A Professional Guide to RFPs and Tendering for Cash Management

advertisement

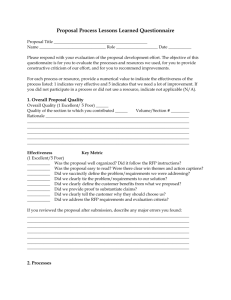

A Professional Guide to RFPs and Tendering for Cash Management Services Kristian Rygh, Nasarius - Rafael Dominguez, Nasarius - 11 Jan 2011 GTNews.com This article explores the different aspects of how a bank cash management tender should be conducted and how the request for proposal (RFP) process should be executed. The focus is cash management services rather than other reasons for tender, such as funding requirements. As part of their continuing focus on improving cash management practices, corporate treasury cash managers have a number of options available to them, from enhanced reporting and controls to detailed policies and complex ‘payment factory’ implementations. Conducting a request for proposal (RFP) is an integral part of these options to improve cash management practices. The decision to issue an RFP is typically influenced by the following factors: Expiration of agreements - existing bank agreements have expired and need to be renegotiated. This is an opportunity for cash managers to reduce pricing and improve liquidity management. Changing risk strategy - economic factors over the past few years have forced companies to re-evaluate their risk management strategies, with particular emphasis on counterparty risk due to changing views of banks’ stability in recent years. Automating internal processes - demand for new banking services such as moving from using a bank’s web portal for payments to full straight-through processing (STP). Mergers and acquisitions - incorporating businesses in new geographical areas or synchronising operations for newly-merged companies will demand changes to their corporate treasury and banking requirements. Changing strategic direction - in the current economy, banks are focusing on their most profitable services and regions, with services either launched in new areas, enhanced in others or withdrawn altogether from some countries, with a direct impact on their banking customers. External factors - structural market changes, such as the single euro payments area (SEPA), can be the catalyst for companies to simplify their cash management setup. In general, a cash management RFP process should be part of an organisation-wide strategic plan with a pre-defined roadmap of actions. While the factors above are important drivers for RFPs, their importance should be aligned with a company’s overall strategic objectives. Furthermore, do not underestimate the time and resources needed for a successful RFP. This covers not only the creation and execution of the RFP itself but also its subsequent implementation. Companies need to avoid re-tendering too often. It should be additionally noted that companies are advised to only issue an RFP and undertake the RFP process when they are open-minded about which bank to award the cash management mandate. A bank’s cash management services cover a company’s day-to-day operations, including payments and collections, cash concentration, and transaction and position reporting. In our experience, the selection of a banking partner is usually based on operational and technical requirements, scope consideration, pricing, service level agreements (SLAs) and timelines (including analysis, evaluation and implementation). This article therefore covers the following areas: Scoping the RFP. The RFP process. Bank selection criteria. Conclusion. Scoping the RFP Before the tender process begins, its scope needs to be clearly understood in the context of existing policies. For example, is cash a corporate asset, and will the local businesses be measured above or below earnings before interest and taxes (EBIT)? This clarity of mandate is vital for the treasury management team, as well as all other stakeholders. The most fundamental scoping elements are: Business requirements. Technical requirements. Geographic coverage. Inviting banks to submit RFPs. Business requirements Nasarius recommends that cash managers are able to provide the banks taking part in the RFP with a clear expectation of the business requirements. A key stage in this process must be for the cash manager to collect knowledge and understanding of the corporate business requirements; these are a combination of overall treasury policies and strategies, the local business needs in each country, and the IT applications involved. As well as providing information on existing processes and requirements, we also encourage companies to describe ‘to be’ process scenarios in the RFP documentation to give the banks advance notice of any future planned developments. For example, an implementation of an internal bank, a netting process or a payment factory will each influence the future need for cash management services, as well as the pricing. It is recommended for companies to include the preferred cash-pooling setup in the RFP. Companies can ask for the bank’s advice for the most efficient cash-pooling solution as long as they are aware that the bank will then have the option to offer a set-up that is less suitable to the business. In most cases, zerobalance cash pools will require intra-day credit limits; if this is the case, it is fundamentally important to ensure that these are discussed and agreed during the RFP process. Legal issues connected to pool structures, such as withholding taxes, should also be included in the discussions. Although banks are not deemed to advise corporations on legal and tax issues, they will often give uncommitted advice based on their experience. Technical requirements In our experience, the technical requirements are often forgotten when corporate cash managers present their business needs to the banks, resulting in the implementation process becoming more cumbersome. Therefore, providing the bank with the company’s technical requirements will make the implementation easier and reduce project risk. The company’s current and expected future plans around market drivers such as SEPA, anti-money laundering (AML), electronic bank account management (eBAM) and other STP tools should be included. Geographic coverage The final step before inviting the banks to submit their RFPs is to define how the company will scope the RFP: by geographic region, currency, or service area. The most common driver is by geographic region, with the company defining how it splits the world’s regions, usually following large areas such as western Europe, Latin America or central Asia. In the event of the company having very different types of business in different locations, such as retail operations in some countries but not in others, splitting the RFP by type of business should be considered. Although cash managers will have their own view of the geographical split, they should take into account the different regional capabilities of each bank. It is advisable to investigate local clearing membership and country-specific coverage requirements before deciding which banks to invite. This way companies will avoid banks being disqualified during the mandate process due to lack of coverage. When companies demand multicurrency and cross-border cash pool setups, it is important to be sure of what the bank can provide in the region and if the service involves overlay structures and/or partner banks, particularly as partner-banking and inter-bank zero balancing setups have been introduced in many regions. If the company uses one global bank to provide an overlay structure, it is important that all float related to the cash pool structure is disclosed by regional banking partners during the bid, enabling the company to calculate the total cost of the selected banks. Finally, if local legislation allows, non-resident bank accounts can be set up to simplify the account structure and this should be discussed with the banks during the RFP process. Inviting banks to submit RFPs The RFP process can impose a considerable burden on both the banks and the corporate itself. The number of banks invited to take part in the RFP should therefore be narrowed down to a sufficiently small number that the company is able to properly understand and thoroughly evaluate the banks’ proposals. In terms of inviting banks to take part in the RFP, most companies have a good network of relationships with several banks, due to their existing funding, foreign exchange (FX) trading, long-term investments, commodities, brokerage and other activities. In addition, cash management and treasury operations are now often more closely linked to funding relations in the aftermath of the financial crisis. The RFP Process Once the business needs are understood and the banks are identified to invite to take part in RFP, the cash manager should invite those banks to an introductory meeting as a prelude to the competitive RFP process. During the meeting, the company should explain the background of the RFP and the subsequent processes, objectives and timeline in order to allow the banks time to allocate appropriate resources to respond to the RFP. The timeline of an RFP typically has four phases: 1. Preparation - the cash manager scopes the tender, identifies the business requirements, gathers internal information and decides which banks to invite. 2. Tender - the company holds introductory meetings with the chosen banks and distributes the RFP document. Banks have the opportunity to have Q&A sessions with the company before they return the completed RFP, after which the company analyses the proposals. 3. Contract - the company and bank sign off the capabilities and pricing while the lawyers negotiate the final legal agreement(s). 4. Implementation - the bank accounts are opened and the data exchange is implemented accordingly. Figure 1: Timeline of a Typical RFP Process Source: Nasarius Treasury consultants regularly support corporate cash managers when conducting RFPs for new banking partners. The treasury consultants will typically provide templates and checklists for the RFP to ensure nothing is forgotten, based on both industry best-practice as well as their experience of previous RFPs. In our experience, it is important to ensure that the short-listed banks respond to the RFP in the company’s chosen format. This makes comparisons between the banks’ responses much easier, fairer and more transparent. We have found that it is almost impossible to meaningfully compare responses when each bank uses its own format. As well as providing expert knowledge and guidance, a consultant’s duty is often to challenge and test the cash manager’s assumptions, new process designs and bank selection. As an independent observer, the consultant is well placed to take a fresh look at a company’s processes and business drivers, ultimately delivering better long-term results. The consultant will also accelerate the entire process, from the initial decision to conduct the RFP through to the chosen bank’s connection to the company’s treasury and enterprise resource planning (ERP) systems. And on a day-to-day basis, the consultant will not only understand and mediate the jargon of both parties, such the technical aspects of banking and treasury systems, but also orchestrate much of the RFP-related work that would otherwise distract cash managers from their core responsibilities. Bank Selection Criteria The selection of the bank will depend on an evaluation of the banks’ capabilities. As the banks will have different strengths and weaknesses, it is important for the treasurer to decide the selection criteria, including their relative importance, before the RFPs are distributed. However, Nasarius advises against disclosing the selection criteria to the short-listed banks to avoid their RFP responses being artificially skewed. Samples of selection criteria include: Cut-off times. Technical capabilities to support STP. Cash-pool capabilities. Country-specific payment formats. Lockbox capabilities. Pricing. It is worth noting that within the pricing criteria, the value of the float is sometimes underestimated, with the float element sometimes actually higher than the recurring bank fees and charges. However, in most instances, price is not the