Ch5

advertisement

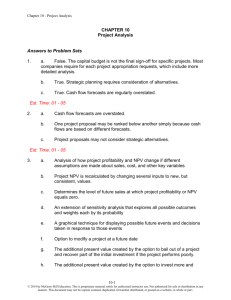

Chapter 05 - Net Present Value and Other Investment Criteria CHAPTER 5 Net Present Value and Other Investment Criteria Answers to Problem Sets 1. a. A = 3 years, B = 2 years, C = 3 years. b. B c. A, B, and C d. B and C (NPVB = $3,378; NPVC = $2,405) e. True. The payback rule ignores all cash flows after the cutoff date, meaning that future years’ cash inflows are not considered. In addition, the payback rule ignores the timing of cash inflows. For example, for a payback rule set at two years, a project with a payback period of one year is given equal weight as a project with a payback period of two years. f. It will accept no negative-NPV projects, but will turn down some with positive NPVs. A project can have positive NPV if all future cash flows are considered but still do not meet the stated cutoff period. Est. time: 6 – 10 2. Given the cash flows C0, C1, . . . , CT, IRR is defined by: It is calculated by trial and error, by financial calculators, or by spreadsheet programs. Est. time: 1 – 5 3. a. $15,750; $4,250; $0 b. 100% Est. time: 1 – 5 4. No (you are effectively “borrowing” at a rate of interest higher than the opportunity cost of capital). Est. time: 1 – 5 5-1 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Chapter 05 - Net Present Value and Other Investment Criteria 5 a. b. Two. There are multiple internal rates of return for a project when there are changes in the sign of the cash flows. −50% and +50%. The NPV for the project using both of these IRRs is 0. c. Yes, NPV = +14.6. Est. time: 1 – 5 6. The incremental flows from investing in Alpha rather than Beta are −200,000; +110,000; and 121,000. The IRR on the incremental cash flow is 10% (i.e., −200 + 110/1.10 + 121/1.102 = 0). The IRR on Beta exceeds the cost of capital and so does the IRR on the incremental investment in Alpha. Choose Alpha. Est. time: 1 – 5 7. 1, 2, 4, and 6 The profitability index for each project is shown below: Project NPV Investment Profitability Index (NPV/Investment) 1 5,000 10,000 5,000/10,000 = 0.5 2 5,000 5,000 3 10,000 90,000 10,000/90,000 = 0.11 4 15,000 60,000 15,000/60,000 = 0.25 5 15,000 75,000 15,000/75,000 = 0.2 6 3,000 15,000 3,000/15,000 = 0.2 5,000/5,000 = 1 Start with the project with the highest profitability index and go from there. Project 2 has the highest profitability index and has an initial investment of $5,000. The next highest profitability index is for Project 1, which has an initial investment of $10,000. The next highest is Project 4, which will cost $60,000 up front. So far we have spent $75,000. Projects 5 and 6 both have profitability indexes of .2, but we only have $15,000 left to spend, so we will add Project 6 to our list. This gives us Projects 1, 2, 4, and 6. Est. time: 1 – 5 8. a. NPVA $1000 $1000 $90.91 (1.10) 5-2 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Chapter 05 - Net Present Value and Other Investment Criteria NPVB $2000 $1000 $1000 $4000 $1000 $1000 $4,044.73 (1.10) (1.10) 2 (1.10) 3 (1.10) 4 (1.10)5 NPVC $3000 $1000 $1000 $1000 $1000 $39.47 (1.10) (1.10) 2 (1.10) 4 (1.10) 5 Projects B and C have positive NPVs. b. Payback A = one year Payback B = two years Payback C = four years c. A and B d. PVA $1000 $909.09 (1.10)1 The present value of the cash inflows for Project A never recovers the initial outlay for the project, which is always the case for a negative NPV project. The present values of the cash inflows for Project B are shown in the third row of the table below, and the cumulative net present values are shown in the fourth row: C0 C1 C2 C3 C4 -2,000.00 -2,000.00 +1,000.00 909.09 -1,090.91 +1,000.00 826.45 -264.46 +4,000.00 3,005.26 2,740.80 +1,000.00 683.01 3,423.81 C5 +1,000.00 620.92 4,044.73 Since the cumulative NPV turns positive between year 2 and year 3, the discounted payback period is: 2 264.46 2.09 years 3,005.26 The present values of the cash inflows for Project C are shown in the third row of the table below, and the cumulative net present values are shown in the fourth row: C0 C1 C2 C3 C4 C5 -3,000.00 -3,000.00 +1,000.00 909.09 -2,090.91 +1,000.00 826.45 -1,264.46 0.00 0.00 -1,264.46 +1,000.00 683.01 -581.45 +1,000.00 620.92 39.47 Since the cumulative NPV turns positive between year 4 and year 5, the discounted payback period is: 4 581.45 4.94 years 620.92 5-3 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Chapter 05 - Net Present Value and Other Investment Criteria e. Using the discounted payback period rule with a cutoff of three years, the firm would accept only Project B. Est. time: 11– 15 9. a. When using the IRR rule, the firm must still compare the IRR with the opportunity cost of capital. Thus, even with the IRR method, one must specify the appropriate discount rate. b. Risky cash flows should be discounted at a higher rate than the rate used to discount less risky cash flows. Using the payback rule is equivalent to using the NPV rule with a zero discount rate for cash flows before the payback period and an infinite discount rate for cash flows thereafter. Est. time: 1 – 5 10. r = -17.44% 0.00% 10.00% 15.00% 20.00% 25.00% 45.27% Year 0 -3,000.00 -3,000.00 -3,000.00 -3,000.00 -3,000.00 -3,000.00 -3,000.00 -3,000.00 Year 1 3,500.00 4,239.34 3,500.00 3,181.82 3,043.48 2,916.67 2,800.00 2,409.31 Year 2 4,000.00 5,868.41 4,000.00 3,305.79 3,024.57 2,777.78 2,560.00 1,895.43 Year 3 -4,000.00 -7,108.06 -4,000.00 -3,005.26 -2,630.06 -2,314.81 -2,048.00 -1,304.76 PV = -0.31 500.00 482.35 437.99 379.64 312.00 -0.02 The two IRRs for this project are (approximately): –17.44% and 45.27%. Between these two discount rates, the NPV is positive. Est. time: 06 - 10 14. a. First calculate the NPV for each project. The NPV for Project D is: NPVD 10,000 20,000 $8,181.82 1.10 The NPV for Project E is: NPVE 20,000 35,000 $11,818.18 1.10 Profitability index = NPV/initial investment. For Project D: Profitability index = 8,181.82/10,000 = .82. For Project E: Profitability index = 11,818.18/20,000 = .59. 5-4 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Chapter 05 - Net Present Value and Other Investment Criteria b. Each project has a profitability index greater than zero, and so both are acceptable projects. In order to choose between these projects, we must use incremental analysis. For the incremental cash flows: PIE D 15,000 1.10 3,636 0.36 ( 10,000) 10,000 10,000 The increment is thus an acceptable project, and so the larger project should be accepted, i.e., accept Project E. (Note that, in this case, the better project has the lower profitability index.) Est. time: 11 - 15 5-5 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.