HMDA/Data Collection Compliance Audit The following checklist

advertisement

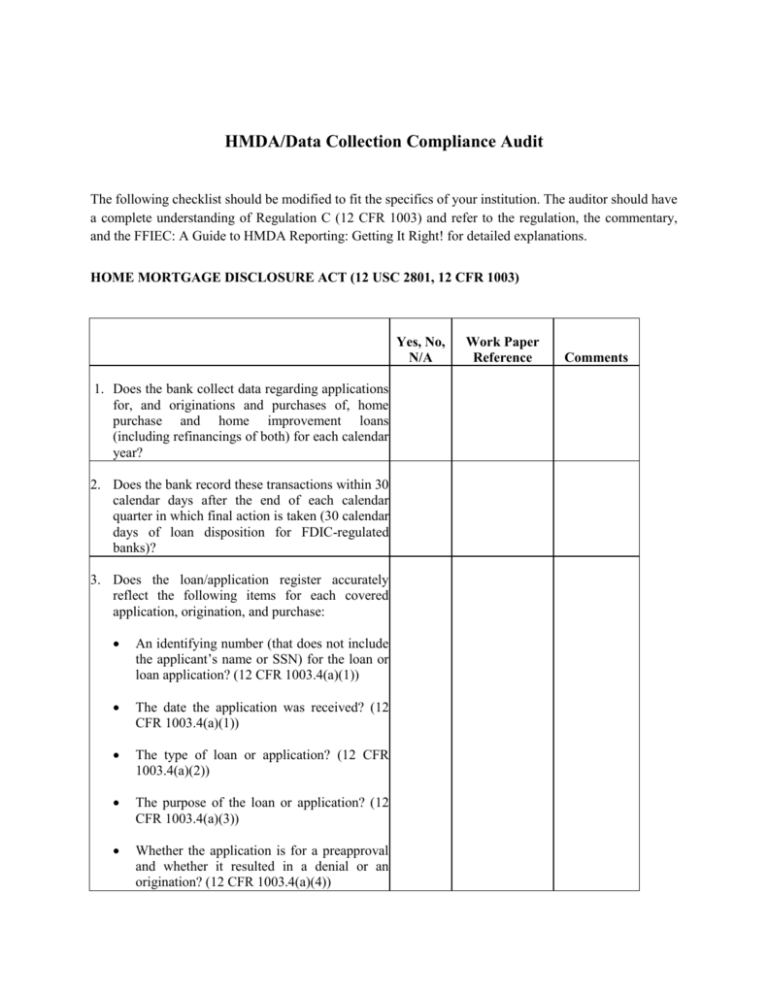

HMDA/Data Collection Compliance Audit The following checklist should be modified to fit the specifics of your institution. The auditor should have a complete understanding of Regulation C (12 CFR 1003) and refer to the regulation, the commentary, and the FFIEC: A Guide to HMDA Reporting: Getting It Right! for detailed explanations. HOME MORTGAGE DISCLOSURE ACT (12 USC 2801, 12 CFR 1003) Yes, No, N/A 1. Does the bank collect data regarding applications for, and originations and purchases of, home purchase and home improvement loans (including refinancings of both) for each calendar year? 2. Does the bank record these transactions within 30 calendar days after the end of each calendar quarter in which final action is taken (30 calendar days of loan disposition for FDIC-regulated banks)? 3. Does the loan/application register accurately reflect the following items for each covered application, origination, and purchase: An identifying number (that does not include the applicant’s name or SSN) for the loan or loan application? (12 CFR 1003.4(a)(1)) The date the application was received? (12 CFR 1003.4(a)(1)) The type of loan or application? (12 CFR 1003.4(a)(2)) The purpose of the loan or application? (12 CFR 1003.4(a)(3)) Whether the application is for a preapproval and whether it resulted in a denial or an origination? (12 CFR 1003.4(a)(4)) Work Paper Reference Comments The property type to which the loan or application relates? (12 CFR 1003.4(a)(5)) The owner-occupancy status of the property to which the loan or application relates? (12 CFR 1003.4(a)(6)) The loan amount or the amount requested on the application? (12 CFR 1003.4(a)(7)) The type of action taken? (12 CFR 1003.4(a)(8)) The date such action was taken? (12 CFR 1003.4(a)(8)) The location of the property to which the loan or application relates by (12 CFR 1003.4(a)(9)): — MSA or MD number (5 digits) — State (2 digits) — County (3 digits) — Census tract number (6 digits) The ethnicity and race of the applicant or borrower? (12 CFR 1003.4(a)(10)) The type of entity purchasing a loan that the institution originates or purchases and then sells within the same calendar year (this information need not be included in quarterly updates)? (12 CFR 1003.4(a)(11)) For originated loans subject to Regulation Z, 12 CFR 1026, the difference between the loan's annual percentage rate (APR) and the average prime offer rate for a comparable transaction as of the date the interest rate is set, if that difference is equal to or greater than 1.5 percentage points for loans secured by a first lien on a dwelling, or equal to or greater than 3.5 percentage points for loans secured by a subordinate lien on a dwelling? (12 CFR 1003.4(a)(12)) Whether the loan is subject to the Home Ownership and Equity Protection Act of 1994, as implemented in Regulation Z (12 CFR 1026.32)? (12 CFR 1003.4(a)(13)) The lien status of the loan or application (first lien, subordinate lien, or not secured by a lien on a dwelling)? (12 CFR 1003.4(a)(14)) Reasons for denial? (12 CFR 1003.4(c)) Note: This is optional information unless you are a national bank or federally chartered thrift. 4. If the applicant or borrower chooses not to provide the monitoring information, does the bank note data about the race or national origin and sex of the applicant or borrower on the basis of visual observation or surname to the extent possible? 5. Does the bank exclude appropriate applications from reporting, such as: loan Loans made or purchased in a fiduciary capacity? Loans on unimproved land? Construction loans and other temporary financing (but construction-permanent loans must be reported)? Purchase of an interest in a pool of mortgages, such as a mortgage participation certificate, a real estate mortgage investment conduit (REMIC), or a mortgage-backed security? Purchase solely of loan servicing rights? Loans originated prior to the current reporting year and acquired as part of a merger or acquisition, or as part of the acquisition of all of the assets and liabilities of a branch office? The acquisition of only a partial interest in a home purchase or home improvement loan or a refinancing by the bank, even if the bank has participated in the underwriting and origination of the loan (such as in certain consortium loans)? Prequalification requests for mortgage loans, as opposed to preapproval requests, which must be reported? See 12 CFR 1003, comment 1003.2(b)-2. Assumptions not involving a written agreement between the lender and the new borrower? The auditor should refer to 12 CFR 1003 and FFIEC: A Guide to HMDA Reporting: Getting It Right! for changes made from time to time. 6. Does the bank send its complete loan/application register to the applicable agency by March 1 of the following year? 7. Does the bank retain a copy of each loan/application register for a period of no less than three years? 