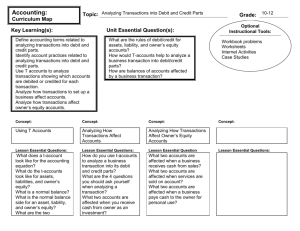

Debit and Credit Theory in Accounting

advertisement

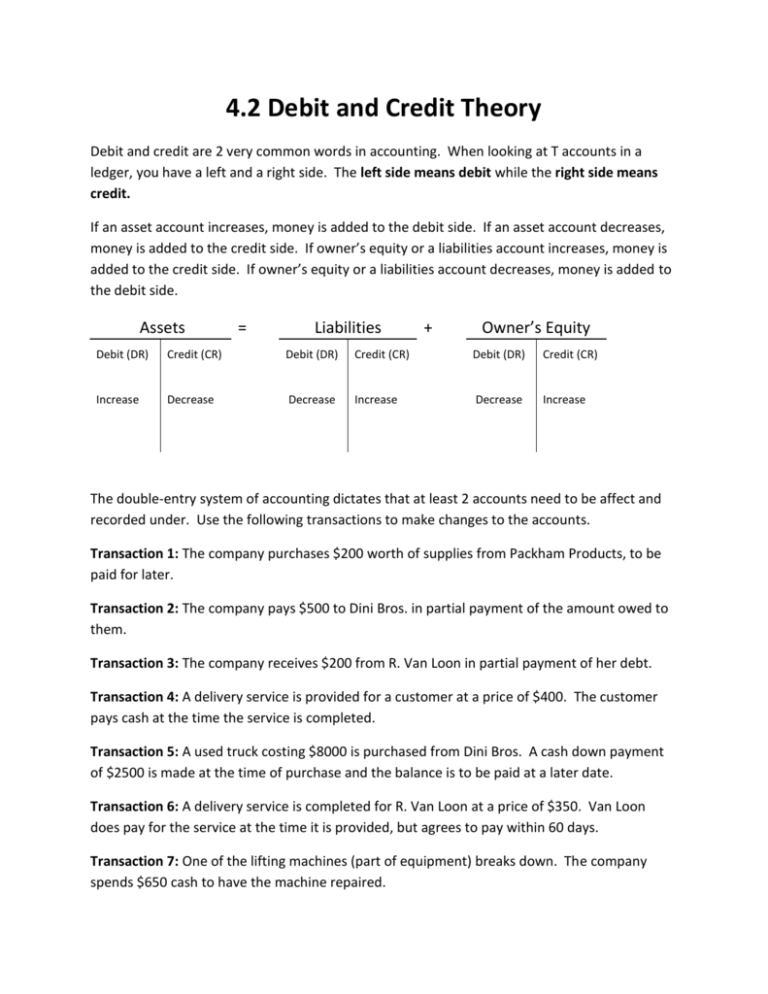

4.2 Debit and Credit Theory Debit and credit are 2 very common words in accounting. When looking at T accounts in a ledger, you have a left and a right side. The left side means debit while the right side means credit. If an asset account increases, money is added to the debit side. If an asset account decreases, money is added to the credit side. If owner’s equity or a liabilities account increases, money is added to the credit side. If owner’s equity or a liabilities account decreases, money is added to the debit side. Assets = Liabilities + Owner’s Equity Debit (DR) Credit (CR) Debit (DR) Credit (CR) Debit (DR) Credit (CR) Increase Decrease Decrease Increase Decrease Increase The double-entry system of accounting dictates that at least 2 accounts need to be affect and recorded under. Use the following transactions to make changes to the accounts. Transaction 1: The company purchases $200 worth of supplies from Packham Products, to be paid for later. Transaction 2: The company pays $500 to Dini Bros. in partial payment of the amount owed to them. Transaction 3: The company receives $200 from R. Van Loon in partial payment of her debt. Transaction 4: A delivery service is provided for a customer at a price of $400. The customer pays cash at the time the service is completed. Transaction 5: A used truck costing $8000 is purchased from Dini Bros. A cash down payment of $2500 is made at the time of purchase and the balance is to be paid at a later date. Transaction 6: A delivery service is completed for R. Van Loon at a price of $350. Van Loon does pay for the service at the time it is provided, but agrees to pay within 60 days. Transaction 7: One of the lifting machines (part of equipment) breaks down. The company spends $650 cash to have the machine repaired. Transaction Account Names A, L, or OE DR or CR Amount 1 2 3 4 5 6 7 ASSETS = A/R – W. Caruso Cash 3265 150 A/R – R. Van Loon 620 55 075 B. Rissen, Capital Bank Loan 18 000 Supplies 2465 Trucks LIABILITIES + OWNER’S EQUITY Equipment 22 174 60 287 A/P – Dini Bros. 1516 A/P – Packham Products 3946 Assignment: Pg 91 Exercises 3, 4 Pg 96 Exercises #1-3 *Hand-in Electronically* Account Balances and Terminology To calculate the balance of any of the accounts you need to: 1. Total each side of the T account. A line is drawn and the pin total is written below it for each side. Make sure that each side lines up. 2. Subtract the smaller total from the larger total. The difference is written in the column with the larger total and circled. This is the account balance. Once you take a look at the account balances, pay attention to what side each one is on. A balance on the debit side is an asset while a balance on the credit side is a liability (or equity). Sometimes, balances will end up on the opposite side than you would expect. These are called exceptional balances. For example, if you spend more money out of your bank account than you have it is no longer an asset. It has just become a liability. Similarly, if you overpay a liability account then this has just become an asset. Returns made to accounts with no balance will shift from asset to liability or vice versa. So far we have been using the term “cash”. It is safe to say that we should be using “bank” from now on. This is because most businesses do no use cash to do transactions. Bill payments and deposits are made to a bank account for simplicity. It is easier to send a cheque than a wad of bills. Also purchases are often made on credit, meaning that they do not have to pay for the bill immediately. If a purchase is put on an account, then this is an agreement between businesses that a payment will be made at a later date.