main factor influencing the decision making, with a typical weighting in the final score of 20-40%. Conclusion A bank cash management RFP is one of the main practices used by corporate treasurers to improve their overall treasury strategy. A properly executed RFP is a great opportunity to not only improve the bank setup strategy and co-operate with the best partner bank, but also to learn the different banks’ capabilities and market trends, optimise pricing and improve value dating. However, two aspects are often underestimated when changing banking partner - the legal framework and the technical implementation. Legal frameworks and documentation - using a new bank and opening of multiple bank accounts require a mass of legal documentation, often duplicated across multiple countries. Furthermore, most banks have stringent requirements concerning know your customer (KYC) regulations, which add to the burden of documentation. Technical implementation - changing bank typically requires the implementation of new interfaces between the treasury management and ERP systems, with complex payment formats adding to the difficulty. Consequently, we advise against a price-driven selection process as the additional implementation time and cost will eclipse any cost savings. Do not underestimate the importance of a cash management tender and the RFP process - once the technical implementation is complete and the company becomes familiar with and dependent on the bank’s services, it can be very hard to change banking partner. The tender and RFP process is too important to be run as a job alongside the cash manager’s normal workload. It should be run and resourced as a standalone, mandated project with its own project team, steering committee, milestones and key performance indicators (KPIs). Don’t forget that you will be living with your new cash management solution for many years, so make the right decisions now. A Rigorous Process for Selecting a Regional Banking Provider Jenny Sutton, RFP Company - Gordon Perchthold, RFP Company - 06 Jan 2011 This article goes through best practice approaches for selecting a regional banking provider, with particular reference to Asia. When interest rates rise, there appears to be greater demand by companies to improve their treasury and cash management processes, thereby realising greater returns on idle funds. However, even in lower interest rate environments, significant upside can be gained by: Improving the effectiveness and efficiency of receipts and disbursements processing. Simplifying bank account architectures. Rapidly concentrating funds. Improving transparency of cash pools and movements. Optimising the number of banking relationships within a country or, for multinationals, across a region. A key enabler for raising the productivity of a corporate’s cash is selecting and managing the right banking provider (or vendor). Given the increasing prominence of Asia in the global economy and the pervasive cash management inefficiencies that exist within many corporations in Asia, this article highlights approaches for selecting a regional banking provider, with particular reference to Asia. The sophistication of treasury and cash management practices does vary quite dramatically by industry and global region. In Asia, regional cash management capabilities provided by global banks have really only started to mature over the past five to eight years. Primarily, this has been to support inter-company and business-to-business (B2B) transaction requirements. Progressively, this is extending to support retail customer collections and disbursements with some creative solutions to address very low value transactions, breadth of geographic coverage, and weaknesses in telecommunications and payments infrastructures. The diverse payment system landscape across countries in Asia is a product of market development and regulatory barriers. Designed to protect the outdated practices of local banking champions, these barriers are progressively falling - thereby permitting greater foreign-domestic collaboration resulting in greater efficiency of commercial and retail transactions. All of the global banks - for example Bank of America, Citibank, Deutsche Bank, HSBC, Standard Chartered, and many others - can flaunt prestigious awards bestowed by various industry bodies and publications that attest to the strength of their treasury and cash management services. With their proliferation, however, these awards have become meaningless as an aid to decision-making, and should not be used by prospective clients as a proxy for proper due diligence. At the very least, the corporate must fully understand which specific region or market and functional areas that such awards apply to in order to determine if they are even relevant to the requirements of their particular business. The Process: Company Buy-in, RFI and RFP A company’s initiative to streamline its treasury and cash management capabilities must be preceded by internal buy-in and active support on the part of the executive team. The Asia regional office cannot simply make the decision to proceed, and mandate participation across the region. Each country operation’s participation and commitment is critical. Herein lies a key challenge - tight, historic relationships between company personnel and their counterparts at the current local banking provider (whether a domestic bank or the local operations of a regional/global provider) will be a significant source of resistance to signing up a new, regional provider. And they will likely not welcome the upheaval associated with changing processes and banking arrangements unless there are obvious benefits to be realised at the local financial and operational level. A proven approach to developing widespread understanding and support is for the company to form an internal project team consisting of a project manager and one or more representatives from each participating country operation, which collectively possess knowledge and experience spanning accounting, treasury, receipts processing, disbursement