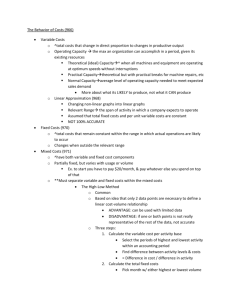

COSTING FOR PRICING DECISIONS

advertisement

COSTING FOR PRICING DECISIONS Gerald E. Smith, D.B.A. Carroll School of Management Boston College PROFITABLE PRICING REQUIRES UNDERSTANDING THE TRUE COST The true cost is the cost incurred if a sale is made, or the cost not incurred if a sale is not made. IDENTIFYING TRUE COSTS Incremental (not the “full cost”) Avoidable (not the “sunk cost”) THE FOCUS OF PROFITABLE PRICING Price Unit Sales Volume Total Revenue $10 100,000 $1,000,000 Unit Variable Costs Total Variable Costs $3 $300,000 Unit Contribution Total Contribution $7 $700,000 Fixed Costs $500,000 Net Income Before Taxes $200,000 IDENTIFY INCREMENTAL VARIABLE COSTS VARIABLE COSTS ARE ALWAYS INCREMENTAL But be careful of averages! The incremental variable cost for a change in sales is often not equal to the average variable cost. Examples: – – – Overtime vs. average cost production; Costs from multiple sources using different technologies (joint product vs. prime sourcing); Average over different types of customers. IDENTIFY INCREMENTAL FIXED COSTS SOME FIXED COSTS ARE ALSO INCREMENTAL FOR PRICING. They are the fixed costs incurred to implement a change in pricing. MOST FIXED COSTS ARE NOT INCREMENTAL Since they do not change with a change in price or sales, they are not incremental. They have no impact on the relative profitability of alternative pricing strategies. Examples: Product Development Costs; Advertising IDENTIFY INCREMENTAL OPPORTUNITY COSTS Full costs--which include non-incremental fixed costs—are neither the actual costs incurred when making additional sales at lower prices, nor the actual costs saved when making fewer sales at higher prices. They are, therefore, misleading as a guide to pricing. Beware of overlooking or ignoring opportunity costs. They are often incremental, even when associated with otherwise “fixed” assets. Examples: Alternative uses of capacity, funds, or management time. SUNK COST FALLACY: WHICH COST IS RELEVANT INITIAL SITUATION Price Per Unit Historical & Replacement Cost Profit Contribution Per Unit Cash Flow Per Unit AFTER COST INCREASE Price Per Unit Historical Cost Replacement Cost Profit Contribution Per Unit Cash Flow Per Unit $22.50 13.50 9.00 9.00 $22.50 13.50 15.00 9.00 7.50 COST ANALYSIS FOR PRICING DECISIONS Boscot Corporation TOTAL Direct Labor $144,000 Materials 42,000 Plant & Equipment 216,000 Sales & Marketing 12,000 Order Process & Ship 24,000 Warehousing 18,000 General & Admin 66,000 TOTAL $522,000 What is the relevant unit cost? $/UNIT $24 7 36 2 4 3 11 $87 TRUE COST __________ __________ __________ __________ __________ __________ __________ USEFUL INFORMATION ABOUT BOSCOT Direct Labor Plant & Equipment Marketing & Sales Order Process & Ship Warehousing General & Admin Overtime pay is 1.5 times normal pay. Depreciated according to IRS rules. New salespeople must be hired, and a new promo program produced to target new buyers. Expected cost $6,000, regardless of sales actually generated. Buyers in new market segment order in quantities half the size of orders of current customers. Owns and rents warehouse space. Warehousing for 1,500 units is charged at $4,500 of original building & maintenance. To warehouse 1,500 more units Build addition towarehouse at charge of $6,500; Stop leasing space to other companies, which earns rents of $6,000 per week. Corporate overhead, R&D, etc Reorganize Costs for Effective Management! PER UNIT (for simple pricing decisions) Price - Unit Variable Cost Contribution Margin INCREMENTAL (for pricing with incremental investment) Incremental Revenue - Incre. Variable Cost Incremental Contribution - Incremental Fixed Costs Net Incre. Contribution TOTAL (for determining overall business profitability) Sales Revenue - Total Variable Costs Total Contribution - Incremental Fixed Costs Net Contribution - Nonincremental Fixed and Sunk Costs Net Profit APPROXIMATELY RIGHT, OR PRECISELY WRONG Determining the true cost of a product or service--the