on business forms http://www.youtube.com/watch?feature=player_detailpage&v=pPVkG9krOMI Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 IV. What is the Goal of the firm? A. B. V. 1. Maximize profit 2. Minimize expenses 3. Maximize marketing share 4. Maximize share price 5. Maximize stakeholder wealth Decision rule for managers: only take actions that are expected to increase the share price. Should the goal of the firm be to “Maximizing Profit”? A. VI. Is there a benchmark that serves as an appropriate measure of whether an action should proceed or not? Profit maximization may not lead to the highest possible share price for at least three reasons: 1. Timing is important—the receipt of funds sooner rather than later is preferred 2. Profits do not necessarily result in cash flows available to stockholders 3. Profit maximization fails to account for risk Goal of the Firm: What About Stakeholders? Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 A. Stakeholders are groups such as employees, customers, suppliers, creditors, owners, and others who have a direct economic link to the firm. 1. This is primarily what the owners want 2. How can the manager increase shareholder wealth? B. A firm with a stakeholder focus consciously avoids actions that would prove detrimental to stakeholders. The goal is not to maximize stakeholder well-being but to preserve it. 1. VII. Such a view is considered to be "socially responsible." The Role of Business Ethics A. Business ethics are the standards of conduct or moral judgment that apply to persons engaged in commerce. B. Violations of these standards in finance involve a variety of actions: “creative accounting,” earnings management, misleading financial forecasts, insider trading, fraud, excessive executive compensation, options backdating, bribery, and kickbacks. C. Negative publicity often leads to negative impacts on a firm D. Ethics programs seek to: 1. reduce litigation and judgment costs 2. maintain a positive corporate image 3. build shareholder confidence 4. gain the loyalty and respect of all stakeholders 5. The expected result of such programs is to positively affect the firm’s share price. Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 E. Is there a place in business for the “Golden Rule”?? Part 1 http://www.youtube.com/watch?list=PLQcenkMor85pMNCHKTG2S79A8AL_9Ssw&v=ntJMyx_zVgY&feature=player_det ailpage Part 2 http://www.youtube.com/watch?v=QFPW3jB0kR8&list=PLQcenkMor85pMNCHKTG2S79A8AL_9Ssw&feature=player_de tailpage Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 VIII. Managerial Finance Function: Relationship to Economics A. Must understand supply and demand B. They must also be able to use economic theories as guidelines for efficient business operation. C. Marginal cost–benefit analysis is the economic principle that states that financial decisions should be made and actions taken only when the added benefits exceed the added costs IX. Managerial Finance Function: Relationship to Accounting A. The firm’s finance and accounting activities are closely-related and generally overlap. 1. In small firms accountants often carry out the finance function, and in large firms financial analysts often help compile accounting information. B. One major difference in perspective and emphasis between finance and accounting is that accountants generally use the accrual method while in finance, the focus is on cash flows. C. Whether a firm earns a profit or experiences a loss, it must have a sufficient flow of cash to meet its obligations as they come due. D. Accountants devote most of their attention to the collection and presentation of financial data. E. Financial managers evaluate the accounting statements, develop additional data, and make decisions on the basis of their assessment of the associated returns and risks. X. Governance and Agency: Corporate Governance A. Corporate governance refers to the rules, processes, and laws by which companies are operated, controlled, and regulated. B. Individual versus Institutional Investors 1. Individual investors are investors who own relatively small quantities of shares to meet personal investment goals. 2. Institutional investors are investment professionals, such as banks, insurance companies, mutual funds, and pension funds, that are paid to manage and hold large quantities of securities on behalf of others. Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 3. Unlike individual investors, institutional investors often monitor and directly influence a firm’s corporate governance by exerting pressure on management to perform or communicating their concerns to the firm’s board. a) Not historically the way the world worked. This has helped individual investors by giving some assurance as to confidence of management and their actions. XI. Government Regulation A. The Sarbanes-Oxley Act of 2002: 1. established an oversight board to monitor the accounting industry; 2. tightened audit regulations and controls; 3. toughened penalties against executives who commit corporate fraud; 4. strengthened accounting disclosure requirements and ethical guidelines for corporate officers; 5. mandated instant disclosure of stock sales by corporate executives; Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 XII. The Agency Issue A. A principal-agent relationship is an arrangement in which an agent acts on the behalf of a principal. For example, shareholders of a company (principals) elect management (agents) to act on their behalf. 