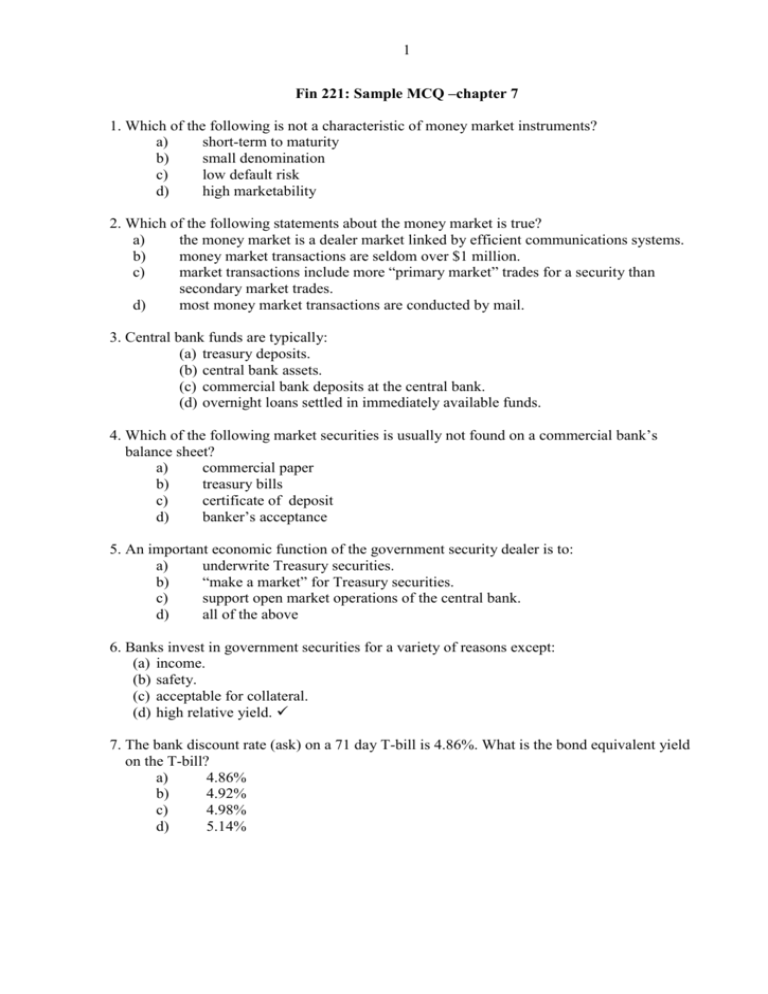

Fin 221: Money Market Sample MCQ - Chapter 7

advertisement

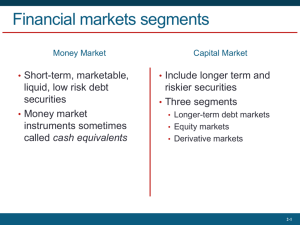

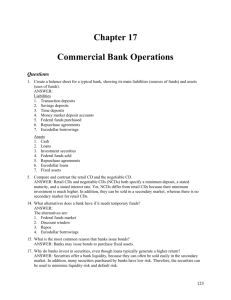

1 Fin 221: Sample MCQ –chapter 7 1. Which of the following is not a characteristic of money market instruments? a) short-term to maturity b) small denomination c) low default risk d) high marketability 2. Which of the following statements about the money market is true? a) the money market is a dealer market linked by efficient communications systems. b) money market transactions are seldom over $1 million. c) market transactions include more “primary market” trades for a security than secondary market trades. d) most money market transactions are conducted by mail. 3. Central bank funds are typically: (a) treasury deposits. (b) central bank assets. (c) commercial bank deposits at the central bank. (d) overnight loans settled in immediately available funds. 4. Which of the following market securities is usually not found on a commercial bank’s balance sheet? a) commercial paper b) treasury bills c) certificate of deposit d) banker’s acceptance 5. An important economic function of the government security dealer is to: a) underwrite Treasury securities. b) “make a market” for Treasury securities. c) support open market operations of the central bank. d) all of the above 6. Banks invest in government securities for a variety of reasons except: (a) income. (b) safety. (c) acceptable for collateral. (d) high relative yield. 7. The bank discount rate (ask) on a 71 day T-bill is 4.86%. What is the bond equivalent yield on the T-bill? a) 4.86% b) 4.92% c) 4.98% d) 5.14% 2 8. Small investors are likely to invest in the money market ___ a. directly; commercial paper b. locally; their credit union c. indirectly; negotiable CDs d. indirectly; money market mutual funds through ______. 9. The bank discount rate (ask) on a 91-day T-bill is 5.35%. What is the price of the $1000 T-bill? a. $976.40 b. $986.48 c. $981.20 d. $989.45 10. The most important money market instrument utilized in the Fed's open market operation is: a. central bank (Federal) funds. b. commercial paper. c. Treasury bills. d. Agency securities 11. Which of the following may be a liability of a non-financial business corporation? a. commercial paper b. central bank (Federal) funds. c. Treasury securities d. agency securities 12. Which of the following bank money market securities is backed by specified collateral? a. negotiable CDs b. banker's acceptances c. repurchase agreements d. commercial paper 13. Banks can satisfy their short-term borrowing needs by: a. Federal Funds purchased. b. Federal Funds sold. c. issuing negotiable CDs. d. both a and c 14. Yields on three-month T-bills are more similar to: a. Two-year Treasury notes rates. b. Ninety-day commercial paper rates. c. central bank (Federal) funds rates. d. Aaa-rated corporate bond rates. ________________________________________________________________________ Answers: 1. (b); 2. (a); 3. (d); 4. (a); 5. (d); 6. (d); 7. (c); 8. (d); 9. (b); 10. (c); 11. (a); 12. (c); 13. (d); 14.(c)