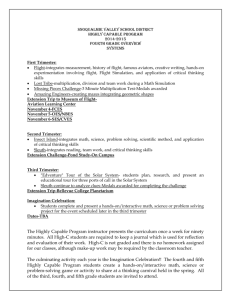

Threats or potential problems the weakness may lead too.

advertisement

Curtin Business School Tutorial Questions Trimester 2A, 2014 Accounting Systems 204 Accounting Systems 204 Additional Questions Trimester 2A, 2014 General comments on answering the questions below These Problems are intended for class and group discussion. They are to be studied in conjunction with the appropriate chapter of the text book and a draft answer is to be prepared before the seminar for discussion in the seminar. AQ 1.1 a. Why is knowledge of systems important to accountants generally? Why is knowledge of systems and related topics important specifically to the following types of accountants? b. Financial Accountant Auditor Business consultant Do the professional accounting bodies recognise this importance? How? AQ 1.2 Consider buying items at a supermarket. a. What Accounting information needs to be recorded from this transaction? b. Why does this information need to be collected? c. How is this information collected? Accounting information Why collected How is this collected 1 2 3 4 5 d. Is there any other information that management may wish to collect at the point of sale? Why? These are some examples only – there are many others students may suggest. Other information Why AQ 1.3 Discussion Question 1.1 (Romney text page 36) AQ 1.4 – Assignment requirements Page 2 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Tutorial Week 2 – Text reference Romney Chapter 1 Lecture points from lecture 1: Definition of data. Definition of information and its usefulness. Definition of a system and business process. Five business cycles. AIS components. Data processing cycle. Computer based storage. ERP. AQ 2.1 Problem 1.4 (Romney text page 39) AQ 2.2 A manager can obtain information from the organization’s system in three ways: by direct inquiry using her portable computer and data extraction software, by a daily printout, and by a monthly report. Using the qualities of information discussed in chapter 1 (Relevant, Reliable, Complete, Timely, Understandable, Verifiable, and Accessible), compare and contrast these three sources of information. Assume: that the daily and monthly reports are prepared by the central information services function and are provided by applications software developed and tested by systems development personnel and that these reports are provided to a number of users. NOTE: Students may make assumptions about which, if any, of the outputs contains historical information and the purpose (e.g. decision) for each output. Such assumptions may mean there are alternative but correct answers. Quality Understandable Inquiry Daily Relevance Timeliness Reliable Verifiable Page 3 of 17 Monthly Accounting Systems 204 Additional Questions Trimester 2A, 2014 Completeness Accessible AQ 2.3 a. What is an accounts receivable aging report? b. Why is an accounts receivable aging report needed for an audit? c. What is an accounts receivable aging report used for in normal company operations? d. What data will you need to prepare the report? e. Where will you collect the data you need to prepare the report? f. What will the report look like (i.e., how will you organize the data collected to create the information your supervisor needs for the audit)? Prepare an accounts receivable aging report in Excel or another spreadsheet package. g. Who should receive the copies? AQ 2.4 Briefly explain the major steps to be performed in a (Offline) Batch Processing system. Page 4 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Tutorial Week 3: Lecture points from lecture 2: Business cycles: Revenue and Expenditure. System Documentation Techniques: DFD. AQ 3.1 Discussion question 3.1 (Romney text page 84) Identify the DFD elements in the following narrative: A customer purchases a few items from a local grocery store. Jill, a salesclerk, enters the transaction in the cash register and takes the customer’s money. At closing, Jill gives both the cash and the register tape to her manager. DFD elements: Data Flows; Data Source; Processes; and Storage: AQ 3.2 An inventory request is received by the purchasing department. The purchasing department prepares and sends a purchase order to the appropriate vendor. When a request is processed, it is recorded in a purchase request file. The vendor file is used when preparing purchase order. One copy of the purchase order is kept in the purchasing department. Draw a context DFD and level 0 DFD of the purchasing system. AQ 3.3 The purchasing department receives purchase requisitions (PR) from various departments. Using a computer terminal, a purchasing agent prepares a purchase order (PO) using the vendor file and inventory file stored on magnetic disk and the PR is filed in the purchasing department using the requesting