Chapter 3 - Haas School of Business

advertisement

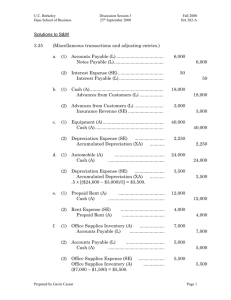

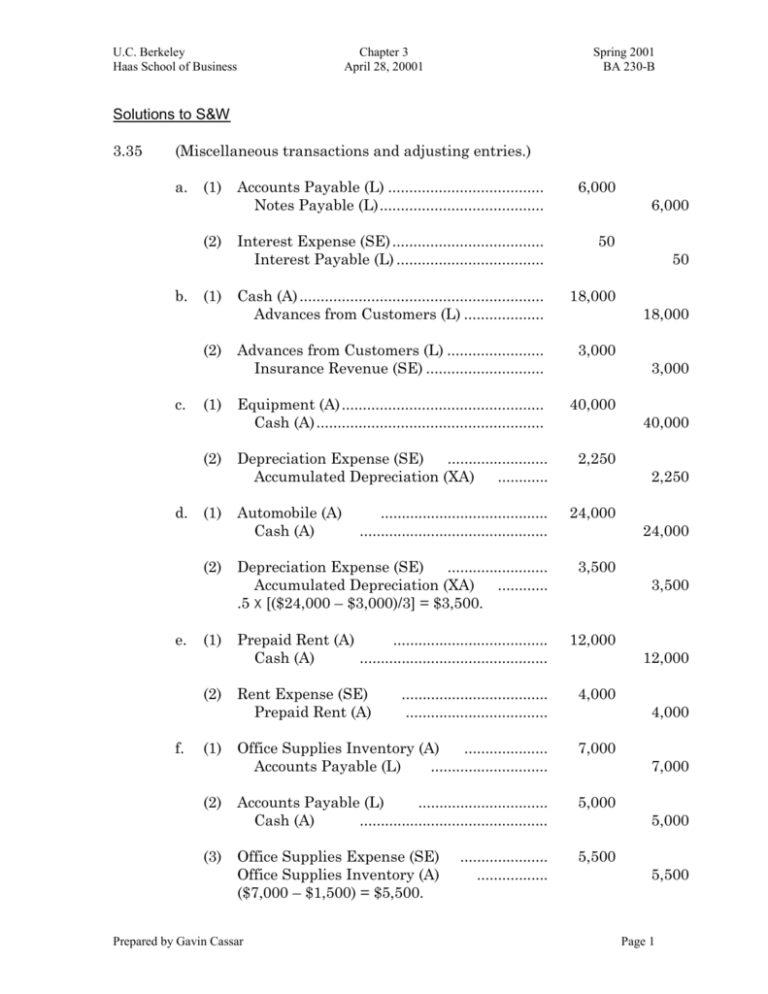

U.C. Berkeley Haas School of Business Chapter 3 April 28, 20001 Spring 2001 BA 230-B Solutions to S&W 3.35 (Miscellaneous transactions and adjusting entries.) a. (1) (2) b. (1) (2) c. (1) (2) d. (1) (2) e. (1) (2) f. (1) (2) (3) Accounts Payable (L) ..................................... Notes Payable (L) ....................................... 6,000 Interest Expense (SE) .................................... Interest Payable (L) ................................... 50 Cash (A) .......................................................... Advances from Customers (L) ................... 18,000 Advances from Customers (L) ....................... Insurance Revenue (SE) ............................ 3,000 Equipment (A) ................................................ Cash (A) ...................................................... 40,000 Depreciation Expense (SE) ........................ Accumulated Depreciation (XA) ............ 2,250 Automobile (A) Cash (A) 6,000 50 18,000 3,000 40,000 2,250 ........................................ ............................................. 24,000 Depreciation Expense (SE) ........................ Accumulated Depreciation (XA) ............ .5 X [($24,000 – $3,000)/3] = $3,500. 3,500 Prepaid Rent (A) ..................................... Cash (A) ............................................. 12,000 Rent Expense (SE) Prepaid Rent (A) 24,000 3,500 12,000 ................................... .................................. 4,000 Office Supplies Inventory (A) .................... Accounts Payable (L) ............................ 7,000 Accounts Payable (L) ............................... Cash (A) ............................................. 5,000 Office Supplies Expense (SE) Office Supplies Inventory (A) ($7,000 – $1,500) = $5,500. 5,500 Prepared by Gavin Cassar ..................... ................. 4,000 7,000 5,000 5,500 Page 1 U.C. Berkeley Haas School of Business 3.41 Chapter 3 April 28, 20001 Spring 2001 BA 230-B (Rybowiak's Building Supplies; preparation of journal entries, T-accounts, adjusted trial balance, income statement, and balance sheet.) a. (T): Transaction Entry (A): Adjusting Entry (1) Accounts Receivable ................................ (T) Sales Revenue ...................................... 85,000 (2) Merchandise Inventory ............................ (T) Accounts Payable ................................. 46,300 (3) Rent Expense .......................................... (T) Cash ................................................... 11,750 (4) Salaries Payable ...................................... (T) Salaries Expense ..................................... Cash ................................................... 1,250 19,350 (5) Cash ...................................................... (T) Accounts Receivable ............................. 34,150 (6) Accounts Payable .................................... (T) Cash ................................................... 38,950 (7) Miscellaneous Expenses .......................... (T) Cash ................................................... 3,200 (8) Insurance Expense (A) Prepaid Insurance $400/8 months. 85,000 46,300 11,750 20,600 34,150 38,950 3,200 ................................. ............................... 50 (9) Depreciation Expense .............................. (A) Accumulated Depreciation .................... 1,750 (10) Salaries Expense (A) Salaries Payable ..................................... ................................... 1,600 (11) Interest Expense ..................................... (A) Interest Payable ................................... $5,000 X .12 X 30/360. 50 (12) Cost of Goods Sold .................................... (A) Merchandise Inventory ........................ $68,150 + $46,300 – $77,950. 