JPS Industries, Inc. Announces Third Quarter 2014 Results

advertisement

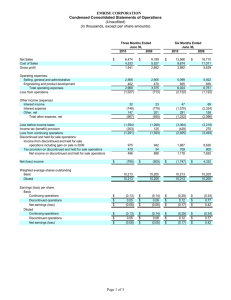

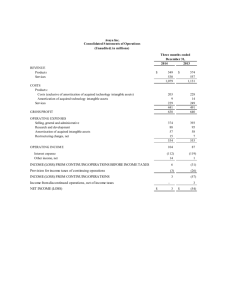

NEWS BULLETIN JPS Industries, Inc. 55 Beattie Place Suite 1510 Greenville, SC 29601 For Further Information: Mikel H. Williams President and Chief Executive Officer (864) 239-3900 JPS Industries, Inc. Announces Third Quarter 2014 Results GREENVILLE, S.C., August 19, 2014 – JPS Industries, Inc. (JPST.PK), a leading manufacturer of composite materials, today announced financial and operating results for our third fiscal quarter ended August 2, 2014. Highlights: Third quarter net sales of $43.5 million, a 12% decrease vs. the year ago quarter 2013 net sales of $49.6 million as the result of $7.6 million lower ballistics market net sales, as the prior year quarter’s results were particularly strong Year to date net sales of $122.4 million, an 8% increase over the prior year Third quarter gross profit of $7.2 million, a 16.4% gross margin vs. a 15.7% gross margin in the year ago third quarter, as lower margin ballistics business comprised a smaller portion of our overall business mix Third quarter SG&A of $3.8 million, increased over the prior year quarter of $3.2 million due to higher non-cash stock related compensation, book pension expense and employee incentive accruals Third quarter adjusted EBITDA of $4.2 million Third quarter GAAP net income of $1.5 million, or $0.14 per share, fully diluted Cash of $4.8 million and escrow cash of $1.5 million with no debt outstanding Contributed $7.1 million in cash to the pension plan in the year to date period Mikel H. Williams, JPS’s CEO stated: “I am pleased to report another solid quarter of operating performance. Last year the ballistics business was back half year loaded, and this year this business is more evenly distributed through the year, as our year to date net sales to this market are up 16% over the prior year’s nine month period. Contributing to the quarter were stronger sales in the electronics and general industrial markets. 1 We also continue our focus on cost management and operational efficiency. We have strengthened our team with a focus to drive lean and “5S” manufacturing principals. Further, we are in a solid financial position, with sufficient cash to execute our business plan and no outstanding debt. Our banking facility remains in place with approximately $25 million available,” Williams concluded. The Statement of Operations for both the current year and the prior year periods have been prepared reflecting the Stevens Urethane division as a discontinued operation, as the sale was closed on April 30, 2014. The prior year balance sheet has not been restated for comparison purposes since the division was not an asset held for sale at that time. Certain reclassifications as well as re-allocations among quarterly periods have been made to the prior year’s third quarter’s financial statements to conform to the current year’s presentation. These changes will have no effect on the previously reported results of operations for the full fiscal year 2013. About JPS Industries, Inc. JPS Industries, Inc. is a major U.S. manufacturer of sheet and mechanically formed glass and aramid materials for specialty applications in a wide expanse of markets requiring highly engineered components. JPS's products are used in a wide range of applications including: advanced composite materials; civilian and military aerospace components; printed electronic circuit boards; filtration and insulation products; specialty commercial construction substrates; automotive and industrial components; soft body armor for civilian and military applications. Headquartered in Greenville, South Carolina, the Company operates three manufacturing locations in Anderson and Slater, South Carolina and Statesville, North Carolina. ### Non-GAAP Financial Measures This release includes 'adjusted EBITDA', a non-GAAP financial measure as defined in Regulation G of the Securities Exchange Act of 1934. Management believes that the disclosure of non-GAAP financial measures, when presented in conjunction with the corresponding GAAP measures, provide useful information to the Company, investors and other users of the financial statements and other financial information in identifying and understanding operating performance for a given level of net sales and business trends. Management believes that adjusted EBITDA is an important factor of the Company's business because it reflects financial performance that is unencumbered by debt service and other non-cash, non-recurring or unusual items. This financial measure is commonly used in the Company's industry. However, adjusted EBITDA should not be considered as an alternative to cash flow from operating activities, as a measure of liquidity or as an alternative to net income as a measure of operating results in accordance with generally accepted accounting principles. The Company's definition of 2 adjusted EBITDA may differ from definitions of such financial measure used by other companies. The Company has provided a reconciliation of adjusted EBITDA to GAAP financial information in the attached Schedule of Non-GAAP reconciliations. "SafeHarbor" Statement under the Private Securities Litigation