Learning plan

advertisement

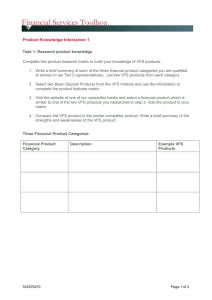

Financial Services Toolbox Learning Plan: Research and Apply Product Knowledge This Learning Plan has been prepared to help you to confirm you have completed all the required learning activities. Print the Learning Plan and tick the boxes as you complete each activity. Client Interaction 1 What to do Why do it Task 1 Read the first section of the team meeting transcript and your manager’s email in Your manager. Your manager’s request will set the scene for your research task. Complete the Financial products short course in Learning opportunities. You will learn about the different categories of financial products. Complete the Client account basics short course in Learning opportunities. You will learn the terminology used in client accounts. Access the product descriptions in the Product section of the VFS intranet and read the descriptions for the Transaction account and the Savings account. You will access the details about these Basic deposit products. You will use this information in your research task. Access a competitor website from those listed in Learning opportunities and identify a product which is similar to the VFS products you have researched. You will have the opportunity to look at a financial product offered by a real financial organisation and compare it to the VFS products. Go to Your tasks and complete Task 1. This task You will be able to demonstrate your will require you to identify the three categories of skills in researching and developing financial products, provide detail on two VFS product knowledge. products and on one competitor product and compare the VFS products with the competitor’s. Task 2 Go to Learning opportunities and ask a colleague about Maintaining product knowledge. You will access advice from a VFS colleague about maintaining product knowledge in a busy workplace. Participate in an discussion in Communication and discuss one of these topics: You will be able to share your ideas for individuals and teams in maintaining product knowledge. You will also be able to learn from the experience of others. List three useful strategies for ensuring your product knowledge remains up to date. List three useful team strategies for helping a work team to keep its product knowledge up to date. Go to Your tasks and complete Task 2. This task will require you to select three ideas for ensuring product knowledge is maintained and write each of them up in the task document. 106755191 You will be able to demonstrate your ability to identify or develop good ideas for maintaining product knowledge. The completed task document will be a useful reminder of these ideas. Page 1 of 5 Financial Services Toolbox Client Interaction 2 What to do Why do it Task 1 Read Tina’s client profile in The client. You will access a summary of Tina’s wants and needs which were developed earlier in an interview with Tina. These details will help you to select an appropriate financial product to meet her needs. Take the Basic deposit products short course in Learning opportunities. You will learn about VFS basic deposit products and how different types of basic deposit products suit different clients. Take the Fixed term deposit products short course in Learning opportunities. You will learn about VFS fixed term deposit products and how different types of fixed term deposit products suit different clients. Consider the products which might meet Tina’s needs and access the product descriptions of these Products in the VFS intranet. You will access details on products which may meet Tina’s needs as expressed in the client profile. Go to Your tasks and complete Task 1. This task will require you to select a financial product to meet Tina’s needs and also to select another financial product which you would recommend if her needs were slightly different. You will be able to demonstrate your ability to select appropriate financial products for clients of differing financial needs. Task 2 Read the conversation with Tina in The client. You will read or hear an example of how a conversation with a client in which a product recommendation is made. Take the Client solutions short course in Learning opportunities. You will learn about the skills required when presenting client solutions. Take the FSRA overview short course in Learning opportunities. You will learn about the requirements of the Financial Services Reform Act in relation to presenting client solutions. Go to Communication and participate in one of the following online discussion topics: You will have an opportunity to discuss with your colleagues some of the issues that are relevant to presenting client solutions or discuss the sales and service aspects of your role. It is up to the client to ask questions if they don’t understand something. If they don’t ask questions you can assume they understand. Agree/Disagree? Why? How is ‘developing and presenting client solution’s about sales skills, and how is it about client service skills? Go to Your tasks and complete Task 2. This task You will have the opportunity to 106755191 Page 2 of 5 Financial Services Toolbox will require you to identify the communication