processing, and application systems. This multi-country team will facilitate the rapid understanding of diverse approaches across the region, promote a regional rather than country/functional perspective, accelerate the collection of transactional data (needed for the business case and request for proposal (RFP)), and promote buy-in through visible participation of local representatives. If they are not already in the loop, do not forget to include the chief financial officer (CFO) and treasury executives from global head office in the communications because inevitably, prospective and incumbent banking service providers will attempt to lobby for their own selection at the global level if they have access to these people. Given the pace at which cash management service capabilities advance within each bank, we recommend issuing a request for information (RFI) to all banks that have a geographic footprint that matches your service requirements in order to understand their latest offerings. The RFI process also helps to educate internal management and project team members on the ‘art of the possible’ (recognising that some of what is presented by the banks can be vapourware - services not yet fully available across Asia), establishes relationships with the key contacts of the potential services providers, and can help to quickly eliminate those banking service providers who clearly would not meet all the requirements. However, an RFI is not a RFP - expect high level, boilerplate information and no pricing data - and remember that this process will help you to identify potential providers, not to make the final selection. Following the RFI process, you will be better equipped to draft the RFP, containing, among other things, the key information required by the banks to submit a firm commercial and services proposal. Be sure to establish the selection criteria (and weighting) when creating the RFP to reduce the potential for drawn-out debate and unsubstantiated biases after proposals have been submitted. This approach also ensures that all the vendors provide the data that is necessary for you to apply your criteria. This sounds simple but it is surprising how often companies issue RFPs which collect mounds of data, little of which is actually used in the decision-making process. Keep it simple when defining the selection criteria. Too often, selection teams lose sight of the actual business objective as they become immersed in thousands of minute requirements with individual weightings that produce a mathematical, yet nonsensical result. Detailed functional requirements should roll up to an overall set of five to 10 key weighted criteria. In order to obtain realistic and comparable pricing from your vendors, you will need to collect at least one year’s worth of receipt and disbursement transaction volume and value data by payment method. You will also need to provide your existing bank account architecture, high-level process overviews, and other required data that will have been identified through the RFI discussions. With an experienced treasury and cash management expert on the project team, you can also brainstorm process redesign opportunities to be outlined in the RFP. Your RFI process should have allowed you to narrow down the list of potential candidates to between three and five. Any more than that and the effort will become too onerous for your selection team, as well as the country finance staff. Typically, each bank will want to send members of their bid team into each of your country operations to ask questions (while establishing relationships that they hope will increase their chances of being awarded the mandate). Although data collected and presented in the RFP activities should have fulfilled all their data requirements, it is sometimes useful to allow one site visit per vendor, assigning each vendor to a different country operation to minimise disruption to any one operation, while still providing all the banks with comparable access to information. As with most RFPs, additional information in the form of vendor presentations, and responses to your clarification questions should be in writing and be evaluated as part of the proposal. With a shortlist of two or three candidates, it can be highly insightful to conduct a ‘solution implementation workshop’ with each of them. You need to be clear to the vendor that there is no role for the sales rep at this workshop, but instead you expect the proposed implementation manager and members of the implementation team to brainstorm solution alternatives and drivers of benefits and costs with your team. This working session will give you a realistic understanding of the vendor’s capabilities, flexibility, creative problem solving skills, and ‘fit’ with your organisation. Assuming you have structured the RFP and criteria well, and followed a disciplined selection process, the primary and alternate choices will be obvious. Be sure to retain two candidates even once contract negotiations have begun, in order to maintain negotiating leverage as well as to have a back-up should one candidate fail due diligence or prove to be an unsatisfactory choice. As you have undertaken this initiative to realise specific business benefits, and the banking vendor will hold the keys to unlocking many of those benefits, payments to the bank should be contingent upon realising such benefits, rather than simply based on the bank’s preferred approach, which is to charge a fee per service/transaction. Conclusion There are few initiatives in a corporation that are ‘no brainers’ in terms of benefits versus costs - but treasury and cash management is one of them. However, a well structured RFP and disciplined RFP process that secures internal buy-in, identifies the right banking service provider, establishes a strong negotiation position, structures a viable implementation plan, and ties fees to results is fundamental to ensuring that the potential benefits of greater interest earnings, reduced bank fees, and the elimination of some manual activities are actually realised.