departments’ name. A copy of the PO is printed and forwarded to the vendor. The status of the PO, captured in an attribute of the PO file, is “PO sent”. The goods and delivery note arrive at the receiving department. The PO number on the delivery note is used to retrieve the PO record. When the receiving department signs off the acceptance of goods, the receiving department clerk completes a receiving report (RR) using a computer terminal. The RR is printed and filed by vendor number. The PO status is then changed to “goods received”. The accounts payable section also receives invoices from various vendors. An accounts payable clerk enters the vendor invoice (VI) number after retrieving the appropriate PO record using the PO number written on the VI. An accounts payable clerk then approves the payment and the PO status is now “VI approved”. The computer then prints a pre-signed cheque which is disbursed to the vendor together with the remittance advice (RA).The computer also prints an accounts payable report for management though what they do with the report is outside the scope of the system to be drawn. Draw the Expenditure system context DFD using the above narratives. Page 5 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Tutorial Week 4: Lecture points from lecture 3: Documenting systems. Flowcharts. AQ 4.1 Draw the following flowchart segments: (i) Entering of details from an invoice on to a master file stored on magnetic disk. (ii) Remittance advices and cheques are separated, the remittance advices are filed in date order and the cheques are manually endorsed and sent to the bank. AQ 4.2 Problem 3.1 (Romney text page 85) – Parts (a) to (g) only. AQ 4.3 Using the narratives given in AQ3.3, draw the document flowchart for the Expenditure system. Page 6 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Tutorial Week 5: Lecture points from lecture 4: The difference between legacy systems and databases. Relational databases. o Definition. o Basic concepts and structure. o Advantages. AQ 5.1 (Revising Flowcharting) A purchasing requisition (PR) is sent from the inventory system to Sky, a purchasing department clerk. Sky prepares a purchase order (PO) using the vendor and inventory files (stored on magnetic disk) and mails it to the vendor. The vendor returns a vendor acknowledgement to Sky indicating receipt of the PO. Sky then sends a PO notification (via internal mail) to Elei, an accounts payable (A/P) clerk. When the receiving department accepts vendor goods, the inventory system sends Elei a receiving report (RR) via manually. Elei also receives invoices in the mail from the various vendors. He matches the invoices with the PO notification and the RR. Elei then sends a payment authorisation, a disbursement voucher and a voucher package, to the accounting department. There, Andeloo prepares a cheque manually and mails it to the vendor. Required: Prepare a document flowchart. AQ 5.2 1. Structure the following data elements into a relational database structure; indicate the primary and foreign keys for each table you define. Use the answer format given below when answering the relational database questions. You may need to add additional fields to be able to properly structure your database: 2. Draw an entity relationship map (ERM) to represent your database. Item number Cost Description Date of sale Quantity sold Answer format: Table Name Quantity on hand Price Invoice number Terms of sale Sale Price Primary Key Customer name Shipping address Billing address Credit limit Account balance Foreign Keys Other Attributes Note: The number of rows in the answer table is not an indication of how many tables you may need in your answer. AQ 5.3 Problem 4.2 page 129 Page 7 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Tutorial Week 6 Lecture points from lecture 5: Definition of fraud and computer fraud. Motivations and perpetrators of fraud, the ‘fraud triangle’. Approaches and techniques used to commit fraud. Examples of common frauds. Overview of preventing and detecting fraud. AQ 6.1 (Relational database revision question) A firm builds pergolas for residential customers. Rather than using employees the firm has a number of contractors that it uses for each job. Each job is given to one contractor who is responsible to a supervisor for the work done. Details that need to be recorded for these arrangements are: Contractor name, contractor address, contractor phone number, contractor mobile phone number, the contractors supervisors name, the contractors supervisors phone number, the contractors supervisors location, the job cost, the job location, job details, customer name, customer address, customer contact number, customer number. Business rules explained by the firm manager are; - One or more jobs are done by one contractor A contractor has one supervisor