Reading list

advertisement

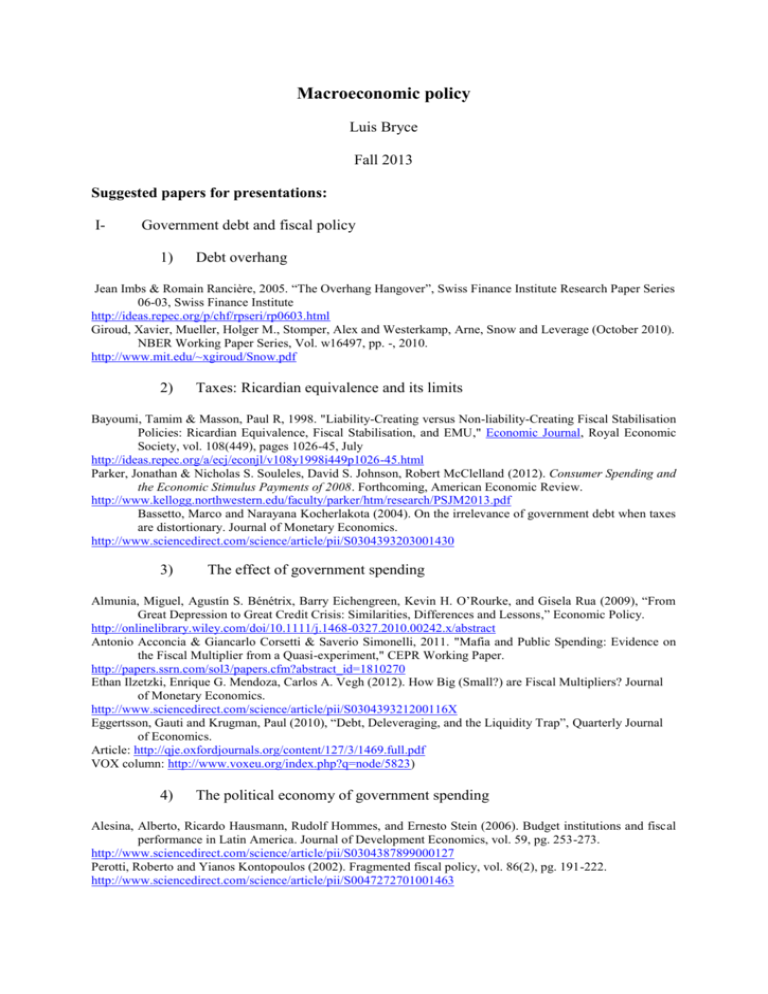

Macroeconomic policy Luis Bryce Fall 2013 Suggested papers for presentations: I- Government debt and fiscal policy 1) Debt overhang Jean Imbs & Romain Rancière, 2005. “The Overhang Hangover”, Swiss Finance Institute Research Paper Series 06-03, Swiss Finance Institute http://ideas.repec.org/p/chf/rpseri/rp0603.html Giroud, Xavier, Mueller, Holger M., Stomper, Alex and Westerkamp, Arne, Snow and Leverage (October 2010). NBER Working Paper Series, Vol. w16497, pp. -, 2010. http://www.mit.edu/~xgiroud/Snow.pdf 2) Taxes: Ricardian equivalence and its limits Bayoumi, Tamim & Masson, Paul R, 1998. "Liability-Creating versus Non-liability-Creating Fiscal Stabilisation Policies: Ricardian Equivalence, Fiscal Stabilisation, and EMU," Economic Journal, Royal Economic Society, vol. 108(449), pages 1026-45, July http://ideas.repec.org/a/ecj/econjl/v108y1998i449p1026-45.html Parker, Jonathan & Nicholas S. Souleles, David S. Johnson, Robert McClelland (2012). Consumer Spending and the Economic Stimulus Payments of 2008. Forthcoming, American Economic Review. http://www.kellogg.northwestern.edu/faculty/parker/htm/research/PSJM2013.pdf Bassetto, Marco and Narayana Kocherlakota (2004). On the irrelevance of government debt when taxes are distortionary. Journal of Monetary Economics. http://www.sciencedirect.com/science/article/pii/S0304393203001430 3) The effect of government spending Almunia, Miguel, Agustín S. Bénétrix, Barry Eichengreen, Kevin H. O’Rourke, and Gisela Rua (2009), “From Great Depression to Great Credit Crisis: Similarities, Differences and Lessons,” Economic Policy. http://onlinelibrary.wiley.com/doi/10.1111/j.1468-0327.2010.00242.x/abstract Antonio Acconcia & Giancarlo Corsetti & Saverio Simonelli, 2011. "Mafia and Public Spending: Evidence on the Fiscal Multiplier from a Quasi-experiment," CEPR Working Paper. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1810270 Ethan Ilzetzki, Enrique G. Mendoza, Carlos A. Vegh (2012). How Big (Small?) are Fiscal Multipliers? Journal of Monetary Economics. http://www.sciencedirect.com/science/article/pii/S030439321200116X Eggertsson, Gauti and Krugman, Paul (2010), “Debt, Deleveraging, and the Liquidity Trap”, Quarterly Journal of Economics. Article: http://qje.oxfordjournals.org/content/127/3/1469.full.pdf VOX column: http://www.voxeu.org/index.php?q=node/5823) 4) The political economy of government spending Alesina, Alberto, Ricardo Hausmann, Rudolf Hommes, and Ernesto Stein (2006). Budget institutions and fiscal performance in Latin America. Journal of Development Economics, vol. 59, pg. 253-273. http://www.sciencedirect.com/science/article/pii/S0304387899000127 Perotti, Roberto and Yianos Kontopoulos (2002). Fragmented fiscal policy, vol. 86(2), pg. 191-222. http://www.sciencedirect.com/science/article/pii/S0047272701001463 II- Financial markets 1) The balance-sheet channel Ben Bernanke; Mark Gertler; Simon Gilchrist (1996), “The Financial Accelerator and the Flight to Quality”, The Review of Economics and Statistics, Vol. 78, No. 1. (Feb., 1996), pp. 1-15 http://people.bu.edu/sgilchri/research/restat_96.pdf Bernanke, Ben S & Gertler, Mark, 1995. "Inside the Black Box: The Credit Channel of Monetary Policy Transmission," Journal of Economic Perspectives, American Economic Association, vol. 9(4), pages 27-48, Fall http://www.jstor.org/stable/pdfplus/2138389.pdf Gertler, Mark & Gilchrist, Simon, 1994. "Monetary Policy, Business Cycles, and the Behavior of Small Manufacturing Firms," The Quarterly Journal of Economics, MIT Press, vol. 109(2), pages 309-40, May