ADMS 4501N - Course Outline

advertisement

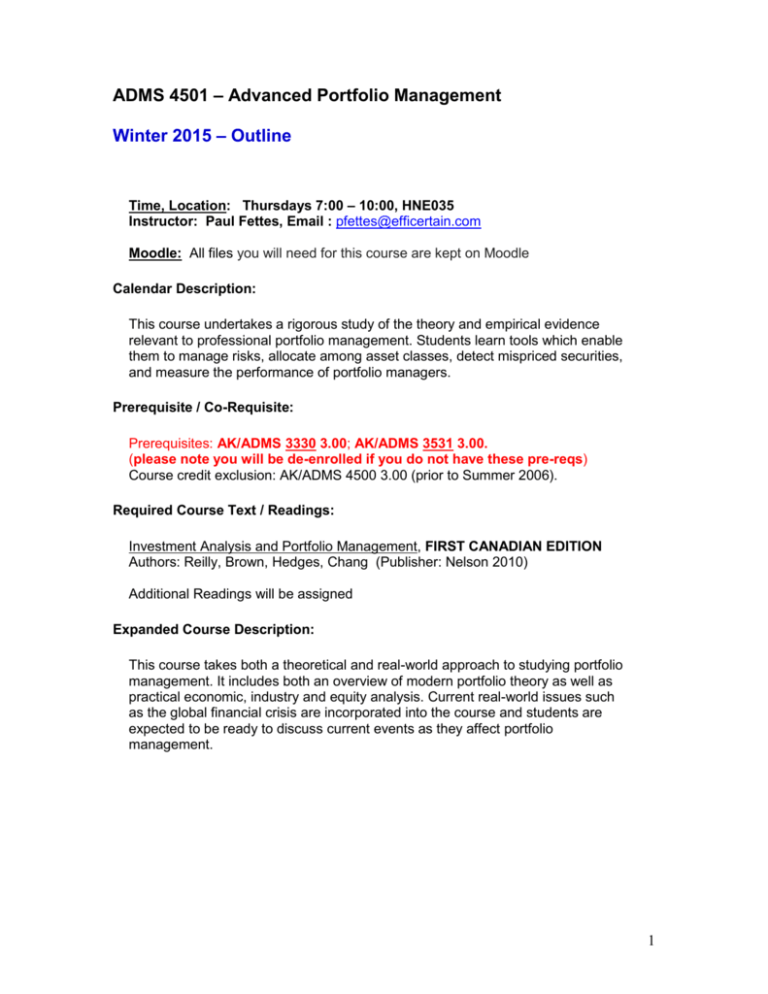

ADMS 4501 – Advanced Portfolio Management Winter 2015 – Outline Time, Location: Thursdays 7:00 – 10:00, HNE035 Instructor: Paul Fettes, Email : pfettes@efficertain.com Moodle: All files you will need for this course are kept on Moodle Calendar Description: This course undertakes a rigorous study of the theory and empirical evidence relevant to professional portfolio management. Students learn tools which enable them to manage risks, allocate among asset classes, detect mispriced securities, and measure the performance of portfolio managers. Prerequisite / Co-Requisite: Prerequisites: AK/ADMS 3330 3.00; AK/ADMS 3531 3.00. (please note you will be de-enrolled if you do not have these pre-reqs) Course credit exclusion: AK/ADMS 4500 3.00 (prior to Summer 2006). Required Course Text / Readings: Investment Analysis and Portfolio Management, FIRST CANADIAN EDITION Authors: Reilly, Brown, Hedges, Chang (Publisher: Nelson 2010) Additional Readings will be assigned Expanded Course Description: This course takes both a theoretical and real-world approach to studying portfolio management. It includes both an overview of modern portfolio theory as well as practical economic, industry and equity analysis. Current real-world issues such as the global financial crisis are incorporated into the course and students are expected to be ready to discuss current events as they affect portfolio management. 1 Organization of the Course (tentative): Lecture Date: Material: 1 Jan 8 Overview of Portfolio Management Ch.1 - The Investment Setting Ch.3 - Global Investing (p.51- 57; 66-68 only) 2 Jan 15 Ch.2 - The Asset Allocation Decision Articles: What went wrong at Harvard and U of T? Sick Kids Foundation Group Assignment Topics assigned 3 Jan 22 Ch.6 - Review of MPT (self study!) Ch.7 - Asset Pricing Models (CAPM & APT) 4 Jan 29 Ch.17 - Money Mgmt, Alt. Investment (pp.531-558 only) Group Written Assignments due at start of class 5 Feb 5 Ch.8 - Economic & Industry Analysis 6 Sunday Feb 8 2-4pm Midterm Exam #1: cover Lectures 1 to 4 7 Feb 12 Ch 9 - Stock Analysis (p 231-247;255-257;266-269) Feb 19 No Lecture – Reading Week 8 Feb 26 Ch.11 - Bond Fundamentals (self- study) Ch.16 - Bond P/M Strategies (pages 492-510;516-518) Ch 15 - Equity P/M Strategies (pages 455-477) 9 Mar 5 Guest Speaker Class 10 Mar 12 Group Presentations 1-5 11 Sunday Mar 15 2-4pm Midterm Exam #2: covers Lectures 5-8 Mar 19 No Lecture due to Midterm Mar 15 12 Mar 26 Group Presentations 6-10 13 Apr 2 Final Exam – In-Class 90 minutes, Lectures 10-12 2 Weighting of Course: Group Assignment Group Presentation Participation Midterm Exam 1 Midterm Exam 2 Final Exam 10% 10% 10% 25% 30% 15% Additional Information/Notes: Participation is assessed through short beginning-of-class tests in lectures 3-8. The tests will be based on the assigned reading materials for each lecture. Lecturing will be minimal. Powerpoint decks will be available on the course moodle site but will not be discussed extensively in class. You will be expected to review all materials prior to in-class application of the materials. Students will be required to monitor the stocks of the Dow 30 index and will be tested on them. Students should subscribe to a stock tracking service that provides news feeds to remain informed. Students will also be required to monitor central bank and federal government fiscal policy decisions for Canada and the USA. MISSED EXAMS Please note that if a student misses a midterm or final exam due to a medical reason, an Attending Physician’s Statement (not just a medical note) will be the required standard documentation. If one or both midterm exams is/are missed for a legitimate reason, the student will be required to write a comprehensive exam at the next exam date. If the final exam is missed, the student will be required to write a deferred final exam in January. There are no alternate midterms or alternate final exams. If a student misses both midterms and final exam, the student will not be permitted to apply for deferred status. Instead the student must petition to write the deferred exam or petition for late withdrawal from the course. 3