but a supervisor looks after several contractors Required: (i) Construct an efficient relational database from the above information. You may need to include additional information for primary and foreign keys. (ii) Draw an ERM from your database. Contractor/ job database Table Name Primary key Supervisor Contractor Job Customer Foreign keys Other attributes AQ 6.2 Problem 5.2 (Romney Text page 158) A client heard through its hot line that John, the purchases journal clerk, periodically enters fictitious acquisitions. After John creates a fictitious purchase, he notifies Alice, the accounts payable ledger clerk, so she can enter them in her ledger. When the payables are processed, the payment is mailed to the nonexistent supplier’s address, a post office box rented by John. John deposits the cheque in an account he opened in the nonexistent supplier’s name. Page 8 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Adapted from the CIA Examination. a. Define fraud, fraud deterrence, fraud detection, and fraud investigation. b. List four personal (as opposed to organizational) fraud symptoms, or red-flags, that indicate the possibility of fraud. Do not confine your answer to this example. c. List two procedures you could follow to uncover John’s fraudulent behavior. AQ 6.3 Auditors discovered an accounts payable clerk who made copies of supporting documents and used them to support duplicate supplier payments. The clerk deposited the duplicate cheques in a bank account she had opened using a name similar to the supplier’s. How could this accounts payable fraud be prevented? Page 9 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Tutorial Week 7 Text reference Romney Chapter 6 (Ignore Sarbanes-Oxley) Lecture points from lecture 6: Threat, exposure and likelihood. Internal control defined. Control frameworks (COSO and COBIT). Segregation of duties. Expected loss. Risk identification and management. Trust Services Framework – System Reliability Principles – Information Security. Time based model of defence and Defense-in-depth. AQ 7.1 & AQ 7.2 Problem 7.2 (Romney text page 228) AQ 7.3 The XYZ Company has discovered it has a serious internal control problem. The impact associated with this problem is $2 million and the likelihood is 10%. Two internal control procedures have been suggested to deal with this problem. Procedure A would cost $50,000 and reduce likelihood to 4%. Procedure B would cost $60,000 and reduce likelihood to 2%. If both procedures were implemented likelihood would be reduced to one fifth of 1%. (a) From this information complete the following table: Expected Loss = Risk x Exposure = $_____________. Control Procedure Without procedure Risk Exposure Revised Expected Loss Reduction in Expected Loss N/A Cost of Control(s) N/A Net Benefit (Cost) N/A A B Both (b) From these calculations which procedure (if any) should be implemented? Justify your answer. (c) List any other factors that may need to be considered in addition to these calculations when making a decision about what control procedures should be implemented? Page 10 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Tutorial Week8 – Text reference Romney Chapter 7 Lecture points from lecture 7: Controls for systems reliability. Five basic principles for systems reliability. Types of controls: o Preventive o Detective o Corrective Controls to protect confidentiality. Controls to protect privacy. Encryption, Hashing, Digital ID/Certificate & VPN. AQ 8.1 Problem 8.4 (Romney text page 265) – Parts (a) to (d) and (g) to (j) only. AQ 8.2 a. What is the difference between authentication and authorization? b. What is the objective authentication and authorization? c. What is the name of the matrix and test used to perform authorization? AQ 8.3 Problem 8.7 (Romney text page 266) Page 11 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Tutorial Week9 – Text reference Romney Chapter 8 Lecture points from lecture 8: Controls to ensure processing integrity. Controls to ensure system availability. AQ 9.1 Problem 10.7 (a) to (Romney page 315) AQ 9.2 Employee Number 121 123 125 122 Pay Rate 6.50 7.25 6.75 67.5 491 88 Hours Worked 38 40 90 40 Gross Pay $247.00 290.00 607.5 2700.00 Deductions 25.50 60.00 450.00 500.00 Net Pay 221.50 230.00 57.50 2200.00 208 3844.50 1035.50 2709.00 (a) What is number of record (i.e. record count)? Which fields can you compute hash-total and financial-total? (b) For a weekly pay cycle, what record/field/data will you picked up when the flowing tests are performed? Field Check: Sequence Check: Limit Check: Reasonableness Test: Crossfooting Balance Test: Page 12 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 AQ 9.3 In evaluating application controls, the methodology of one of the Big 4 public accounting firms differentiates between the point in the system at which the