The Effects on Lessee Financial Statements: Case

advertisement

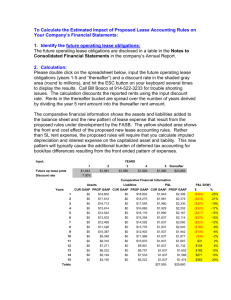

FASB/IASB Lease Accounting Project The Effects on Lessee Financial Statements Leaseurope/FLA Business Forum May 22, 2009 Lease Accounting Project Impact Presenter Bill Bosco Consultant, Leasing 101 ELFA Technical Advisor 914-522-3233 wbleasing101@aol.com Lease Accounting Project Impact Agenda • • • • • • The new direction Lessee impacts Who is impacted? Capitalization calculator Case study Summary and Q&A Analysis – The 2008 version Overall Model – best realistic outcome we could hope for! - But the project has a long way to go! • • • • • • • Right of use model = lowest capitalization for lessees Fair valuing lessee options and RV Guarantees = minimal value based on FMV/UAB curves, BUT could add complexity to lessee accounting and potential P&L volatility Right to terminate defines lease term* = low capitalization Lessor accounting = direct finance lease accounting (no operating leases) There is sympathy for simplicity in lessee accounting for immaterial leases. Lessor accounting similar to direct finance lease accounting (they will review this carefully) BUT EVERYTHING HAS CHANGED!!!!!!!! Analysis – The 2009 version Overall Model – Capitalizes more than current GAAP with complex calculations and adjustments ignoring lease economics • Lessee only rules change • Estimate lease term and payments (renewals, contingent rents & PO’s) and capitalize at incremental borrowing rate with continual adjustments to estimates • Treat all leases as a purchase of an asset and a loan. SL depreciation and imputed interest replace SL rent expense • “Fixes” liability issue – but misrepresents the lease asset, P&L and cash flow statement Analysis – The 2009 version Lessee impacts to be analyzed • Complexity for little benefit but much cost and confusion • P&L cost is front ended (accelerated) • Asset value is de-linked from liability value • Deferred tax accounting for all leases • Cash flow statement = financed CAPEX Lease Accounting Project Impact US Market Info • • • • ELFA estimates >75% of the $ in operating lease rents are from real estate leases All companies lease and ELFA estimates are 90-99% of leases by numbers are equipment leases Proposed rules will be a a burden for lessees as the vast majority of leases are insignificant. 2008 US equipment lease statistics are: Segment $ Range % of $ % of # Micro <$25k 5.4% 52.4% Small $25-250k 26.1% 42.5% Mid $250k-5m 49.3% 4.7% Large >$5m 19.2% 0.4% 100.0% 100.0% Totals Lease Accounting Project Impact US Market Info • Walgreen’s is the largest lessee with 21 billion in off balance sheet rent obligations. • Retailers dominate the numbers with 15 of the top 30 – due to real estate leases that can’t be anything but rentals if they want to be in malls. The Lease Accounting Project Com pany Nam e YR 1 YR 2 YR3 YR 4 YR 5 Beyond Total Walgreen Co. 1,309.3 1,345.9 1,309.0 1,242.1 1,215.0 15,455.4 21,876.7 Continental Airlines Inc. 1,388.0 1,330.0 1,293.0 1,253.0 1,210.0 12,516.0 18,990.0 CVS Corp. 1,181.3 1,120.8 1,060.0 1,008.1 972.8 9,997.1 15,340.1 AMERICAN AIRLINES INC 1,093.0 1,037.0 972.0 956.0 912.0 8,387.0 13,357.0 808.0 722.0 645.0 596.0 573.0 7,827.0 11,171.0 FedEx Corp. 1,707.0 1,555.0 1,436.0 1,329.0 1,169.0 7,820.0 15,016.0 AMR Corp. 1,092.0 1,022.0 996.0 938.0 840.0 7,534.0 12,422.0 McDonald's Corp. 1,061.7 999.7 929.1 865.0 806.6 6,780.5 11,442.6 Kohl's Corp. 314.6 324.0 317.0 311.1 311.1 6,218.4 7,796.2 Wal-Mart Stores Inc. 730.0 700.0 626.0 578.0 530.0 5,908.0 9,072.0 Northw est Airlines Corp. 788.0 794.0 803.0 767.0 744.0 5,857.0 9,753.0 Hom e Depot Inc. 660.0 613.0 566.0 514.0 464.0 5,113.0 7,930.0 General Motors Corp. 898.0 946.0 782.0 1,290.0 674.0 4,249.0 8,839.0 Kroger Co. 784.0 