http://www.jstor.org/stable/pdfplus/2118465.pdf Campello, Graham and Harvey (2012), “The real effect of financial constraints: Evidence from a financial crisis”, Journal of Financial Economics. http://www.sciencedirect.com/science/article/pii/S0304405X10000413# Aghion, Marinescu, "Cyclical budgetary policy and growth: what do we learn from OECD panel data?", Macroeconomics Annual 2007, Volume 22 (p. 251 - 278) http://www.nber.org/chapters/c4081.pdf 2) The bank-lending channel Puri, Rocholl and Steffen (2012) “Global retail lending in the aftermath of the US financial crisis: Distinguishing between supply and demand effects”, Journal of Financial Economics. http://www.sciencedirect.com/science/article/pii/S0304405X10002904# Adrian and Shin (2008), “Financial Intermediaries, Financial Stability, and Monetary Policy” http://www.jstor.org/stable/25592465http://papers.nber.org/papers/w18335?utm_campaign=ntw&utm_medium= email&utm_source=ntw Schularick and Taylor (2012): “Credit booms gone bust: Monetary policy, leverage cycles and financial crises, 1870-2008”, forthcoming American Economic Review. http://www.econstor.eu/bitstream/10419/37515/1/VfS_2010_pid_34.pdf III- The crisis 1) The panic of 2007 Gorton and Metrick (2012), “Securitized banking and the run on repos”, Journal of Financial Economics. http://www.sciencedirect.com/science/article/pii/S0304405X1100081X Brunnermeier, Markus (2009), “Deciphering the Liquidity and Credit Crunch 2007–2008”, Journal of Economic Perspectives—Volume 23, Number 1—Winter 2009—Pages 77–100, http://www.princeton.edu/~markus/research/papers/liquidity_credit_crunch.pdf Nicola Gennaioli & Andrei Shleifer & Robert W. Vishny, 2011. A Model of Shadow Banking. The Journal of Finance. http://onlinelibrary.wiley.com/doi/10.1111/jofi.12031/abstract Nicola Gennaioli & Andrei Shleifer & Robert W. Vishny, 2010. Neglected Risks, Financial Innovation, and Financial Fragility. Journal of Financial Economics. http://www.sciencedirect.com/science/article/pii/S0304405X11001176 2) Monetary policy during the crisis Ben S. Bernanke & Vincent R. Reinhart & Brian P. Sack, 2004. "Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment," Brookings Papers on Economic Activity, Economic Studies Program, The Brookings Institution, vol. 35(2), pages 1-100 http://ideas.repec.org/a/bin/bpeajo/v35y2004i2004-2p1-100.html Gauti B. Eggertsson, 2008. Great Expectations and the End of the Depression, American Economic Review. http://www.jstor.org/stable/29730131 Cecchetti (2008), “Monetary Policy and the Financial Crisis of 2007-2008”, http://www.cepr.org/pubs/PolicyInsights/PolicyInsight21.pdf Annette Vissing-Jorgensen and Arvind Krishnamurthy (2011) The Effects of Quantitative Easing on Interest Rates: Channels and Implications for Policy, with Arvind Krishnamurthy, Brookings Papers on Economic Activity, Fall 2011. http://www.brookings.edu/~/media/files/programs/es/bpea/2011_fall_bpea_papers/2011_fall_bpea_conference_ krishnamurthy.pdf 3) Sovereign debt and banks Reinhart and Rogoff (2011), “From financial crash to debt crisis”, American Economic Review. http://scholar.harvard.edu/files/rogoff/files/from_financial_crash.pdf Patrick Bolton & Olivier Jeanne, 2011. "Sovereign Default Risk and Bank Fragility in Financially Integrated Economies," NBER Working Papers 16899, National Bureau of Economic Research, Inc. http://ideas.repec.org/p/nbr/nberwo/16899.html Nicola Gennaioli & Alberto Martin & Stefano Rossi, 2012. "Sovereign Default, Domestic Banks and Financial Institutions," Working Papers 622, Barcelona Graduate School of Economics. http://ideas.repec.org/p/bge/wpaper/622.html