BUSINESS LAW 410 - the College of Business!

advertisement

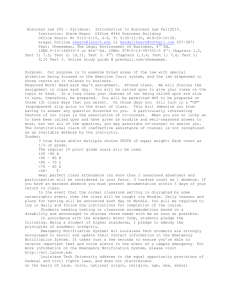

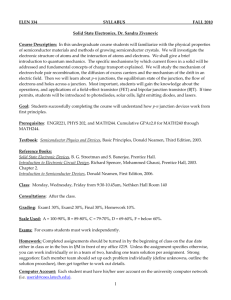

BUSINESS LAW 410-051/510-051 Monday, 6:00-9:45 p.m., Cobb # 111 FALL 2015 Instructor: Forrest L. Moegle, J. D. Office: College of Business, Room 111 Office Hours: By appointment, Monday through Friday, 8:00am – 5:00pm Contact Information: (318) 254-0100 (my firm’s #), fmoegle@latech.edu Text: Bisk CPA Review Regulation Thomson Reuters, 44th edition 2015 Overview This course provides a concentrated study of various areas of business law including, but not limited to, contracts, credit transactions, governmental regulations, business organizations, and property related topics that you will encounter in the business world. Accommodations for Special Needs Students needing special accommodations based on a disability must notify me as soon as possible. Academic Misconduct Academic misconduct will not be tolerated. Cheating of any kind may result in an “F” being awarded for the entire course. Students caught cheating or who are suspected of cheating will be reported to the Office of Judicial Affairs. Students are encouraged to read the university academic misconduct policy in the current University Catalog. In accordance with the Academic Honor Code, students pledge the following: Being a student of higher standards, I pledge to embody the principles of academic integrity. (www.latech.edu/documents/honor-code.pdf) Emergency Notification System All students are encouraged to enroll in the Emergency Notification System and to keep their contacts current on BOSS. The FirstCall system contains information concerning weather updates, traffic accident related notifications, and safety cell-phone theft reminders. For information concerning emergency, weather, and health related changes, go to http://www.latech.edu and click on the hurricane icon, or go directly to http://storm.latech.edu. Attendance As required by university policy, attendance will be monitored at each class meeting. You must be physically present in class for the entire class time to be counted as attending that class session. Students who miss three (3) classes, whether excused or unexcused, will automatically fail the course. Please arrive on time for class. Examinations There will be three tests given during the quarter, consisting of fifty (50) multiple-choice and true/false questions. No make-up exams will be administered. In the event a student misses either Test 1 or Test 2, he or she will take a comprehensive Test 3 consisting of fifty (50) multiple-choice and true/false questions which will encompass material gleamed from Tests 1, 2, and 3. Furthermore, any student who misses any two (2) scheduled tests will automatically fail the course. Lastly, any student who misses the third scheduled test will receive a grade of “0%” as her/his respective grade for Test 3. BLAW 510 students Business Law 510 students and/or students taking the class for graduate credit will be required to draft a persuasive position paper on a topic relative to the subject matter of the course. All topics must be approved by the instructor. No ENRON papers! All papers must conform to the following drafting requirements: a font of No. 12 Times New Roman or other acceptable font, double-space, proper citation to authority, a Works Cited page, a length of between five (5) ten and ten (10) pages, and 1” margins all around. The due date for the paper will be determined by September 28, 2015. Graduate students will meet as necessary with the instructor as a group or one-on-one in order to gauge progress, receive critiques on drafts, thesis development, etc. The final paper will be handed in as a hard copy. The grading scale for the research paper is as follows: 100, 90, 80, 70, 60, 50, 40, 30, 20, and 10 (%). The final averaged grade for the research paper will be worth 25% of the overall final grade. Grading There will be three exams at 100 points each. The grading scale is 100–90% = A, 89-80% = B, 70-79% = C, 69-60% = D, 59-50% = F. Chapters Covered Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8 Chapter 9 Chapter 10 Chapter 11 Chapter 12 Chapter 13 Chapter 14 Chapter 15 Chapter 16 Contracts Sales Negotiable Instruments and Documents of Title Secured Transactions Debtor & Creditor Relationships Agency Business Structures Federal Securities Regulations Other Federal Regulations Accountants’ Ethics & Responsibilities Federal Taxation: Individuals Federal Taxation: Property Federal Taxation: Estates, Trusts & Exempt Organizations Federal Taxation: Corporations Federal Taxation: Partnerships Federal Taxation: Other Tax Topics THIS SYLLABUS IS SUBJECT TO CHANGE AT THE DISCRETION OF THE INSTRUCTOR.