Exam 4 - Angelfire

advertisement

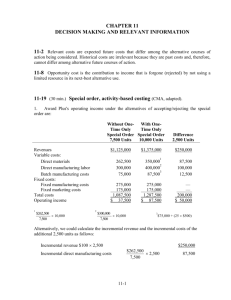

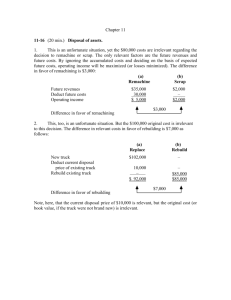

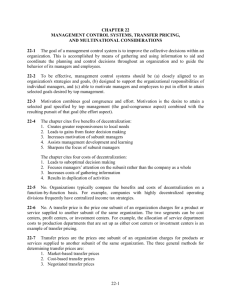

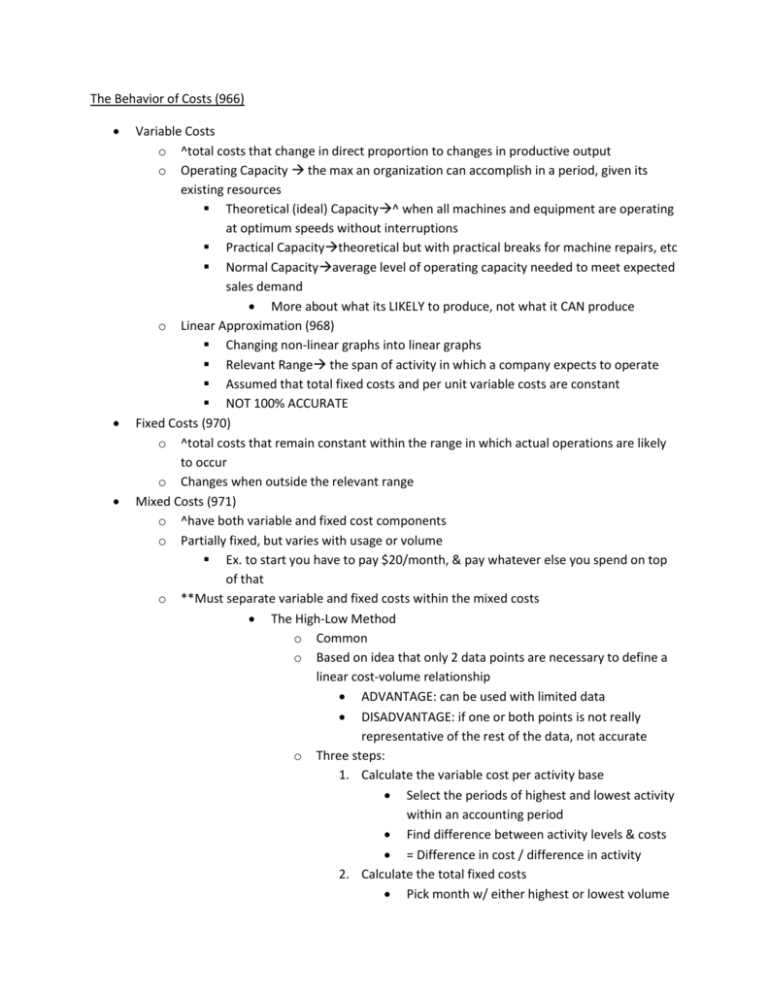

The Behavior of Costs (966) Variable Costs o ^total costs that change in direct proportion to changes in productive output o Operating Capacity the max an organization can accomplish in a period, given its existing resources Theoretical (ideal) Capacity^ when all machines and equipment are operating at optimum speeds without interruptions Practical Capacitytheoretical but with practical breaks for machine repairs, etc Normal Capacityaverage level of operating capacity needed to meet expected sales demand More about what its LIKELY to produce, not what it CAN produce o Linear Approximation (968) Changing non-linear graphs into linear graphs Relevant Range the span of activity in which a company expects to operate Assumed that total fixed costs and per unit variable costs are constant NOT 100% ACCURATE Fixed Costs (970) o ^total costs that remain constant within the range in which actual operations are likely to occur o Changes when outside the relevant range Mixed Costs (971) o ^have both variable and fixed cost components o Partially fixed, but varies with usage or volume Ex. to start you have to pay $20/month, & pay whatever else you spend on top of that o **Must separate variable and fixed costs within the mixed costs The High-Low Method o Common o Based on idea that only 2 data points are necessary to define a linear cost-volume relationship ADVANTAGE: can be used with limited data DISADVANTAGE: if one or both points is not really representative of the rest of the data, not accurate o Three steps: 1. Calculate the variable cost per activity base Select the periods of highest and lowest activity within an accounting period Find difference between activity levels & costs = Difference in cost / difference in activity 2. Calculate the total fixed costs Pick month w/ either highest or lowest volume Total fixed costs= total costs-total variable costs 3. Calculate the formula to estimate the total costs within the relevant range add the answer to steps 1 & 2 to get total costs per month Break-even Analysis (977) [diagram of scatter graph on page 978] Breakeven point point at which total revenues = total costs o point at which organizations begin to earn profits o Sx- VCx – FC= $0 o ***can use Contribution Margin (CM) amt that remains after all variable costs are subtracted from sales (S – VC = CM) and (CM-FC= Profit) o BE Units = (FC / CM per Unit) OR (CM per Unit x BE Units) – FC = $0 Margin of Safety number if sales units or amount of sales dollars by which actual sales can fall below planned sales without resulting in a loss Using C-V-P Analysis to Plan Future Sales, Costs and Profits (982) Estimates the profitability of a venture (a “what if” idea) Managers select scenarios and compute and compare the profits Sales =Variable Costs + Future Cost + Profit Targeted Sales Units = (FC + P) / CM per Unit About cost BEHAVIOR, NOT cost FUNCTION Alternatives: o Decrease Variable Costs, Increase Sales Volume o Increase Fixed Costs, Increase Sales Volume o Increase Selling Price, Decrease Sales Volume Incremental Analysis (Differential Analysis) for Short-Run Decisions o ^comparing alternatives by focusing on the differences in their projected revenues and costs o Irrelevant Costs and Revenues o Differential / incremental cost a cost that changes between alternatives o Irrelevant cost a cost that doesn’t change between alternatives Sunk Costcost that was incurred bc of a previous decision and can no longer be recovered through a current decision o Opportunity Costs o Benefits that are forfeited when one alternative is chosen over another Application of Incremental Analysis to Short-Run Decision (1167) Incremental Analysis for Outsourcing Decisions o o Outsourcing using suppliers outside the organization