36,500 Prepared by Gavin Cassar 50 1,750 1,600 50 36,500 Page 2 U.C. Berkeley Haas School of Business Chapter 3 April 28, 20001 Spring 2001 BA 230-B b. and e. Cash 44,200 11,750 34,150 20,600 38,950 3,200 3,850 Bal. (5) Bal. Bal. (2) Bal. (3) (4) (6) (7) Bal. Merchandise Inventory 68,150 36,500 (12) 46,300 77,950 Bal. Equipment 210,000 Bal. 210,000 (6) (4) Bal. (2) Bal. Salaries Payable 1,250 1,250 1,600 1,600 Bal. (10) Bal. (3) Prepared by Gavin Cassar Rent Expense 11,750 11,750 Bal. Bal. Accounts Receivable 27,250 34,150 85,000 (5) 78,100 Prepaid Insurance 400 50 (8) 350 Accumulated Depreciation 84,000 Bal. 1,750 (9) 85,750 Bal. Accounts Payable 33,100 38,950 46,300 40,450 Retained Earnings 76,650 10,750 87,400 Bal. (1) Bal. (15) Bal. (14) (13) (4) (10) Note Payable 5,000 Bal. 5,000 Bal. Common Stock 150,000 Bal. 150,000 Bal. Sales Revenue 85,000 85,000 (1) Salaries Expense 19,350 1,600 20,950 20,950 Page 3 (14) U.C. Berkeley Haas School of Business (7) (9) Chapter 3 April 28, 20001 Miscellaneous Expenses 3,200 3,200 (14) Depreciation Expense 1,750 1,750 Interest Payable 50 50 Income Summary 74,250 85,000 10,750 85,000 (14) (15) c. (14) (11) Bal. Spring 2001 BA 230-B (8) Insurance Expense 50 50 (14) (11) Interest Expense 50 50 (14) (12) Cost of Goods Sold 36,500 36,500 (14) (13) RYBOWIAK’S BUILDING SUPPLIES Adjusted Preclosing Trial Balance July 31, Year 9 Cash ..................................................... Accounts Receivable .............................. Merchandise Inventory ........................... Prepaid Insurance ................................. Equipment ............................................. Accumulated Depreciation ...................... Accounts Payable ................................... Note Payable .......................................... Salaries Payable ..................................... Common Stock ....................................... Retained Earnings (September 30) ............ Sales Revenue ........................................ Rent Expense ......................................... Salaries Expense .................................... Miscellaneous Expenses ......................... Insurance Expense ................................ Depreciation Expense ............................. Interest Expense .................................... Interest Payable ..................................... Cost of Goods Sold ................................... Totals ................................................ Prepared by Gavin Cassar $ 3,850 78,100 77,950 350 210,000 $ 85,750 40,450 5,000 1,600 150,000 76,650 85,000 11,750 20,950 3,200 50 1,750 50 50 36,500 $444,500 $444,500 Page 4 U.C. Berkeley Haas School of Business d. Chapter 3 April 28, 20001 Spring 2001 BA 230-B RYBOWIAK’S BUILDING SUPPLIES Income Statement For the Month of July, Year 9 Sales Revenue ........................................ Less Expenses: Cost of Goods Sold ............................... Salaries Expense ................................. Rent Expense ...................................... Depreciation Expense .......................... Insurance Expense ............................. Interest Expense ................................. Miscellaneous Expenses ...................... Net Income ........................................... f. $ 85,000 $ 36,500 20,950 11,750 1,750 50 50 3,200 (74,250) $ 10,750 RYBOWIAK’S BUILDING SUPPLIES Balance Sheet July 31, Year 9 Assets Current Assets: Cash .................................................. Accounts Receivable ............................ Merchandise Inventory ....................... Prepaid Insurance .............................. Total Current Assets ........................ Noncurrent Assets: Equipment—at Cost ............................ Less Accumulated Depreciation Total Noncurrent Assets .................. Total Assets .................................... $ 3,850 78,100 77,950 350 $160,250 $210,000 (85,750) Liabilities and Shareholders' Equity Current Liabilities: Accounts Payable ................................ Note Payable ....................................... Salaries Payable .................................. Interest Payable .................................. Total Current Liabilities ................... Shareholders' Equity: Common Stock .................................... Retained Earnings .............................. Total Shareholders' Equity ................ Total Liabilities and Shareholders' Equity ......................................... Prepared by Gavin Cassar 124,250 $284,500 $ 40,450 5,000 1,600 50 $ 47,100 $150,000 87,400 $237,400 $284,500 Page 5