Accounts - Ms. Huffman

advertisement

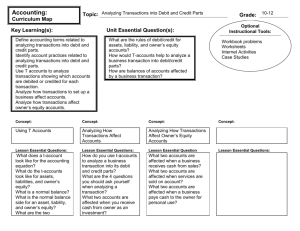

Chapter 2-1 Analyzing Transactions into Debit and Credit Parts Asset Accounts • • • • Cash Prepaid Insurance Supplies Accounts Receivable(People who owe us money—purchased services on account) Liabilities • Accounts Payable(people we owe money to) Owner’s Equity • Owner Name, Capital Analyzing The Accounting Equation • We could, theoretically, record every transaction directly into the Accounting Equation • BUT, the number of accounts used by most businesses would make the accounting equation extremely complicated to use as a financial record • A separate record is commonly used for each account The Accounting Equation • Assets Left Side = Liabilities + O.E. Right Side • Remember the equation must always be in balance. • Right side always equals the left side Accounts • A record summarizing all of the information pertaining to a single item in the equation is known as an account – Each of these is an “account” • • • • • • Cash Supplies Accounts Receivable Prepaid Insurance Accounts Payable Kim Park, Capital Transactions • Change the balances of accounts in the equation • We started with all zeros and each transaction we did changed balances in the accounts • An accounting device used to analyze transactions is called a T-Account Amounts Recorded in TAccounts • There are special names for amounts recorded on the left and right sides of a T-Account debit credit • An amount recorded on the left side is called a “debit” • An amount recorded on the right side is called a “credit” • Abbreviations are “dr” for debit and “cr” for credit Account Balances • The side of the account that is INCREASED is called the Normal Balance • Assets are increased on the left side of the equation and have normal “DEBIT” balances • Liabilities are on the right side of the equation and have normal “CREDIT” balances • Owner’s Capital is on the right side and has a normal “CREDIT” balance Look At Page 29 • • • • DEBIT means LEFT CREDIT means RIGHT They do not mean increase and decrease They do not mean good and bad Increases and Decreases in Accounts • Remember the transactions in Chapter 1. • When we bought supplies with cash, one account was increased, the other was decreased. • The “normal balance” side is always the side that the account increases on. • Accounts decrease on the opposite side • Assets have normal “debit” balances so they increase on the left side • Liabilities and Owner’s Capital accounts have normal “credit” balances so they increase on the right side Work Together, OYO 2-1 • Logon to Aplia • Do WT and OYO 2-2 Analyzing How Transactions Affect Accounts • Let’s go back to the first transaction and breaking it down using T-Accounts • August 1. Received cash from owner as an investment, $5000.00 • Page 32 Steps For Analyzing a Transaction Into Its Debit and Credit Parts • • • • 1. Which accounts are affected? 2. How is each account classified? 3. How is each classification changed? 4. How is each amount entered in the accounts? Page 33 • August 3. Paid cash for supplies, $275.00 • Look at Steps-Let’s answer them • Look at diagram on top of page 33. Pages 34-36 • We are going to look at each of these transactions and do the T-Accounts on the board Page 37 • 2-2 WT, OYO • Logon to Aplia 2-3 Analyzing How Transactions Affect Owner’s Equity Accounts • Using the same steps that we did for section 2-2, let’s do the transactions on pages 38-39 together. Transactions Involving Expenses • Liabilities increase on the Credit or the right side of the equation • Expenses DECREASE owner’s equity, therefore, they are considered separate accounts and have a normal Debit balance • Owner’s Capital Increase on the Credit Side, and since expenses decrease owner’s equity, they are increased on the debit side • CLEAR AS MUD?? • Let’s try it • Page 40 Receiving Cash on Account • Page 41 Paid Cash to Owner for Personal Use • Page 42 Review 2-3 • Page 44 • Logon to Aplia • WT, OYO 2-3