to perform services or produce goods that could be performed or produced internally 1. Benefit: reduces investments in physical assets, human resources, and operating expenses (increased cash flow and improved operating income) Make-or-Buy Decision decision of whether to make a part internally or buy it from supplier (outsourcing) Incremental Analysis for Segment Profitability Decisions (1171) o Purpose: to identify the segments with negative segment margins so managers can drop them or take corrective action o Segment margin segments sale’s revenue – direct costs o Avoidable costs a cost that could be avoided if management were 2 drop the segment o Direct fixed costs fixed costs that are traceable to the segments Incremental Analysis for Sales Mix Decisions (1173) o ^select the alternative that maximizes the contribution margin per constrained resource based on the organization’s strategic plan and tactical objectives, the relevant revenues and costs and qualitative factors o Two steps: 1. Need to calculate the CONTRIBUTION MARGIN per constrained resource for each PRODUCT or SERVICE Selling price per unit – variable costs per unit 2. Calculate the CONSTRIBUTION MARGIN / unit of the CONSTRAINED RESOURCE CM per unit / quantity of constrained resources required per unit Incremental Analysis for Sell or Process—Further Decisions (1175) o ^ decision about whether to sell a joint product at the split-off point or sell it after further processing 1. OBJECTIVE: select the alternative that maximizes op income o Joint Products 2 or more products, made from a common material or process that cannot be identified as separate products r services during some or all of the processing o Split-off Point joint products or services become separate and identifiable o Steps: 1. Calculate incremental revenue Total revenue from split-off point – total rev from further processing 2. Compare incremental revenue to the incremental costs to process further 3. Make decision (IGNORE JOINT COSTS) If costs > revenue, sell at split-off point If costs < revenue, sell after processing further o Depreciation Expense and income Taxes Depreciation expense can allow for significant income tax savings Operating income after income taxes + non-cash expenses (depreciation) – noncash revenues = NET CASH INFLOWS The Time Value of Money (1180) ^the concept that cash flows of equal dollar amts separated by an interval of time have different present values bc of the effect of compound interest Interest o ^cost associated with the use of money for a specific period of time o Simple interest the interest cost for one or more periods when the amt on which the interest is computed stays the same from period to period o Compound Interest interest cost for two or more periods when the amt on which interest is computed changes in each period to include all interest paid in previous periods o Interest Expense = Principal x Rate x Time o Total Maturity Value = Principal + Interest Present Value o Present vs. future value o Present Value x (1 + Interest Rate) = FUTURE VALUE Present Value of a Single Sum Due in the Future o Future Value x Present-Value Factor = Present Value Present Value of an Ordinary Annuity o ^ a series of equal payments or receipts that will begin one time period from the current date Analyzing Capital Investments Proposals: The Net Present Value Method (1184) ^ evaluates a capital investment by discounting its future cash flows to their present values and subtracting the amount of initial investment from their sum Advantages of the Net Present Value Method o Incorporates the time value of money into the analysis of proposed capital investments o Cost of capital the weighted-average rate of return a company must pay to its longterm creditors and shareholders for the use of their funds o Tables 3 & 4 are used to discount each future cash inflow and cash outflow over the life of the asset to the present If positive, GOOD means