control is "established" and the later point at which that control is "exercised." Speculate about the meaning of the terms establish a control and exercise a control by discussing those terms in the context of: a. Batch total procedures b. Use of pre-numbered documents c. Turnaround document. Is establishing the control or exercising the control of more importance in ensuring the effectiveness of internal controls? Page 13 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Tutorial Week 10 – Text reference Romney Chapter 9 Lecture points from lecture 9: Auditing. Types of auditing. The audit process. Risk based auditing. IS Audit The use of Computer audit software. Operational Audit AQ 10.1 Clues are on the next page. 1 2 3 5 6 7 8 9 10 11 12 www.CrosswordWeaver.com Page 14 of 17 4 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Across 1 5 7 8 10 11 12 Segments of code that perform audit functions, report results to the auditor, and store collected evidence (3 words). Audit evidence evaluation: A level of confidence that strikes a balance between costs and benefits. The likelihood that a material misstatement will get through the control structure (2 words). Type of audit that examines reliability and integrity of accounting records. Places a small set of test records in the genuine master file, such as creating a fictitious store. Type of audit to determine whether resources are being used efficiently and effectively. A technique by which selected transactions are marked with a special code, and audit modules record the transactions and their master files before and after processing. Down 2 3 4 6 7 9 The likelihood that auditors and their procedures will miss a material error or misstatement (2 words). Audit evidence evaluation: The potential impact of a risk on an event. Uses audit modules to continuously monitor transactions and collect data on those with special audit significance. Measures how susceptible an area would be with no controls (2 words). Type of audit that examines effectiveness of internal controls and how well they're being followed. Routine that flag suspicious transactions and provide real-time notification. AQ 10.2 (a) Explain the difference between segregation of duties of accounting functions and systems function. Explain why programmers should not be performing computer operator’s duties and how the duties should be separated. AQ 10.2 (b) Problem 11.6 (Romney text 342) AQ 10.3 a) Which inter-related component of the COSO Internal Control – Integrated Framework do you find information about auditing? b) Which committee should the internal audit function reports to improve its independence? c) Why is the audit committee be usually made up of outside members of the board of directors? d) What is purpose of audit planning? e) What is first step of audit planning? Page 15 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Tutorial Week 11 – Text reference Romney Chapter 10 Lecture points from lecture 10: Revenue cycle business activities and data processing operations. Revenue cycle decisions and the information needed to make those decisions. Major threats and controls for the revenue cycle. AQ 11.1 Problem 12.2 Parts (a) to (j) (Romney page 380) AQ 11.2 The following is a brief description of a portion of a revenue cycle business system. The marketing department consists of four sales representatives. Upon receiving an order over the phone, a sales person manually prepares a pre-numbered, two part sales order. One copy of the order is filed by date and the second copy is sent to the shipping department. All sales are on credit. Because of the recent increase in sales, the sales representatives have not had time to check credit histories. The marketing department also deals with all customer enquiries about the progress of their orders. Required: Identify three significant weaknesses from the system description given above. Identify the threats or problems the weakness may lead too and then suggest a control to correct the weakness you identified. Use the table given below to format your answer. Weaknesses in the system Threats or potential problems the Recommendation(s) to weakness may lead too. Correct Weaknesses 1. 2. 3. AQ 11.3 Problem 12.2 Parts (k) to (r) (Romney text page 380) Page 16 of 17 Accounting Systems 204 Additional Questions Trimester 2A, 2014 Tutorial Week 12 – Text reference Romney Chapter 11 Lecture points from lecture 11: Expenditure cycle business activities and data processing operations. Expenditure cycle decisions and the information needed to make those decisions. Major threats and controls for the Expenditure cycle. AQ 12.1 Problem 13.1 Parts a to f (Romney text page 415). AQ 12.2 Problem 13.1 Parts g to l (Romney text page 415) AQ 12.3 Problem 13.2 (Romney text page 415) End of tutorials for the unit!! Page 17 of 17