1. Whenever a manager owns less than 100% of the firm’s equity, a potential agency problem exists. 2. In theory, managers would agree with shareholder wealth maximization. 3. However, managers are also concerned with their personal wealth, job security, fringe benefits, and lifestyle. 4. This would cause managers to act in ways that might not always benefit the firm shareholders. B. Agency costs arise from agency problems that are borne by shareholders and represent a loss of shareholder wealth. XIII. How can we insure Mangers will act in shareholder interest? A. Management Compensation Plans 1. Incentive plans are management compensation plans that tie management compensation to share price; one example involves the granting of stock options. 2. Performance plans tie management compensation to measures such as EPS or growth in EPS. Performance shares and/or cash bonuses are used as compensation under these plans. Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 B. CEO Performance vs. Pay the business man http://www.youtube.com/watch?feature=player_detailpage&v=8SHt44I9S6k C. The Threat of Takeover 1. When a firm’s internal corporate governance structure is unable to keep agency problems in check, it is likely that rival managers will try to gain control of the firm. 2. The threat of takeover by another firm, which believes it can enhance the troubled firm’s value by restructuring its management, operations, and financing, can provide a strong source of external corporate governance. Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 Chapter 1 Class Notes • Chapter One Intro to Finance What is Finance? 1. What are the tasks of the financial manager? From Harvard Business.org video • http://www.youtube.com/watch?feature=player_detailpage&v=aJsmJsd6GIw 1. What is the difference between Accounting and finance? 2. What is meant by “keeping score”? 3. Universal score points? What is meant by this? 4. What is meant by transparent? Global Business 1. What has this shift done to the ordinary business person? Forms of Business http://www.youtube.com/watch?feature=player_detailpage&v=pPVkG9krOMI 1. Where do people go to get money for a new business? 2. What characteristics are the primary drivers of choice of the type of business organization? Goals 1. What is a benchmark? 2. How would you describe the following: – Maximize profit – Minimize expenses – Maximize market share – Maximize shareholder wealth Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 Ethics Part One http://www.youtube.com/watch?list=PLQcenkMor85pMNCHKTG2S79A8AL_9Ssw&v=ntJMyx_zVgY&feature=player_det ailpage Part Two http://www.youtube.com/watch?v=QFPW3jB0kR8&list=PLQcenkMor85pMNCHKTG2S79A8AL_9Ssw&feature=player_de tailpage 1. What is ethics? 2. Warren Buffet once said (paraphrased) that in deciding on acting ask yourself: If this was in the newspaper tomorrow (and your mother was reading the article); How would you feel? 3. Who are the stakeholders of a business? 4. Are competitors stakeholders? Agency 1. 2. 3. 4. 5. What is it? Why does it exist? Does it exist? What does it do? How can we try to stop it? What is a hostile takeover? The Business man!!! http://www.youtube.com/watch?feature=player_detailpage&v=8SHt44I9S6k Content Coordinator: Dr. Lawrence Byerly Notes for BUA321 Chapter 1 Chapter 1 Web exercise Go to http://finance.yahoo.com Step 1 Pick a company to explore. Enter the company name next to the ticker symbol ABT GE ADP GOOG BA HOG CSCO KFT DIS BRKB DOW PFE DUK TAP PG XOM RL (12) Input the company’s Name? _____________ Ticker symbol? ____________ Go to summary What is the most recent dividend? _______ Go to profile 1) CEO? ______________________ Age? ______ 2) How many employees? ____________ 3) What industry and sector is the company in? Industry ________________ Content Coordinator: Dr. Lawrence Byerly Sector _________________ Notes for BUA321 Chapter 1 A) Click on the Sector Components of the sector (list the 4 largest components of the sector sorted by market cap) 1) 2) 3) 4) (25) B) Industry Leaders and laggards In the table below list the names of the top 3 leaders and the bottom 3 laggards for the industry for each variable below include the number listed for that company a) price performance intraday b) free cash flow growth c) market capitalization d) PE ratio Enter company names and the value in the blocks. Leaders Market cap Price performance Content Coordinator: Dr. Lawrence Byerly PE FCF growth Notes for BUA321 Chapter 1 Laggards Market cap Price performance PE FCF growth What companies seem to show up frequently? From observation who is the best and the worst? Where is your company? 4) What is the company’s index membership? Copy and paste the financial statements into this document. Highlight the statement, right click to copy. Paste special as a picture into the word document. Content Coordinator: Dr. Lawrence Byerly