Basically, we put most of our money into four sectors: Financial

advertisement

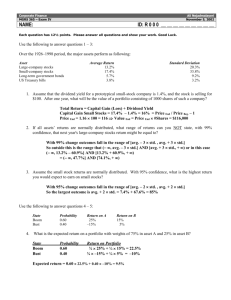

Assessment and Group Dynamics To be frank, during this time, no investment is safe. It’s really hard for us to measure the risk for different stocks. We were trying hard to make the risk lower than the average. Our team members found their information varied based on their own experience and channels. We mainly got our stock information from some financial websites, such as Yahoo Finance, Google Finance etc. Basically, we chose our picks based on diversification throughout our portfolio. According to the diversification of our portfolio, we have to consider about different sectors, from those sectors, we need to pick up the best ones we thought based on the different considerations. Firstly, we found out lots of profiles of the companies from their websites and some articles. We also considered about the companies’ strategies for the future to make sure they keep consistency. This should be the entry level risk about the companies we picked. Second, we tracked about the historical data about the companies we want to pick, including P/E ratios, Beta, previous market return, the expected return forecasting, dividend payment policy, current ratio, quick ratio etc. Thirdly, we almost kept comparing the industrial ratios and percentages to those stocks we want to pick to against the risk we took. We would like to describe our portfolio week by week to illustrate the results we make. From initial position to the week one: Our portfolio: BAC: Bank of America Corporation is a financial organization which provides financial service in US and internationally. They provide retail banking business, investment banking service both for persons and business organizations. WFC: Wells Fargo & company offers banking and investing products and services in the US from their three sectors: Community Banking, Wholesale Banking and Wells Fargo Financial THI: well-known franchise brand which offers fast food from all their restaurants between US and Canada. ATA.TO: ATS is a dominate manufacture automation solutions provider around the world. AAPL: A famous designer, manufacturer of digital products and computers. HSB.PR.C: HSBC is the world’s local bank which provides every part of financial service around the world. YRI: Yamana Gold Inc is a leading company in gold mining industry. CP: Canadian Pacific Railway Limited is a transportation company which provides transportation services around US and Canada. AMGN: Amgen Inc is a biotech company to discover, develop, manufacture and market the human therapeutics base on cellular and molecular biology. AAH: Astra Technologies Limited. The Group’s main business is to engage in the whole process of communication and support systems of buildings. WJA: WestJet Airlines Ltd. A airline service company to transport both people and goods around North America. NOK: Nokia Corporation, the designer, manufacturer and distributor of today’s most of cell phones around the world. Our sectors: Financial Service technology Basic Materials Week one’s sector’s beta Financial: BAC HSB.PR.C WFC AVG 1.89 1.2 0.99 1.36 Service: THI ATA.TO CP WJA AVG 0.89 1.22 1.14 1.19 1.11 Technology: APPL AAH NOK AVG 1.55 0.86 1.58 1.33 Basic Materials: AMGN 0.32 YRI 0.95 AVG 0.635 Base on risk and return for our picks, we went through lots of company profiles from some websites to get the information about the companies we wanted to pick. In addition to the profiles, we found out the betas for every company which is showing above from the table. Because the risk-free rate and market premium rate are the same for all the stocks we picked, the only difference is the beta, the higher of the beta, the higher risk we undertook in our portfolio, among our sectors, financial one was considered the most risky one. Because the average beta of them is 1.36, it indicates that we expect more return on those stocks. The second one is the technology section, beta is 1.33 in average, it also demonstrated that we wanted high return for those ones. In order to put our overall risk down to the average, we picked some service companies and basic materials ones to balance out our risk. The betas of these two parts are 1.11 and 0.634 respectively. Because it was our first week to begin to invest the stock market, we tried to put more money on the higher risk ones to take a chance to earn more money as a good start. Those above are how we assess the risk, how we make the decisions about the picks. Week two: Portfolio change: Purchased: TA: TransAlta Corporation is a company providing electronic energy around the North America. ACO.X:Atco Ltd. This company distribute electricity, gas, power transmission. BIR:Birchcliff Energy Ltd. They are doing the oil and natural gas reserves’ exploration, development and production in the western Canadian Sedimentary Basin BVF:Biovail Corporation, a pharmaceutical company being involved in the formulation, clinical testing, registration, manufacture, and commercialization of pharmaceutical products around the US and Canada. GE:A conglomerate who is producing almost everything we need in our life. OIL:Oilexco Incorporated, oil and natural gas exploration, development and production Company in the UK North Sea. TCW:Trican Well Service Ltd is manufacturing products being used in the drilling completion stimulation and reworking of oil and gas. ARZ:Aurizon Mines Ltd. is a Canada-based gold producer with operations and development activities in the Abitibi region of northwestern Quebec. Sold: ATS Automation Tooling Systems Inc. Apple Inc HSBC Bank – Canada Canadian Pacific Railway Ltd Nokia Corp. Our sectors: ATA.TO AAPL HSB.PR.C CP NOK Financial Service Technology Basica Materials conglomerates health care Financial : BAC WFC 1.89 0.99 1.44 Basic Materials YRI 0.95 BIR -0.7 OIL 2.1 ARZ 1.5 TCW 1.43 1.056 Service: THI WJA ACO.X TA 0.89 1.19 0.58 1.49 1.0375 Conglomerates: GE 1.27 Technology: AAH 0.86 Health care: AMGN 0.32 BVF 0.83 0.575 Since the unsuccessful practice in the stock market, we decided to withdraw some money back from the financial sector and technology sector. We put less