techniques used in the conversation with Tina, whether the appropriate disclosures were made in relation to terms and conditions and the documentation that would need to be provided to Tina. 106755191 demonstrate your ability to identify effective communication techniques, make appropriate disclosures and provide appropriate documentation to clients. Page 3 of 5 Financial Services Toolbox Client Interaction 3 What to do Why do it Task 1 Read the transcript of the conversation with Ahmed in The client. You will learn about Ahmed’s situation and his needs. Take the Non-cash payment facilities short course in Learning opportunities. You will learn about the range of noncash payment facilities available at VFS and the benefits to clients of each of these products. Access the VFS intranet and read the product descriptions of each of the non-cash payment facilities. You will learn details of the various VFS non-cash payment facilities. This will help you to identify a product which is suitable for Ahmed. Go to Your tasks and complete Task 1. This task will require you to select a product to meet the client’s needs, list the key features of this product and the reason’s you selected it. You will be able to demonstrate your ability to select a financial product to meet a client’s needs and identify the key features of the product that will benefit the client. Task 2 Take the Client solutions short course in Learning opportunities You will learn about the skills required when presenting client solutions. Ask a colleague about Overcoming objections in Learning opportunities. You will access advice from a colleague about how to respond effectively to objections from clients when you are presenting a client solution. Go to Your tasks and complete Task 2. This task You will be able to demonstrate your will require you to participate in a simulated ability to respond to a client objection. conversation with the client in which you propose a product to meet his needs and overcome an objection. You will then record two communication skills that you used in the conversation. Take the Trade Practices Legislation and FTRA Overview short courses in Learning opportunities. You will learn about how the Financial Transactions Reporting Act and the Trade Practices Act impact on you when transacting with clients like Ahmed. Go to Communication and participate in both the following online discussion topics: You will have the opportunity to discuss what you learned in the two courses in Learning opportunities with your colleagues. Is Ahmed’s transaction a significant or suspect transaction? Would it need to be reported to AUSTRAC? Why? Why not? What mistakes could the CSO make when assisting Ahmed that may result in a breach of the Trade Practices Act? 106755191 Page 4 of 5 Financial Services Toolbox Client Interaction 4 What to do Why do it Task 1 Access the conversation with The client. You will find out about Stephanie’s request for assistance. Then go to Learning opportunities and take the short course Insurance markets. You will learn about the various players in the insurance market. Then go to Learning opportunities and take the short course Insurance contracts act. You will learn about the regulations that govern the provision of insurance products. Then go to Learning opportunities and take the short course Insurance products. You will learn about the types of insurance products VFS offers and how the different types of insurance may benefit clients. Go to Your tasks and complete Task 1. This task You will be able to demonstrate your will require you to answer a series of questions understanding of insurance markets and about communication skills, insurance insurance products. intermediaries, disclosure and Tier 2 insurance products Task 2 Access the conversation with Stephanie and her partially completed application form in The client. You will be able to access the details Stephanie has already added to her application. Go to Your tasks and complete Task 2. This task You will be able to demonstrate your will require you to complete an insurance ability to assist a client to complete an application form based on the transcript of the application form. conversation with Stephanie. Task 3 Access the conversation with Stephanie in The client. You will review the content of the conversation with Stephanie. Go to Learning opportunities and ask a colleague about Cross Selling. You will access hints and tips on how to cross sell products without offending. Participate in an online discussion on the following topic in Communication: You will be able to share your views on which products might benefit Stephanie and how you might uncover her needs. Based on the conversation, which other VFS products may be of use to Stephanie and her partner? What questions could you ask to uncover these needs? Go to Your tasks and complete Task 3. This task will require you to list a number of VFS products you could offer to Stephanie and her partner and the questions you would ask Stephanie to uncover her needs. 106755191 You will be able to demonstrate your ability to select appropriate products for cross selling and to uncover the customer’s need of these products. Page 5 of 5