Fin 70520 syllabus Spring 2002

advertisement

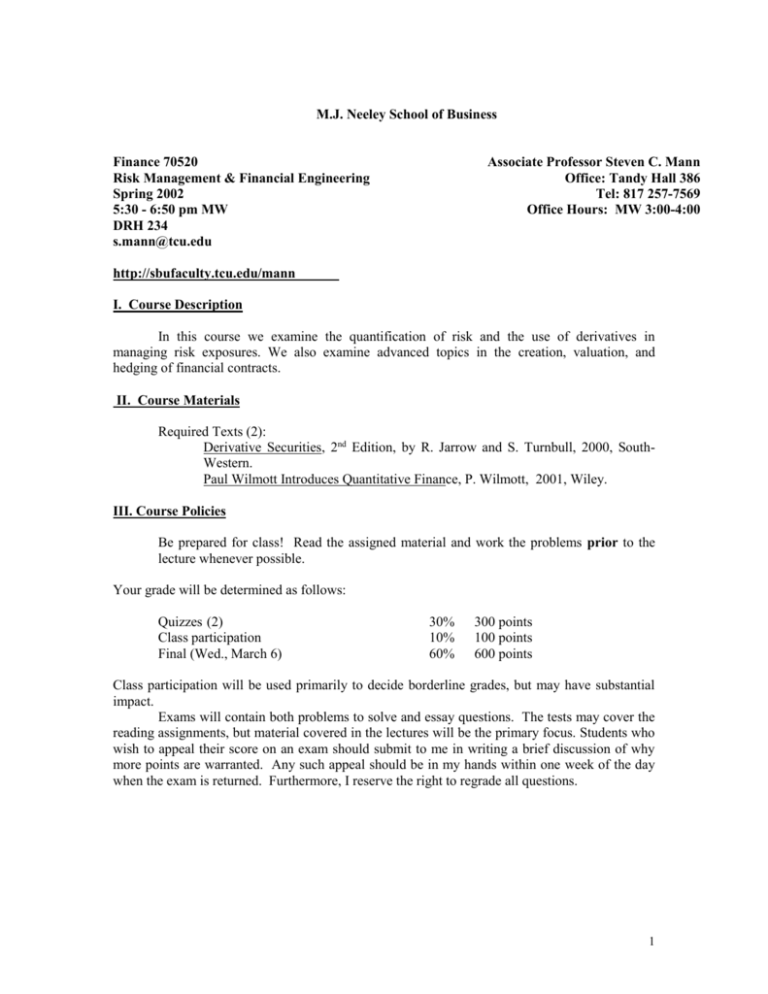

M.J. Neeley School of Business Finance 70520 Risk Management & Financial Engineering Spring 2002 5:30 - 6:50 pm MW DRH 234 s.mann@tcu.edu Associate Professor Steven C. Mann Office: Tandy Hall 386 Tel: 817 257-7569 Office Hours: MW 3:00-4:00 http://sbufaculty.tcu.edu/mann I. Course Description In this course we examine the quantification of risk and the use of derivatives in managing risk exposures. We also examine advanced topics in the creation, valuation, and hedging of financial contracts. II. Course Materials Required Texts (2): Derivative Securities, 2nd Edition, by R. Jarrow and S. Turnbull, 2000, SouthWestern. Paul Wilmott Introduces Quantitative Finance, P. Wilmott, 2001, Wiley. III. Course Policies Be prepared for class! Read the assigned material and work the problems prior to the lecture whenever possible. Your grade will be determined as follows: Quizzes (2) Class participation Final (Wed., March 6) 30% 10% 60% 300 points 100 points 600 points Class participation will be used primarily to decide borderline grades, but may have substantial impact. Exams will contain both problems to solve and essay questions. The tests may cover the reading assignments, but material covered in the lectures will be the primary focus. Students who wish to appeal their score on an exam should submit to me in writing a brief discussion of why more points are warranted. Any such appeal should be in my hands within one week of the day when the exam is returned. Furthermore, I reserve the right to regrade all questions. 1 Tentative schedule; reading assignments & suggested problems (J&T) : Finance 70520 - Spring 2002. March 18 March 20 Chapter Black-Scholes-Merton Eight Topics: Continuous-time representations of price movements; Black-Scholes European; Model properties; hedging; historic and implied volatility; greeks; strategies. Problems in Chapter 8 and beyond will often require software. Software by Jarrow and Turnbull is provided with the text. Mann software will usually be provided via Mann's web site. Questions: 8.1 Relationships among call "moneyness", maturity, and delta 8.2 Relationships among put "moneyness", maturity, and delta 8.3 delta sensitivity to maturity and volatility. 8.4 collar construction. 8.5 find implied volatilities. problems 8.6 through 8.12 require analysis of the greeks for the position: 8.6 vertical bear spread 8.7 vertical bull spread 8.8 Butterfly 8.9 Strangle 8.10 time spread 8.11 Condor 8.12 Seagull Wilmott: March 25 Chapter 8: (all); Chapter 9 (optional: math lover’s delight) Chapter 10: (all) Chapter Extensions to the Black-Scholes model Nine: Topics: Models for known dividends: Psuedo-American model; Roll model; constant dividend yield models; options on forwards. Questions: 9.1 9.3 9.4 9.5 9.6 9.8 9.9 9.10 European options with dividends implied volatility with and without dividends Psuedo-American call valuation options on futures contracts hedging a futures option with either spot or futures. hedge futures option with nearby futures implied volatility of futures option American vs. European futures options. 