746.0 691.0 644.0 595.0 4,201.0 7,661.0 Suncor Energy Inc. 144.7 154.0 159.4 161.7 171.0 3,753.0 4,543.8 Rite Aid Corp. 543.9 516.4 481.2 451.1 419.7 3,521.9 5,934.2 Sprint Corp. (FON Group) 1,251.0 1,094.0 899.0 729.0 619.0 3,511.0 8,103.0 EDISON MISSION ENERGY 317.0 355.0 353.0 352.0 348.0 3,300.0 5,025.0 Burlington Northern Santa Fe C 492.0 454.0 407.0 398.0 381.0 3,280.0 5,412.0 Albertsons Inc. 429.0 409.0 388.0 357.0 330.0 3,088.0 5,001.0 1,297.0 988.0 861.0 743.0 626.0 2,967.0 7,482.0 Safew ay Inc. 405.9 396.8 380.9 362.5 328.3 2,778.6 4,653.0 Best Buy Co. Inc. 454.0 424.0 391.0 385.0 379.0 2,621.0 4,654.0 1,383.0 1,231.0 1,009.0 849.0 764.0 2,482.0 7,718.0 Sears Holdings Corp. 451.0 429.0 391.0 358.0 321.0 2,447.0 4,397.0 Staples Inc. 576.2 554.8 521.3 483.0 454.2 2,445.1 5,034.5 Regal Entertainm ent Group 277.2 274.3 274.2 274.4 272.1 2,409.0 3,781.2 Target Corp. 146.0 142.0 137.0 117.0 102.0 2,405.0 3,049.0 MetLife Inc. 603.0 582.0 541.0 465.0 400.0 2,332.0 4,923.0 Winn-Dixie Stores Inc. 402.2 369.7 350.3 334.2 316.8 2,320.8 4,094.0 CINGULAR WIRELESS LLC Citigroup Inc. General Electric Co. Lease Accounting Project Impact Lease Capitalization Calculator • Case Study – Bank Of America under the new rules – BofA’s annual operating lease commitments for the next 5 years and thereafter in $billions are: $2.3, 2.1, 1.8, 1.5, 1.2, and 8.3 – Assuming a 7% discount rate and Moody’s style capitalization calculations, $12 billion in assets and liabilities will be added to the balance sheet and lease expense will increase by $300 million – Long term debt increases by 5%, earnings drop by 5% – Increased capital needs are $1 billion for the increased assets and $200 million for the accelerated lease costs – Recent news from US bank stress tests is that BofA needs to raise $34 billion in new capital based on current accounting – Is this the latest loss of capital due to new accounting theories? Lease Accounting Project Impact Lease Capitalization Calculator Input: YEARS Future op lease pm ts 1 2 3 4 5 $2,300 $2,100 $1,800 $1,500 $1,200 thereafter $8,300 7.00% Discount rate Com parative Financial Inform ation Assets Years Liabilties P&L P&L B/(W) CUR GAAP PROP GAAP CUR GAAP PROP GAAP CUR GAAP PROP GAAP $ % 1 $0 $12,009 $0 $12,009 $2,300 $2,605 ($305) -13% 2 $0 $10,245 $0 $10,550 $2,100 $2,316 ($216) -10% 3 $0 $8,667 $0 $9,188 $1,800 $1,949 ($149) -8% 4 $0 $7,361 $0 $8,031 $1,500 $1,606 ($106) -7% 5 $0 $6,318 $0 $7,094 $1,200 $1,286 ($86) -7% 6 $0 $5,528 $0 $6,390 $1,186 $1,237 ($51) -4% 7 $0 $4,738 $0 $5,652 $1,186 $1,185 $0 0% 8 $0 $3,948 $0 $4,862 $1,186 $1,130 $56 5% 9 $0 $3,159 $0 $4,016 $1,186 $1,071 $115 10% 10 $0 $2,369 $0 $3,112 $1,186 $1,008 $178 15% 11 $0 $1,579 $0 $2,144 $1,186 $940 $246 21% 12 $0 $790 $0 $1,108 $1,186 $867 $318 27% 13 $0 $0 $0 ($0) $0 ($0) $0 #DIV/0! 14 $0 $0 $0 ($0) $0 ($0) $0 #DIV/0! 15 $0 $0 $0 ($0) $0 $0 $0 #DIV/0! $17,200 $17,200 Totals Lease Accounting Project Impact Pro Forma Financials • Case Study – 10 year lease under the new rules – The proposed rules for a former operating lease will look like PP&E purchase and loan accounting with estimated contingent rents and renewals capitalized and reviewed and adjusted continually – In the US the tax treatment is operating lease treatment creating a book/tax difference and the need for deferred tax accounting – The ELFA proposes to account for the P&L on a straight line basis to reflect economic reality – This means amortizing the asset and liability using “mortgage amortization” against rent expense, accruing the average rent expense and charging the rent payment to accrued rent payable – Results of the new approach: • Year 1 rent expense 21% higher than SL • Cumulative expense distortion 64% through year 5 Lease Accounting Project Impact Pro Forma Financials