The University of Alabama in Huntsville

advertisement

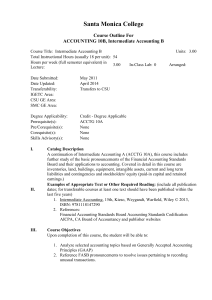

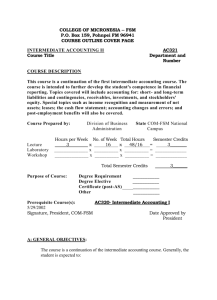

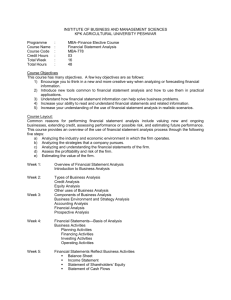

The University of Alabama in Huntsville Course Approval Form College: Administrative Science Course Number: ACC311 Undergraduate X Graduate Department or Program: Accounting Course Title: Intermediate Financial Accounting II Credit Hours: 3 New Course Course Change X Course Deletion Fee Charge $30 Effective Date Spring 1998 Catalog Description: An in-depth examination of issues concerning the measurement and reporting of income, cash flows, assets, liabilities, and owner’s equity in financial statements. Topics include long-term debt, leases, deferred taxes, and revenue recognition. Reference is made to professional pronouncements and the current literature, with attention to the financial reporting environment and rule setting process. This is the second of a two course sequence. Prerequisite: ACC310F, Sp. Prerequisites: ACC310. Grading System: Letter (A-F) X Satisfactory/Unsatisfactory (S-U) Pass/Fail (P/F) For course changes, give justification for changes to an existing course: Improve/update course title and description. Approvals: ________________________________________________________________________ Department Chair Date ________________________________________________________________________ College Curriculum Committee Date ________________________________________________________________________ College Dean Date ________________________________________________________________________ Undergraduate Curriculum Committee Date ________________________________________________________________________ Graduate Dean Date ________________________________________________________________________ Provost Date Distribution: Provost, Dean, Department, Scheduling, Undergraduate Advising or Graduate Studies MASTER COURSE SYLLABUS Date: January 2002 Course Number: ACC 311 Course Title: Intermediate Financial Accounting II Instructor(s): Bryson, Maddocks, Kile Typical Textbook: Gleim, Financial Accounting, 8th edition, Accounting/Gleim Publications, 1998. Kieso, Intermediate Accounting, 10th edition, Wiley & Sons, 2001. Catalog Description: An in-depth examination of issues concerning the measurement and reporting of income, cash flows, assets, liabilities, and owner’s equity in financial statements. Topics include long-term debt, leases, deferred taxes, and revenue recognition. Reference is made to professional pronouncements and the current literature, with attention to the financial reporting environment and rule setting process. This is the second of a two course sequence. Prerequisite: ACC310. F, Sp. Prerequisites: ACC310. Course Objectives: To give students the conceptual background necessary to understand issues in financial reporting. To introduce some of the professional pronouncements that affect financial reporting. MASTER COURSE SYLLABUS ACC 311 January 2002 Subject Matter: (based on 28 eighty-minute sessions) Item Sessions 1. Current Liabilities and Contingencies 2 2. Long-term Liabilities 2 3. Stockholders' Equity: Contributed Capital 2 4. Stockholders' Equity: Retained Earnings 2 5. Dilutive Securities and Earnings per Share 2 6. Investment - Temporary and Long Term 2 7. Revenue Recognition 2 8. Financial Statement Analysis 2 9. Accounting for Leases 2 10. Accounting for Income Taxes 2 11. Accounting for Pensions and Post Retirement Benefits 2 12. Accounting Changes and Error Analysis 2 13. Examinations/Presentations/Projects 4 Computer Usage: Students use spreadsheets to complete several exercises reinforcing textual and lecture materials. Students may also access accounting information using the Internet. Research Paper: No major paper required. Students have a number of small research projects. Ethics Coverage: The discussion of ethics starts with the concept of substance over form and continues throughout the course. Students receive encouragement to consider and discuss "gray-area" matters in class.