2 March 27 – April 3 Chapter Option hedging and risks Ten Topics: Problems with Delta hedging; Delta-gamma hedging; Delta-gamma-vega hedging. Questions: 10.1 10.2 10.3 10.4 10.5 10.6 10.7 10.8 10.9 10.10 hedge outcomes hedge outcomes and stochastic volatility multiple sources of price changes (total from partials) delta hedge short call with puts delta hedge short call with a different call create delta-vega neutral hedge create delta-gamma neutral hedge create delta-theta neutral hedge delta-gamma hedge a short call delta hedge a short straddle Value at Risk April 8 Wilmott: Chapter 20 (all) Chapter 21-23 (optional); Chapter 24 (all) April 10 Chapter Eleven Foreign Currency (FX) Topics: FX derivatives: options, forwards, futures; payoff definitions and quotes; Options on FX futures; building exchange rate lattices; hedging. Questions: 11.2 11.3 11.4 11.5 11.6 11.7 11.8 11.9 11.10 (optional: derive FX call lower bound) derive FX option put-call parity. FX collar construction. construct exchange rate lattice; price option. FX option relationships: maturity and "moneyness" find FX option implied volatility. implied volatility patterns (smiles). construct synthetic currency put. build an Index Currency option Note (ICON) 3 April 15 Chapter Index and Commodity Derivatives. Twelve Topics: Equity Index derivatives; Index futures; program trading; spreads; Index options and options on futures; Commodity futures and futures options; Questions: Wilmott: April 17 Chapter Thirteen Topics: Questions: Wilmott: April 22 April 24 12.1 12.2 12.3 12.4 12.5 12.6 12.7 12.8 12.9 Equity Index time spreads. Making sector bets with futures. implied volatility of index options. implied volatility and index dividend yields. hedging index options with index futures. implied volatility patterns. hedge option position with futures. gold options. commodity linked bond construction. Chapter 19: (optional) Interest rate contracts. Zero-coupon bonds, coupon bonds; yield curves and yield curve construction; interest rate risk measures and limitations; interest rate futures contracts. 13.1 13.2 13.3 13.4 13.5 13.6 13.7 13.8 13.9 13.10 Price value of basis point for T-bill. simple interest vs. continuous compounding. discount rates and simple interest. discrete vs. continuous yield-to-maturity. Yield-to-maturity. clean and dirty prices. calculate Treasury Bond conversion factors. determine cheapest-to-deliver bond. use term structure to price T-note. build spot and forward yield curves. Chapter 14 (all) Chapter Swaps Fourteen Topics: Interest rate swaps; pricing and valuation; varieties; FX swaps; Commodity swaps; Equity swaps Questions: 14.1 14.2 14.3 14.4 14.5 14.6 14.7 14.8 14.9 14.10 Wilmott: Use term structure to price fixed-for-floating swap. value an existing swap. value an existing amortizing swap. price swap by choosing spread rather than fixed rate. build a swap to meet client needs. price a currency swap. commodity swap usage. price a commodity swap. price a forward commodity swap. application of equity swap. Chapter 15 (all) 4 (optional) Chapter Using term structure models. Fifteen Topics: Interest rate evolution; term