money in these sectors in terms of higher risk. We added a health care sector to our portfolio to bring the risk down a little bit. We did not want to give the financial sector up, because it has higher return for our whole portfolio. We sold two financial stocks to get our money to a safer sector. We put more money on the basic materials and the service sector. The average beta for financial, service and basic materials are 1.44, 1.0375 and 1.056 respectively. The average beta for technology decreased to 0.86. we added one conglomerate company to our portfolio which is high risky. The beta for this one is 1.27. For the health care sector, the beta is only 0.575, we just want to put some money on there to earn some cash equivalent to the inflation. Week three: Portfolio changing: Portfolio change: Purchased: TXT: Textron, Inc. operates in the aircraft, industrial, and finance businesses worldwide. It operates through five segments: Cessna, Bell, Textron Systems, Industrial, and Finance. BFC: BFI Canada, Ltd is a income trust units that provide some financial services. L: Loblaw Companies Limited. The Group's principal activity is to distribute food and provide general merchandise products, drugstore and financial products and services through its operating banners. Sold: Wells Fargo & Company General Electric Oilexco WFC GE OIL Our sectors: Financial Service Basic Material Conglomerate s Health care Our beta for every sector Financial : BAC BFI avg Basic Materials YRI 1.89 0.93 1.41 0.95 Service: THI WJA ACO.X TA L avg Conglomerates: TXT 0.89 1.19 0.58 1.49 0.4 0.91 2.36 Health care: AMGN 0.32 BIR ARZ TCW avg 0.7 1.5 1.43 1.145 BVF avg 0.83 0.575 For the third week, the financial sector was the same with last week we had. For the service part, we adjusted our stocks to lower the risk based on beta, it was 0.91 in the third week. The basic materials, we almost kept the same amount and stocks in our portfolio. The beta is 1.145. We changed the conglomerate; we sold the GE stock to buy a even more risky one called TXT. We were trying to make a high return for this one. For the health care sector, as I mentioned in the last week’s portfolio, we would keep it for a long-term investment to go along with the inflation rate. Week Four: Portfolio changing: Purchased: EDU: New Oriental Education & Technology Group, Inc is a China-base leading English-training organization which has a comprehensive English teaching system being used around 30 cities in China. SINA: A comprehensive Chinese website like Yahoo in North America. TM: Toyota Motor Corporation operates in the automotive industry worldwide. It engages in the design, manufacture, assembly, and sale of passenger cars, minivans, and trucks and related parts and accessories. Sold: BFI Canada Ltd. BFC Our sector: Financial Service Technology Basic Materials Conglomerates Health care consumer goods Beta for every sector: Financial : BAC 1.89 Basic Materials: YRI 0.95 BIR -0.7 avg 0.125 Service: THI 0.89 WJA 1.19 ACO.X 0.58 TA 1.49 L 0.4 EDU 1 avg 0.925 Conglomerates: TXT 2.36 Technology: SINA 1.34 Health care: AMGN BVF avg 0.32 0.83 0.575 Consumer Goods: TM 0.62 In the fifth week, due to the market changing, we sold one more financial stock to withdraw our money back from the risky financial sector. We put more and more money into the service sector in terms of the great practice in the past couple of weeks. The beta was going to be lower than before which is 0.925. We sold out our technology stocks we bought from the previous weeks, we bought a now Chinese tech stock instead to keep the diversification. We sold some basic materials too to lower this sector’s risk. In addition, we bought Toyota to lower our overall risk, because the beta is only 0.62. We are going to more conservative way to invest. Week five to week seven: Our portfolio changing : Our chart: Financial Service Technology Basic Materials Conglomerates Health care consumer goods Beta for every sector: Financial : BAC 1.89 Basic Materials: YRI 0.95 BIR -0.7 avg 0.125 Service: THI 0.89 WJA 1.19 ACO.X 0.58 TA 1.49 L 0.4 EDU 1 avg 0.925 Conglomerates: TXT 2.36 Technology: SINA 1.34 Health care: AMGN BVF avg 0.32 0.83 0.575 Consumer Goods: TM 0.62 From week 5 to week 7, the stock market was stable; we actually haven’t done any transaction except for one disposal. We sold TXT based on risk consideration. Because the beta of TXT is extremely high for us, all of us decided to keep them in our portfolio for these weeks. Week 8: Portfolio changing: Portfolio change: Purchased: TLM: Talisman Energy Inc., an upstream oil and gas company, engages in the exploration, development, production, transportation, and marketing of crude oil, natural gas, and natural gas liquids (NGLs) in primarily North America, the United Kingdom, Scandinavia, and the Southeast Asia. The company was founded in 1925 and is headquartered in Calgary, Canada. MGO: Migao Corporation, based in China, produces specialty potash-based fertilizers for the high-value agricultural Chinese market. POT: Potash Corporation of Saskatchewan Inc. engages in the production and sale of fertilizers, and related industrial and feed products in North America. Sold: Bank of America Corporation BAC Loblaws Amgen Inc. West Jet Airlines Atco LTD The New Oriental Education & Technology Group SINA Toyota L AMGN WJA ACO.X EDU SINA TM Our chart: Service Basic Materials Health care Final Shot Beta for every week: Service: THI TA avg 0.89 1.49 1.19 Health care: BVF 0.83 Basic Materials: YRI 0.95 BIR -0.7 avg 0.125 Last week TLM 2.13 MGO 1.25 POT 1.79 avg 1.7233333 Because of the terrible condition of the stock market, we lost part of our money. The amount of we lost is smaller than the whole market, but we still need to take our final shot to pull our money back. We almost sold half of our stocks in the beginning of the final week; we put cash to three stocks. We all want to take more risk to get more return for our investment. We picked TLM, MGO, POT, there were all high risky, the average beta for this final shot is 1.7233 which is higher than any other sector we ever had before. Finally, we gained from one stock, and we lost from another stock. It balanced out finally.