File - TMC Business - Home

advertisement

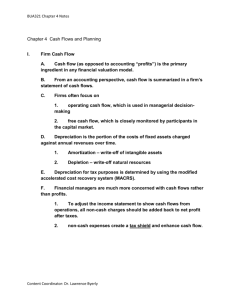

BUA325 Chapter One 1) General Information TEXT: Gitman and Joehnk, Fundamentals of Investing, 12th ed. Addison-Wesley, Boston MA. i) PearsonMyLab : Instructor supplies a course code ii) Listen throughout the course to the audio book by Benjamin Graham: The intelligent investor (a) You can find this audio book on You Tube under the above title or at the weebly site 2) OBJECTIVE: This course explores the basics in investing. We will follow a process of examining the economy, industries and individual companies. We will explore common stock, bonds, and other common financial instruments. 3) Tentative course schedule: The course will follow the general layout of the text. Each chapter is supplemented by homework, group assignments, and a quiz. The PearsonMYLAB online program is utilized to complete the individual homework and quizzes. This will also serve as the gradebook for the course. (a) Grading 1. Quizzes 50% 2. Research Assignments 20% 3. Individual Homework 20% 4. Attendance and participation 10% (b) Grades are based on a total point system. The above weights are approximate Content Coordinator: Dr. Lawrence Byerly BUA325 Chapter One 4) Chapter One: Investment Environment 5) What is an Investment? a) How do you make money from investing? Income from investment Increase in value from investment 6) Figure 1.1 Direct Stock Ownership by Households a) What does “direct” investment mean? b) Who invests the most in equity? The least? c) How does this impact the economy of that country? Purchase of stock USA / France Citizen wealth tied closely to the stock market Content Coordinator: Dr. Lawrence Byerly BUA325 Chapter One 7) Types of Investments a) Debt, Equity or Derivative Securities (a) What is a derivative? Neither debt or equity Derive value from underlying assets b) Low Risk or High Risk i) What is Risk? Uncertainty Volatility The chance of not getting what you expected Can this be good and bad?? c) Short-Term or Long-Term What is short-term? Short-term less than 365 days Why so important? d) Types of Investors i) Individual Investors Invest for personal financial goals Retirement / homes / vacations / cars / education ii) Institutional Investors Paid to manage other people’s money Large volumes Banks / ins companies / mutual funds / pension funds Content Coordinator: Dr. Lawrence Byerly BUA325 Chapter One 8) Steps in Investing a) Step 1: Meeting Investment Prerequisites What are the necessities of life? Protection against common risks Emergency funds b) Step 2: Establishing Investment Goals i) What are examples of goals? Retirement funds Enhancing income Saving for expenditures Sheltering income from taxation c) Step 3: Adopting an Investment Plan written d) Step 4: Evaluating Investment Vehicles Assess potential return and risk e) Step 5: Selecting Suitable Investments Research and gather information on specific investments f) Step 6: Constructing a Diversified Portfolio Diversification can increase returns or decrease risk Chapter 5 content g) Step 7: Managing the Portfolio Make comparisons and adjustments 9) Taxes in Investing Decisions a) What does this mean? “It’s not what you make, it’s what you keep that is important.” Content Coordinator: Dr. Lawrence Byerly BUA325 Chapter One b) Tax Planning Involves: The desired return after-taxes Type of income received from investments Timing of profit and ;loss recognition c) What are the three basic types of income? Active : 1099 and W2 Portfolio income : investing in securities Passive Income : tax sheltering income / rentals , royalties, limited partnerships d) What is the difference between Ordinary Income and capital gains? 10) Table 1.2 Tax Rates and Income Brackets for Individual and Joint Returns (2009) Have you ever heard the concern about people getting a pay raise and then complaining because they are in a higher tax bracket? Why is this wrong? Individual Taxable Income 0 8,701 35,351 85,651 178,651 388,351 over Joint Taxable Income 0 17,401 71,701 142,701 217,451 388,351 over 8,700 35,350 85,650 178,650 388,350 marginal tax base formula 10% 0 0+(amount over 0) 15% 870 870+(15% *amount over 8700) 25% 4867 4867+(25%*amount over 35350) 28% 17442 17442+(28% of amount over 85650) 33% 43481 43481+(33% of amount over 178650) 35% 112682 112682+(35% of amount over 388350) 17,400 70,700 142,700 217,450 388,350 marginal tax base formula 10% 0 0+(amount over 0) 15% 1740 1740+(15% *amount over 17400) 25% 9734 9734+(25%*amount over 70700) 28% 27484 27484+(28% of amount over 85650) 33% 48414 48414+(33% of amount over 178650) 35% 104811 104811+(35% of amount over 388350) Content Coordinator: Dr. Lawrence Byerly BUA325 Chapter One 11) Tax Example a) Don Winsalot and his wife, Lucy, have taxable income of 75K and 120K, respectively. What is the tax liability, if they file single? Joint? What are the average and marginal tax rates? No spreadsheet application b) Single Don Joint Lucy Don and Lucy (1) Don? 14,779 Lucy? 27,060 75,000-35,350 * .25 + 4,867 120,000-85,650 *.28 + 17,442 ATR = tax / income 19.71% 22.55% (2) Joint? 