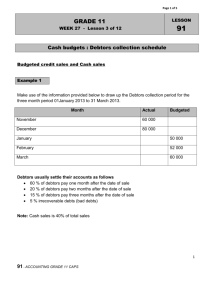

Page 1 of 5 GRADE 11 WEEK 27 - Lesson 2 of 12 LESSON 90

Page 1 of 5

GRADE 11

WEEK 27 - Lesson 2 of 12

LESSON

90

Debtors’ collection schedule

Sales Budget

The sales budget of the business will include the budgeted cash sale and budgeted credit sale if they do trade on credit.

Credit sales

You need to take into consideration that when goods are sold on credit:

Proper screening of customers should be done

Compliance with National credit Act .(You cannot give a debt to a customer who cannot afford paying back)

Sales will increase and the also the risk of bad debts

Administrative expenses will also increase, maintaining and monitoring debtors’ accounts.

Debtors’ collection schedule

Reflects the amounts expected to be owed by debtors and as well as receipts from debtors.

The following information is used to prepare the debtors schedule:

Expected credit sales to debtors

Actual credit sales

Credit policy that determines period for collecting debtors accounts , the trader must clearly indicate the credit terms to be allowed e.g.30 days, 60 days, 90 days etc.

The cash discount, the customer can be entitled to when he pays before the stipulated date.

Advanced exercises will provide you with the balance of debtors control and amounts to be received from debtors.

1

90 Accounting Grade 11 - CAPS

Let’s do an exercise to clarify this concept

Green Store’s credit sales were as follows:

Month

July

August

September

October

November

Actual

80 000

90 000

Budgeted

96 000

100 000

110 000

Debtors usually settle their accounts as follows

50% during the month of sales (transaction month)

30% during the month following the month of sales (one month after sales / 30 days)

18% during the second month after sales (two months after sale / 60 days)

2% irrecoverable debts (bad debts/ 90 days)

Required

Calculate the expected collections from debtors during the budgeted months of September,

October and November.

2

90 Accounting Grade 11 - CAPS

Solution Debtors Collection Schedule schedule

Always start with the Actual sales when preparing the debtors collection

Debtors collection schedule

Collection period

Month Credit sales Terms

July 80 000 × 50 % (July) same month

September October

× 30 % (Aug) 30 days

× 18 % (Sept) 60 days

Aug 90 000 × 50 % (Aug)

14 400

November

× 30 % (Sept) 27 000

× 18 % (Oct )

Sept 96 000 × 50 % (Sept )

48 000

16 200

× 30% (Oct )

× 18 % (Nov)

Oct 100 000 × 50 % (Oct)

× 30 % (Nov )

× 18 % (Dec )

Nov 110 000 × 50% (Nov)

× 30% (Dec)

× 18% (Jan)

28 800

50 000

172 80

30 000

55 000

89 400 95 000 102 280 Receipts from debtors

Show only the amounts to be collected for the specific months

3

90 Accounting Grade 11 - CAPS

OR

Debtors’ collection schedule

Month Credit sales Terms

50 % 30 % 18 %

July 80 000

Aug 90 000

September

14 400

27 000

Collection period

October November

16 200

48 000 28 800

50 000

17 280

30 000

Sept 96 000

Oct 100 000

Nov 110 000

Receipts from debtors 89 400 95 000

Transfer amounts from Debtors’ collection schedule to Cash budget

55 000

102 280

Extract from the Cash Budget

Cash Receipts

Cash Sales

September October xxx xxx

November xxx

Receipts from debtor 89 400 95 000 102 280

Do activities from the text book on Debtors’ collection schedule

4

90 Accounting Grade 11 - CAPS