Reform Act of 1995 Except for historical information contained in this release, statements in this release may constitute forward-looking statements regarding the Company's assumptions, projections, expectations, targets, intentions or beliefs about future events. Words or phrases such as "anticipates," "believes," "estimates," "expects," "intends," "plans," "predicts," "projects," "targets," "will likely result," "will continue," "may," "could" or similar expressions identify forward-looking statements. Forward-looking statements involve risks and uncertainties, which could cause actual results or outcomes to differ materially from those expressed. The Company cautions that while it makes such statements in good faith and it believes such statements are based on reasonable assumptions, including without limitation, management's examination of historical operating trends, data contained in records, and other data available from third parties, it cannot assure you that the Company's projections will be achieved. In addition to other factors and matters discussed from time to time in the Company's filings with the U.S. Securities and Exchange Commission, or the SEC, some important factors that could cause actual results or outcomes for JPS or its subsidiaries to differ materially from those discussed in forward-looking statements include changes in general economic conditions in the markets in which it may compete and fluctuations in demand in the electronics industry; the Company's ability to sustain historical margins; increased competition; increased costs; loss or retirement of key members of management; currency exchange rate fluctuations; integration of acquired operations; international operations; compliance with environmental regulations; potential impacts of natural disasters on the electronics industry and the Company’s supply chain; increases in the Company's cost of borrowings or unavailability of additional debt or equity capital on terms considered reasonable by management; and adverse state, federal or foreign legislation or regulation or adverse determinations by regulators. Any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by law, the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all such factors. 3 JPS INDUSTRIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Dollars in thousands, except per share data) (Unaudited) 13 Weeks Ended August 2, July 27, 2014 2013 Net sales Cost of sales $ Gross profit Selling, general & administrative and other expenses Litigation charge (recovery) Severance and restructuring Distribution expense 43,531 36,373 $ 49,648 41,859 $ 122,420 102,085 $ 113,512 93,820 7,158 16.4% 7,789 15.7% 20,335 16.6% 19,692 3,793 3,148 (502) 4,021 1,038 10,664 10,678 (502) 4,021 2,801 890 Operating profit 39 Weeks Ended August 2, July 27, 2014 2013 2,475 Interest expense, net 84 5.7% 93 2,781 6,890 0.2% 325 2,694 5.6% 535 945 Income before income taxes 2,382 (241) 6,355 1,749 Income taxes Income from continuing operations 877 1,505 (113) (128) 2,339 4,016 611 1,138 824 7,471 999 1,612 Discontinued operations: Gain on sale of discontinued operations, net of taxes Income from discontinued operations, net of taxes Net income WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: Basic Diluted $ 1,505 3.5% $ 696 1.4% $ 12,486 10.2% $ 2,750 10,328,960 10,281,460 10,305,210 10,258,877 10,488,675 10,339,896 10,418,828 10,342,051 Basic earnings per common share $ 0.15 $ 0.07 $ 1.21 $ 0.27 Diluted earnings per common share $ 0.14 $ 0.07 $ 1.20 $ 0.27 $ 1,505 93 877 393 350 $ $ 12,486 535 2,339 1,182 385 $ $ 2,750 945 611 839 98 4,021 (502) (1,612) 2,760 9,910 $ $ $ 1,502 105 1,507 Adjusted EBITDA: Net income Plus interest expense Plus income taxes Plus depreciation and amortization Plus stock comp expense Severance and restructuring Less litigation recovery in SGA Gain on sale of discontinued operations, net of taxes Income from discontinued operations, net of taxes Plus pension and post retirement expense Adjusted EBITDA Capital expenditures Cash taxes paid Cash pension contributions $ 955 4,173 $ $ $ 84 268 4,711 4 9.6% $ $ $ $ 696 325 (113) 279 6 4,021 (502) (824) 920 4,808 9.7% 294 55 821 $ (7,471) (999) 2,863 11,320 $ $ $ 658 506 7,057 9.2% 17.3% 2.4% 2.4% 8.7% JPS INDUSTRIES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Dollars in thousands) (Unaudited) August 2, 2014 ASSETS Current Assets: Cash Restricted cash Cash held in escrow Accounts receivable, net of reserves Inventories Prepaid expenses and other Total current assets $ Property, plant and equipment, net Deferred income taxes Goodwill Other assets 4,827 1,500 28,043 24,348 7,640 66,358 November 2, 2013 $ 31,295 24,341 7,525 68,502 12,856 47,162 10,100 319 Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities: Accounts payable Accrued pension costs Accrued expenses, salaries, benefits and withholding Current portion of long-term debt Total current liabilities 136,795 $ 151,027 $ 13,818 6,005 3,352 23,175 $ 10,013 8,611 7,487 4,980 31,091 Total liabilities Total shareholders' equity $ 5 16,935 54,954 10,100 536 $ Long-term debt Accrued pension costs Other long-term liabilities Total liabilities and shareholders' equity 1,656 3,685 26,060 534 18,147 27,648 534 49,769 77,420 87,026 73,607 136,795 $ 151,027