FSA_MBA 4th_2011

advertisement

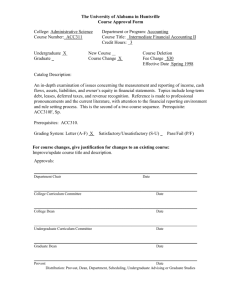

INSTITUTE OF BUSINESS AND MANAGEMENT SCIENCES KPK AGRICULTURAL UNIVERSITY PESHWAR Programme Course Name Course Code Credit Hours Total Week Total Hours : : : : : : MBA–Finance Elective Course Financial Statement Analysis MBA-778 03 16 48 Course Objectives This course has many objectives. A few key objectives are as follows: 1) Encourage you to think in a new and more creative way when analyzing or forecasting financial information. 2) Introduce new tools common to financial statement analysis and how to use them in practical applications. 3) Understand how financial statement information can help solve business problems. 4) Increase your ability to read and understand financial statements and related information. 5) Increase your understanding of the use of financial statement analysis in realistic scenarios. Course Layout: Common reasons for performing financial statement analysis include valuing new and ongoing businesses, extending credit, assessing performance or possible risk, and estimating future performance. This course provides an overview of the use of financial statement analysis process through the following five steps: a) Analyzing the industry and economic environment in which the firm operates. b) Analyzing the strategies that a company pursues. c) Analyzing and understanding the financial statements of the firm. d) Assess the profitability and risk of the firm. e) Estimating the value of the firm. Week 1: Overview of Financial Statement Analysis Introduction to Business Analysis Week 2: Types of Business Analysis Credit Analysis Equity Analysis Other uses of Business Analysis Components of Business Analysis Business Environment and Strategy Analysis Accounting Analysis Financial Analysis Prospective Analysis Week 3: Week 4: Financial Statements—Basis of Analysis Business Activities Planning Activities Financing Activities Investing Activities Operating Activities Week 5: Financial Statements Reflect Business Activities Balance Sheet Income Statement Statement of Shareholders’ Equity Statement of Cash Flows Additional Information Week 6: Financial Statement Analysis Preview Analysis Tools Comparative Financial Statement Analysis Common-Size Financial Statement Analysis Ratio analysis Cash Flow Analysis Valuation Models Week 7: Financial Reporting and Analysis Reporting Environment Statutory Financial Reports (Key SEC Filings) Form 10-K Form 10-Q Form 20-F Form 8-K Regulation 14-A Factors Affecting Statutory Financial Reports Generally Accepted Accounting Principles (GAAP) Managers Monitoring and Enforcement Mechanisms Corporate Governance Alternative Information Sources Week 8: Nature and Purpose of Financial Accounting Desirable Qualities of Accounting Information Important Principles of Accounting Relevance and Limitations of Accounting Week 9: Introduction to Accounting Analysis Need for Accounting Analysis Process of Accounting Analysis Evaluating Earnings Quality Adjusting Financial Statements Week 10: Analyzing Financing Activities Liabilities Current Liabilities Noncurrent Liabilities Analyzing Liabilities Week 11: Leases Accounting and Reporting for Leases Analyzing Leases Restating Financial Statements for Lease Reclassification Off-Balance-Sheet Financing Off-Balance-Sheet Examples Week 12 Shareholders' Equity Capital Stock Retained Earnings Book Value per Share Liabilities at the “Edge” of Equity Week 13: Prospective Analysis The Projection Process Projecting Financial Statements Week 14: Application of Prospective Analysis in the Residual Income Valuation Model Trends in Value Drivers Week 15: Risk Analysis Types of Risk Short-term liquidity Long-term solvency Credit risk Bankruptcy risk Financial reporting manipulation risk Week 16: Framework for Risk Analysis Bankruptcy Prediction Investment Factors Financing Factors Operating Factors Other factors Market Equity Beta Risk Manipulation Risk Reference Books: 1. Financial Statement Analysis - Subramanyam, K. R.; Wild, John (10th Edition) McGraw-Hill Higher Education Publishers 2. Financial Reporting, Financial Statement Analysis, and Valuation:A Strategic Perspective - Stickney, Brown, and Wahlen (Sixth Edition)