42,128 195,000 – 142,701 * .28 + 27,484 ATR = 21.60% 12) Capital Gains and Losses a) Taxation of Capital Gains i) Capital assets held less than one year: ordinary income tax rates ii) Capital assets held more than one year: 15% (or 5 %) b) Taxation of Capital Losses i) Capital losses can be used to offset capital gains ii) Up to $3,000 per year of capital losses can be used to offset ordinary income (such as wages) 13) Capital losses a) This year a person has sustained $20,000 in capital losses. Their other income is $50,000. i) What can they do this year? Deduct $3K from the $50K Carry forward the $17K Content Coordinator: Dr. Lawrence Byerly BUA325 Chapter One b) Next year they earn $10,000 in capital gains and $50,000 in other income. i) What can they do this year? Offset the $10K gain with the carried forward $17K (remainder is $7K Reduce income $50K with $3K in ST cap losses carry forward $4K 14) Tax-Advantaged Retirement Vehicles a) Allows taxes to be deferred until withdrawn in future b) Employer-sponsored plan c) Individual plans i) Individual retirement arrangements (IRAs) and Roth IRAs 15) Investing Over the Life Cycle a) Growth-oriented youth stage i) Higher potential growth; Higher potential risk ii) Stress capital gains over current income b) Middle-Aged Consolidation Stage i) Move toward less risky investments to preserve capital ii) Transition to higher-quality securities with lower risk c) Retirement Stage i) Preservation of capital becomes primary goal ii) Highly conservative investment portfolio iii) Income needed to supplement retirement income d) What are some investments for each stage? i) Growth-oriented: Common stocks, options or futures ii) Middle-age: Low-risk growth and income stocks, preferred stocks, convertible stocks, highgrade bonds iii) Income-oriented: Low-risk income stocks and mutual funds, government bonds, quality corporate bonds, bank certificates of deposit Content Coordinator: Dr. Lawrence Byerly BUA325 Chapter One 16) Investments and the Business Cycle a) Investments are affected by conditions in the U.S. economy b) The business cycle reflects the current status of several common economic indicators: i) What are the definitions of the following (1) gross domestic product (GDP) (2) industrial production (3) disposable income (4) unemployment rate c) A strong economy is reflected by an expanding business cycle i) What do stock prices do during expanding business cycles? Stock prices tend to rise during expanding business cycles and fall during declining business cycles d) Bonds and other forms of fixed-income securities are also affected by the business cycle since their values are tied to interest rates, which are affected by economics conditions (1) What happens to interest rates in expanding business cycles (2) What happens to bond prices? (a) Interest rates and bond prices move in opposite directions Interest rates rise Bond prices fall 17) The Role of Short-Term Investments a) Define Liquidity Ability to be converted into cash quickly at the current market value How liquid is a check? How liquid is a house? Can you sell a house very quickly? Content Coordinator: Dr. Lawrence Byerly BUA325 Chapter One b) Primary use is for emergency cash reserve or to save for a specific short-term financial goal c) Advantages and Disadvantages of Short-Term Investments Adv High liquidity Low risk Disadv Low returns Purchasing power losses 18) Investment Suitability a) Short-Term Vehicles are used for: i) Savings (1) Emphasis on safety and security instead of high yield ii) Investment (1) Yield is often as important as safety (2) Used as component of diversified portfolio (3) Used as temporary outlet waiting for attractive permanent investments 19) Investment Profile a) A mechanism used to establish the risk tolerances for a certain person for a certain investment. i) Each person will answer the questions differently ii) Different investment needs will also have different strategies for achieving them. Content Coordinator: Dr. Lawrence Byerly BUA325 Chapter One Web Exercises: (50 points) 1) Open the finance spreadsheet. Go to the worksheet BUA325 Project 1. 2) Create a line graph with the companies on one axis and the index on the other. Graph the returns for the past 4 years data. (insert here) (20 pts) From a visual inspection, what can you say about the performance over the past several years? (10 pts) 3) Choose one of the companies from #1, go to http://finance.yahoo.com and find the competitors for this company. Identify the competitors and complete the following table: (10 pts) Company Industry Competitor 1 Mkt cap. Employees Net Income Qtrly Rev growth EPS How does this company compare to it’s competitors? (10 pts) Content Coordinator: Dr. Lawrence Byerly Competitor 2