structure models; lattice construction; Options on T-bills; T-Bill futures. Questions: (optional) 16.1 16.2 16.3 16.4 16.5 16.6 16.7 16.8 16.9 Use Heath-Jarrow-Morton model to evaluate interest rate risk of Bill. use HJM to create delta neutral hedge of a T-bill. Hedge T-notes with T-bills. Gamma hedging using HJM to hedge notes with bills. Redington's duration. use a bond to hedge a bond. use bill futures to hedge bond. forward vs. futures prices. Chapter Term structure models and interest rate options. Seventeen Topics: Options on bills; Caps, Floors, Caplets, Floorlets; The Black model; Options on Bonds; Swaptions; Options on Bond futures; Questions: (optional) Use Black-Derman-Toy model to price an interest rate cap. Black-Derman-Toy cap pricing and hedging. Bill options. Pricing T-Bill futures with the Black-Derman-Toy model. Chapter Term structure models, bonds, bills, and interest rate futures. Sixteen Topics: Heath-Jarrow-Morton model; interest rate mean reversion and volatility reduction; Bond hedging; Delta and gamma hedging; duration and delta; convexity and gamma. Questions: (optional) 15.2 15.3 15.4 15.5 17.1 17.2 17.3 17.4 17.5 17.6 Options on T-Bills. synthetic options on Bills. Value a floor with the Heath-Jarrow-Morton model. Use the Black model to value a floor. Use Bills to hedge bond option. price a swaption. Chapter Credit risk Eighteen Topics: Bonds with credit (default) risk; yield spreads; pricing risky debt; martingale default probabilities; swaps and options with default risk. Questions: 18.1 18.2 18.3 18.4 18.5 18.6 18.7 18.8 18.9 Use lattice and martingale default probabilities to price risky bond. Price an option on the risky bond of problem 18.1 Price an option on a riskless bond written by a risky counterparty. Embedding default risk into bond prices. Use Information in 18.4 to determine martingale default probabilities. use info from 18.4 and 18.5 to price an option on a risky bond. Price caps with default risk. Usage of credit swaps. Find swap rate for risky counterparty. Wilmott: Chapters 16-18 (optional) 5 April 29 – May 1 Chapter Exotic Options: Non-path dependent. Nineteen Topics: Digital (binary) options; gap options; Paylater options; Compound options; Chooser options; Rainbow options. Questions: 19.1 19.2 19.3 19.4 19.5 19.6 19.7 19.8 (optional proof: lower bound of digital option value) logic of range digital options. price a chooser option. using FX digital options to hedge currency payments; hedge outcomes. hedge a short digital option position. using FX paylater options to hedge currency payments; hedge outcomes. chooser options. hedging strategies with compound options. Chapter Exotic Options: Path dependent. Twenty Topics: Barrier options; Lookback options; extrema options; Asian options (average price options). Questions: 20.1 20.2 20.3 20.4 20.5 20.6 20.7 20.8 using ordinary FX options to hedge barrier options. hedging with barrier puts. FX down-and-in calls. price an up-and-out barrier FX put. price a lookback put. hedging with call vs. extrema put. lookback extrema call. Asian put. Wilmott: Chapters 12 & 13 Final exam: Friday, May 3, 1:00-3:00, DRH 234 6