incremental, avoidable cost--requires making adjustments to the full, average costs as calculated for financial purposes. These adjustments often require that you make judgments about which you are uncertain, and that are debatable. This is not, however, a reason to avoid making such judgments. It is better to make pricing decisions based on a rough idea of the true unit cost of your product or service than on a precise accounting of costs that are irrelevant to its profitability! WHY FOCUS ON CM Tool of Competitive Advantage – – Tool for Segmentation Pricing – – Relative Advantage Relative Cost Set different prices for different segments Can reach more segments Indicator of how to drive profitability – – High Margin: Volume-based Strategies Low Margin: Gross Profit Bundling Strategies Strategic Models to Manage the Business Unit Gross Profit Strategy Corporate Strategy Operating Strategy Decision Maker Market Managers Top Management Operating Managers Management Focus Short-term gross profitability of customer opportunities Longer-term net profitability of business investments and resource allocations Short-term efficiency and effectiveness of Management Decisions Which opportunity to serve Terms of the transaction -- Pricing -- Product definition -- Service definition -- Where to deliver (location) -- When to deliver (timing) -- How much (volumes) Which business units to invest resources in How much to invest What resource mix to invest -- Financial -- Human resources -- Tangible assets -- Intangible assets How to deploy resources How to manufacture How to service When to serve What to deliver How to deliver Performance Measures Business unit gross margins, gross profit Customer, market segment gross margins, gross profit Total net earnings Financial Return Measures, e.g., ROI, ROA, ROE Customer satisfaction Perceived quality Process efficiency Process productivity Figure 1 Incremental Gross Profit Strategies Volume-Based Gross Profit Strategies -drive volume across the market Incr Cost Service Y Segment B Margin Product A Segment A Price/Bundling Gross Profit Strategies -drive gross profit bundles through target segments Margin Segment A Incr Cost Segment B Margin Segment D Margin Segment D Incr Cost TOTAL GROSS PROFIT Segment E Margin Incr Cost Product C Segment E Service X High Margin Product Margin Service Z Incremental Cost Segment C Product B Segment C Margin Incr Cost TOTAL GROSS PROFIT Figure 2 Customer Opportunity Portfolio and Gross Profit Strategies for Low Margin Managers Low Price Sensitivity Customized Bundling Strategies Higher relative prices, greater brand loyalty Custom Solution or Specialty Buyers Convenience Bundling Strategies Emerging Value Buyers High-Differentiation Volume Strategies Loyal Volume Buyers Platform Bundling Strategies ValueAdded Buyers High Price Sensitivity High Cost To Serve Lower relative costs, greater volume and scale, lower transaction, relationship, and opportunity costs Low Cost To Serve Cost to Serve Figure 3 Perceived Competitive Advantage Competitor A Perceived Advantage Competitor B Perceived Disadvantage 20% Perceived Gross Margin 80% Perceived Gross Margin 80% Perceived Cost 20% Perceived Cost Strategic Options: 1. Compete with Advertising 2. Compete with Promotions 3. Compete with Price Managerial Motivation: • Offensive, Aggressive • Drive Volume Strategic Options: 1. Compete with Limited Non-Price Promotions Managerial Motivation: • Defensive, Cautious • Protect Margin Sidebar Figure 1A Arrow Electronics Customer Portfolio (Bubble size = Segment Gross Profit relative to Total Gross Profit) Higher relative prices, greater brand loyalty Low Price Sensitivity Customized Bundling Strategies High-Differentiation Volume Strategies ICPBAS ICPVA Convenience Bundling Strategies Platform Bundling Strategies OEMBAS CMVA High Price Sensitivity CMM&P High Cost To Serve X86VA OEM VA CMBAS Lower relative costs, greater volume and scale, lower transaction, relationship, and opportunity costs X86BAS Low Cost To Serve Cost to Serve