Office space lease - assumptions • • • • • • • • • • • Square feet 15,000 Rent rate per sq ft $30 Annual rent in $ $450,000 Payment timing arrears Term in years 10 Inception month January Lessee incr borrowing rate 8.00% PV of rents $3,019,537 Tax treatment true lease Annual tax deduction $450,000 Income tax rate 40.00% Lease Accounting Project Impact Pro Forma Financials Journal entries - Capital lease accounting as proposed by DP dr Equipment cr Capitalized lease obligation To capitalize the lease 3,019,537 dr Depreciation expense cr Accumulated depreciation To depreciate the asset in 1st mo 301,954 3,019,537 301,954 dr Interest expense 241,563 dr Capitalized lease obligation 208,437 cr Cash 450,000 To record 1st mo rent payment, cap lease obligation amort & imputed interest dr Current taxes payable 37,407 cr Deferred taxes payable 37,407 To record tax impact of temporary book/tax difference Lease Accounting Project Impact Pro Forma Financials Journal entries – Right-of-use lease accounting as proposed by ELFA dr Right to use equipment cr Capitalized lease obligation To capitalize the lease 3,019,537 3,019,537 dr Capitalized lease obligation 208,437 cr Rent expense 208,437 dr Rent expense 208,437 cr Right to use equipment 208,437 To amortize 1st year right to use asset & lease obligation dr Rent expense cr Accrued rent payable To accrue 1st year rent expense 450,000 dr Accrued rent payable cr Cash To record rent payment 450,000 450,000 450,000 Lease Accounting Project Impact Pro Forma Financials Balance sheet Equipment Cap lease obligation Deferred tax liability P&L Depreciation Interest expense Tax expense Net after tax cost Balance sheet Right to use equip Cap lease obligation Comparative Financial Statements - Capitalized lease accounting YR 1 YR 2 YR 3 YR 4 YR 5 YR 6 YR 7 YR 8 YR 9 2,717 2,415 2,113 1,811 1,509 1,207 905 603 301 2,811 2,585 2,342 2,080 1,796 1,490 1,159 802 416 37 68 91 107 114 113 101 79 45 301 241 217 326 YR 1 2,811 2,811 301 224 210 316 301 206 203 305 301 187 195 293 301 166 187 281 301 143 178 267 301 119 168 252 301 92 157 236 YR 10 0 0 0 301 64 146 219 301 33 134 201 Right to use accounting YR2 YR 3 YR 4 YR 5 YR 6 YR 7 YR 8 YR 9 YR 10 2,585 2,342 2,080 1,796 1,490 1,159 802 416 0 2,585 2,342 2,080 1,796 1,490 1,159 802 416 0 P&L Rent expense Tax expense Net after tax cost Diff in AT Income 450 180 270 (56) 450 180 270 (46) % Diff in AT income 21% 17% 450 180 270 (35) 450 180 270 (23) 450 1 80 270 (11) 13% 9% 4% Cumulative 64% 450 180 270 2 1% 450 180 270 17 6% 450 180 270 33 12% 450 180 270 50 9% 450 180 270 68 26% Lease Accounting Project Impact Cash Flow Statement Impact Category Of Cash Now Proposed Operating Activities Rent is cash outflow Depreciation and interest added back Investing Activities No activity reported Capital expenditure Financing Activities No activity reported Proceeds from lease obligation Lease payment is cash outflow Lease Accounting Project Impact Implications for Lessees Preliminary views of rights & obligations at inception in a lease • EBITDA improves (strange result?) and whether they meet definitions of an asset/liability are: • Depreciation/interest vs. rent expense (operating expense) • Capital needs increase • Financial institutions impacted • Debt covenants broken • Earnings/EPS erode if SL P&L eliminated • 1st year lease costs increase dramatically (+7% in 3 yr lease, +21% in 10 yr lease) • Retailers impacted – after tax earnings hit of 5+% in US • Transportation & Banks impacted • Cost/Benefit • Complex calculations with continuous adjustments • Lack of clarity, ignores economic reality – worse than buying • Will customers continue to lease???????? FASB/IASB Lease Accounting Project The Effects on Lessee Financial Statements Leaseurope/FLA Business Forum May 22, 2009