17b. Intro to Accounting-Balance Sheet Questions

advertisement

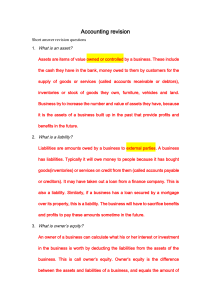

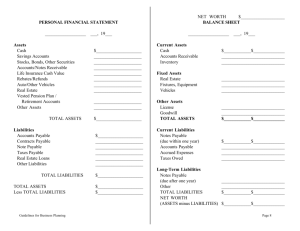

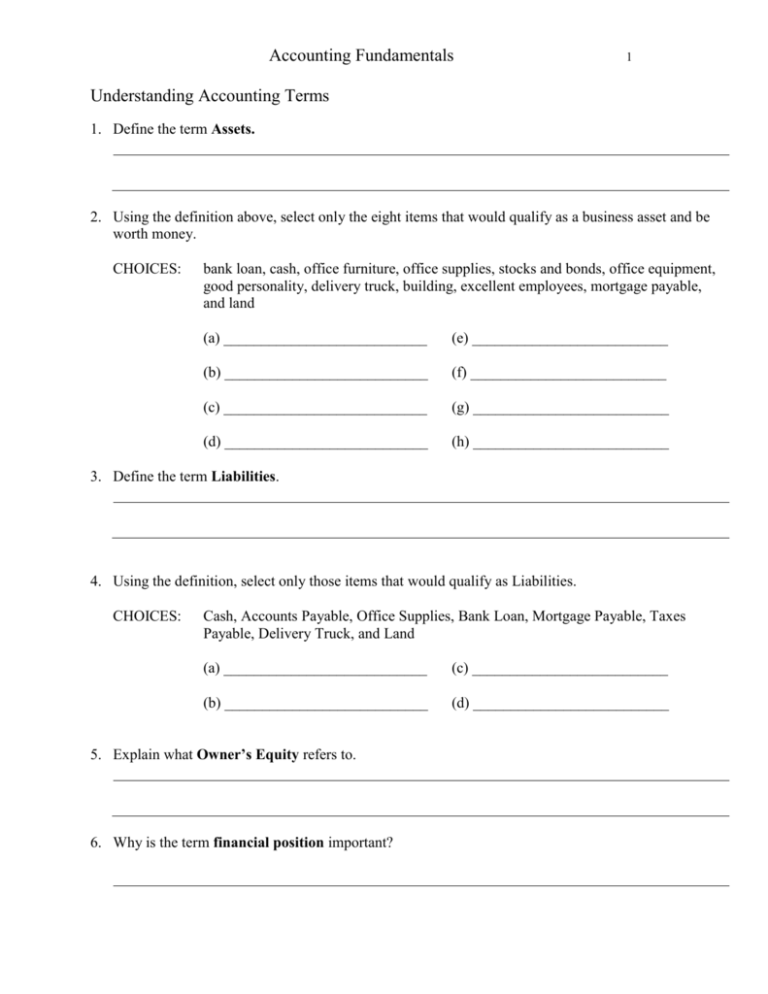

Accounting Fundamentals 1 Understanding Accounting Terms 1. Define the term Assets. 2. Using the definition above, select only the eight items that would qualify as a business asset and be worth money. CHOICES: bank loan, cash, office furniture, office supplies, stocks and bonds, office equipment, good personality, delivery truck, building, excellent employees, mortgage payable, and land (a) ___________________________ (e) __________________________ (b) ___________________________ (f) __________________________ (c) ___________________________ (g) __________________________ (d) ___________________________ (h) __________________________ 3. Define the term Liabilities. 4. Using the definition, select only those items that would qualify as Liabilities. CHOICES: Cash, Accounts Payable, Office Supplies, Bank Loan, Mortgage Payable, Taxes Payable, Delivery Truck, and Land (a) ___________________________ (c) __________________________ (b) ___________________________ (d) __________________________ 5. Explain what Owner’s Equity refers to. 6. Why is the term financial position important? Accounting Fundamentals 2 7. Write the Fundamental Accounting Equation. 8. Using the various possible rearrangements of the equation, solve the following problems. (a) A business has a total of $56 000 in assets and $45 000 in liabilities. How much is the Owner’s Equity? Equation: ___________________________________ Answer: ___________________________________ (b) A business has a total of $12 000 in liabilities and Owner’s Equity of $14 000. How much is the value of the assets? Equation: ___________________________________ Answer: ___________________________________ (c) A business has assets of $90 000 and Owner’s Equity of $30 000. How much in debt is the company? Equation: ___________________________________ Answer: ___________________________________ IDENTIFYING ELEMENTS 9. Identify each of these items as either as ASSET, LIABILITY, or OWNER’S EQUITY. (a) Office Supplies ___________________________ (b) Bank Loan ___________________________ (c) Cash in the Bank ___________________________ (d) Mortgage Payable ___________________________ (e) Delivery Van ___________________________ (f) Assets – Liabilities ___________________________ (g) Warehouse ___________________________ (h) Office Equipment ___________________________ (i) Land ___________________________ (j) Capital ___________________________ Accounting Fundamentals 3 10. Explain what a Balance Sheet refers to. 11. On a Balance Sheet: (a) (b) 12. Explain what is found on each of the three lines of the heading. Top _________________________________ Middle _________________________________ Bottom _________________________________ What three sub-headings are found on a Balance Sheet? (1) __________________________________ (2) __________________________________ (3) __________________________________ On a Balance Sheet, lines in a money column have a mathematical meaning. Explain what this means: (a) A single line under a column of numbers ____________________________________ (b) A double line under a number _____________________________________________ 13. What do these terms mean? (a) Accounts Receivable (debtor) Is this an Asset, Liability, or O.E.? ________________________ (b) Accounts Payable (creditor) Is this an Asset, Liability, or O.E.? ________________________ Accounting Fundamentals 4 14. What does the word Liquidation mean? 15. Explain the term Liquidity. 16. Organize this list of assets in order of Liquidity. ASSETS: Delivery Van, Building, Cash on Hand, Accounts Receivable, Office Supplies, Office Equipment, Cash in Bank, Office Furniture, Plant Equipment, Land 1. ___________________________________________ 2. ___________________________________________ 3. ___________________________________________ 4. ___________________________________________ 5. ___________________________________________ 6. ___________________________________________ 7. ___________________________________________ 8. ___________________________________________ 9. ___________________________________________ 10. ___________________________________________ 17. Organize this list of liabilities according to their “Urgency of Payment” or “Maturity Date Rule.” LIABILITIES: Mortgage Loan, Bank Loan (demand), Bank Loan (5 years), Wages Payable, Accounts Payable. 1. ___________________________________________ 2. ___________________________________________ 3. ___________________________________________ 4. ___________________________________________ 5. ___________________________________________ Accounting Fundamentals 5 BALANCE SHEET Use the following accounts to prepare a Balance Sheet for the Alpha Company owned by Jennifer Kirk. Assets Cash-in-bank Accounts Receivable: Aldrich, P. Jones, A. Harrison, H. Supplies Furniture Equipment Building Land Liabilities $ 5 000 400 600 1 000 300 8 000 10 000 50 000 35 000 Accounts Payable: ACME Supply ABC Company Dominion Inc. Bank Loan (5 years) Mortgage Payable $ 500 1 000 2 000 10 000 50 000 Remember to use the proper format (including underlining and dollar signs) learned in class. ____________________________________________________________________________________ ____________________________________________________________________________________ ____________________________________________________________________________________