Introduction to Business Management

advertisement

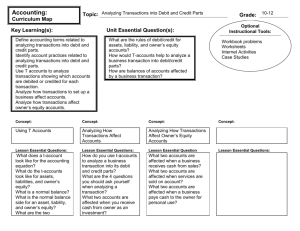

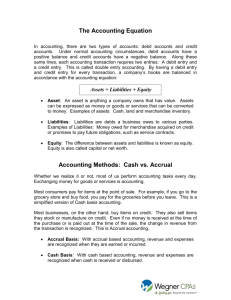

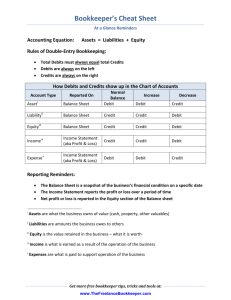

Double Entry Accounting Key Concepts Purpose of Accounting Accounting Methods Accounting Cycle Transactions Financial Statements Closing the Books Actimax Learning, Inc. 2 Think about… How do you keep track of your money? How do you know if your records are accurate? How do you know if your enterprises or activities are profitable? How much you are worth financially? Actimax Learning, Inc. 3 Keeping Track of Information Is important for businesses to determine performance and be accountable Bookkeeping is recording or posting the transactions of a business vs Accounting is the entire process of identifying, recording, and communicating financial information of a business Actimax Learning, Inc. 4 Purposes of Accounting Summarize economic activity of a business Internally (managers, employees) Externally (investors, regulators, IRS) Actimax Learning, Inc. 5 Accounting Methods Cash Method Revenue is recorded when received Expense is recorded when paid Reap version of The Farming Game Accrual Revenue and expense are recorded in the year that the activity occurred More accurate representation Actimax Learning, Inc. 6 Single-Entry vs. Double-Entry Single-Entry System Accounting profession does not acknowledge; not good practice “Shoebox” method – put all receipts in one box and all bills in another box Double-Entry System Debit and credit sides of the transaction must be equal Actimax Learning, Inc. 7 Accounting Cycle Basic Accounting Equation Assets = Liabilities + Owner’s Equity Assets Liabilities Property owned by a business Cash, accounts receivable, equipment, supplies Claims against business assets Accounts payable, notes payable, salaries payable, interests payable Owner’s Equity Actimax Learning, Inc. Remaining assets that go to owners after all liabilities are paid, if the business liquidates 8 Accounting Cycle General Journal (or T-Accounts) General Ledger Trial Balance Financial Statements Actimax Learning, Inc. 9 Asset # Debit 1/ 1 20,000 Credit Accounts Owner’s Equity # # 1 1 Debit Credit 20,000 Assets, liabilities, income, expenses and owner’s equity can be broken down into accounts Each account has two sides (T-accounts) Debit = Left side Credit = Right side Each account has a debit or credit balance Increase left side = Debit entry Increase right side = Credit entry Actimax Learning, Inc. 10 # 1/ 1 Debit Account vs. Credit Accounts Asset Cash Expense Actimax Learning, Inc. Income Owner’s Equity Notes Payable 11 Debits vs. Credits If you debit a Debit Account, it increases the value of that account If you credit a Debit Account, it decreases the value of that account If you credit a Credit Account, it increases the value of that account If you debit a Credit Account, it decreases the value of that account Actimax Learning, Inc. 12 Illustration of Accounting Cycle Sample year is illustrated in Part 2 See sample year of General Journal & T-Accounts General Ledger Trial Balance Actimax Learning, Inc. 13 General Journal Historical record of transactions Chronological order GENERAL JOURNAL Date 1/1 Account & Description Asset Debit Credit 20,000 Equity Ref# 1 20,000 Inherited 10 Acres of Hay Actimax Learning, Inc. 14 Posting from General Journal to Specific Accounts T-Accounts are done for illustrations or educational purposes More graphic Most business post to General Ledger More textual Order of accounts are the same as the Balance Sheet Actimax Learning, Inc. 15 General Journal to T-Accounts Done for educational purposes Asset # 1/1 Debit 20,000 Actimax Learning, Inc. Credit Owner’s Equity # # 1 1 Debit Credit # 20,000 1/1 16 General Ledger No description of transactions (references transactions in General Journal) Tracks rolling balances of each account GENERAL LEDGER Asset Ref# Date Debit 1 1/1 20,000 Credit Balance 20,000 Owner’s Equity Ref# 1 Actimax Learning, Inc. Date 1/1 Debit Credit Balance 20,000 20,000 17 Running a Trial Balance Completed at the end of a reporting period Done to see if debits and credits equal each other Helps identify possible errors from journalizing or posting Adjusting entries can be made before preparing financial sheets (not done in The Farming Game) Actimax Learning, Inc. 18 Trial Balance TRIAL BALANCE Account Debit Asset 50,000 Credit Owner’s Equity Notes Payable Income 40,000 8,000 16,300 Expense 6,000 Cash TOTAL 8,300 58,300 Actimax Learning, Inc. 58,300 19 Reap’s Accounting Cycle Transaction Register replaces General Journal & T-Accounts General Ledger Trial Balance Transaction Register Actimax Learning, Inc. Financial Statements 20 Preparing the Financial Statements Final trial balance provides the figures for financial statements Balance Sheet Income Statement Statement of Owner’s Equity Actimax Learning, Inc. 21 Closing the Books Temporary or nominal accounts are closed when preparing the financial statements All accounts related to revenues and expenses Closing temporary accounts resets them to zero and they start afresh for the next accounting period Permanent or real accounts keep a running total for the following year (rolling) All accounts related to the balance sheet **Ending balances become the opening balances for the next accounting period Actimax Learning, Inc. 22 Review Questions Why do businesses perform accounting? What is the cash method? What is the accrual method? What is single entry accounting? What is double entry accounting? Actimax Learning, Inc. 23 Review Questions What is the basic accounting formula? What is the comprehensive accounting cycle? How does Reap adapt this cycle to a simpler system? What are T-accounts? How are transactions entered in a general journal? Actimax Learning, Inc. 24 Review Questions What is a general ledger? What is a trial balance? What is reflected on an income statement? What is an owner’s equity statement? What is reflected on the balance sheet? What period of time does it cover? Actimax Learning, Inc. 25 Review Questions What does ‘closing the books’ mean? What are 2 examples of nominal or temporary accounts? What are 3 examples of accounts with credit balances? Actimax Learning, Inc. 26 Review Questions What factors can be used when making finance decisions? Define credit and borrowing capacity; leverage and profitability; leverage and risk; and repayment capacity. How does marketing affect a business? Actimax Learning, Inc. 27 Are you ready to track and manage information? Reap with The Farming Game® Ahhtomoney Learning Series Actimax Learning, Inc. 28