there is a high rate of return project accepted! If negative, BAD means there is a low rate of return project rejected! If zero, OK means the rate of return is adequate project accepted! Other Methods of Capital Investment Analysis (1187) The Payback Period Method o Simple to use see which option will take a shorter amt of time to pay off debts o o o o Payback Period = Cost of Investment / Annual Net Cash Flow (i.e. revenue - expenses) Annual Depreciation = (Cost – Residual Value) / Life of Asset If payback period is 5 years or less APPROVED Disadvantages: Does NOT measure profitability Does NOT adjust cash flows for the time value of money (i.e. it ignores the present values of cash flows from different periods) Emphasizes the amt of time it takes to get return on investment, not long-term return on the investment It ignores all future cash flows after the payback period is reached The Accounting Rate of Return Method o ^ an imprecise but easy way to measure the estimated performance of a capital investment since it uses financial statement information o Two variables : 1) estimated annual net income from the project 2) average investment cost o Accounting Rate of Return = Project’s Average Annual Net Income / Average Investment Cost (below here) o Average Investment Cost = [(Total investment – Residual Value) / 2] + Residual Value o Disadvantages: Net income is averaged over the life of the investment not a reliable figure Method is unreliable when estimated annual net income differs over the years Cash flows are IGNORED The time value of money is not considered (i.e. future and present $ are treated Cost-Based Pricing Methods (1221) Gross Margin Pricing o Emphasizes the use of the INCOME STATEMENT o GM = sales - total production costs o Cost-based pricing method in which the price is computed using a markup percentage based on a product’s total production costs Markup percentage covers: Selling, general and administrative expenses and desired profit o Markup % = (desired profit + total ^ expenses) / total production costs o Gross Margin-Based Price = total production costs per unit + (markup % x total production costs per unit) o Gross Margin-Based Price (based on desired profit)= (total production costs + total selling, general and administrative costs + desired profit) / total units produced Return on Asset Pricing o Emphasizes the use of the BALANCE SHEET o o o Based on earning a profit equal to a specified rate of return on the assets employed in the operation Return on Assets-Based Price = total costs and expenses per unit + (desired rate of return x cost of assets employed per unit) Return on Assets-Based Price = [(total production costs + total selling, general and administrative costs) / units to be produced] + [desired rate of return x (total cost of assets employed / units to be produced)] Pricing Based on Target Costing (1227) Designed to enhance a company’s ability to compete Target Costing is a pricing method that: o Identifies a price at which a product will be competitive in the market place o Defines the desired profit to be made on the product o Computes the target cost for the product by subtracting the desired profit from the competitive mark price Target Cost = Target Price – Desired Profit Target cost is viewed as a MAXIMUM possible cost Allows the assessment of a product’s potential before allocating resources for its production Differences between Cost-Base Pricing and Target Costing (1228) Cost-based designs the product before worrying about a price o Committed costs the costs of design, development, engineering, testing and production that are engineered into a product or service at the design stage of development o Incurred costs actual costs incurred in making the product Price-basedcomputes the best price, then starts to designing the product based on price limitations A new product is designed only if its projected costs are equal to or lower than its target cost