8. Does the bank make its mortgage loan disclosure statement available to the public at its home office no later than three business days after receiving it from the Federal Financial Institutions Examination Council (FFIEC)? 9. Does the bank make its mortgage loan disclosure statement available to the public within 10 business days in at least one branch office in each MSA? 10. Does the bank make its mortgage loan disclosure statements available for five years? 11. Does the bank make its modified loan/application register available to the public at its home office no later than March 31 of the following year? 12. Does the bank make its modified loan/application register available to the public in at least one branch office in each MSA no later than March 31 of the following year? 13. Does the bank make its modified loan/application register available for three years? OCC-Regulated Banks — National Fair Housing Home Loan Data System 1. If the bank receives 50 or more home loan applications a year, as measured by the previous calendar year, and is not covered by the Home Mortgage Disclosure Act (HMDA), does it record and maintain for each decision center the following information for purchase, constructionpermanent, and refinance applications: Number of applications received? Number of loans closed? Number of applications denied? Number of loans withdrawn by the applicant? 2. Is such information updated quarterly, within 30 calendar days after the end of each calendar quarter? 3. Does the bank attempt to obtain all of the following information on applications for home loans: Loan amount requested? Interest rate requested? Number of months requested to maturity? Location: complete street address, city, county, state, and zip code? Number of residential units in the dwelling? Year the dwelling was built? Purpose of the loan: purchase, refinance, or construction-permanent? Name and present address of the applicant? Age of the applicant? Marital status, using the categories married, unmarried, and separated? Number of years applicant employed in the present line of work or profession? Number of continuous years applicant employed by the current employer? Gross total applicant? monthly income Proposed monthly housing principal, and interest? of each payment, Purchase price? Total monthly payments on all outstanding liabilities? Net worth? Date of application? Sex? Race/national origin? 4. If the applicant does not voluntarily provide the information on sex and race/national origin, does the bank request the applicant to note that fact, and does the bank provide the information based on visual observation or surname? 5. Does the bank disclose to the applicant that: The information on race/national origin and sex is requested by the federal government, if the loan is related to a home loan, to monitor the bank's compliance with equal credit opportunity and fair housing laws? The applicant is not required to furnish the information but is encouraged to do so, and the bank may neither discriminate on the basis of this information nor on whether the applicant chooses to furnish it? If the applicant chooses not to furnish the information, federal regulations require the lender to note race and sex on the basis of visual observation or surname? 6. Does the bank maintain the following information in each of its home loan files, as applicable: Appraised value? Census tract number? Disposition of loan application? Final terms, if offered (even if not accepted)? Commitment date? Type of mortgage? Name or identification of the bank office where the application was submitted? If denied, a copy of the ECOA credit notice and statement of credit denial? Any additional information used by the bank?