File - Business Studie

advertisement

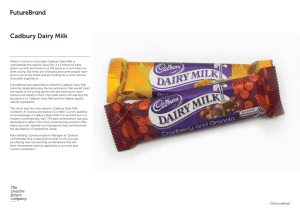

Cadbury bets big on small packs Nov16th 2009 Cadbury India is aiming to add consumers by selling in small packets. The company expects this strategy to expand the Rs 2,000crore domestic market by 5 per cent a year. India’s No. 1 chocolate company, with a market share of around 70 per cent, will price packs in the Rs 2-5 range to boost sales and improve brand visibility. “Very few people in India consume chocolates on a daily basis, so the challenge is to grow the market. In smaller towns and stores, price plays a very important role,” V. Chandramouli, director (human resources and strategy) of Cadbury India, told The Telegraph. He said many Indians would prefer to shell out Rs 5 rather than Rs 50. “It’s the frequency and velocity; a lot of people buying a little at a time, adds up to a lot.” The company has small convenient-to-carry packages for its brands, including Perk, 5 Star, Dairy Milk, Eclairs and Gems. The smallpack strategy is already paying off. Dairy Milk Shots, which was introduced last year and costs Rs 2 per packet, has already contributed 15 per cent to Dairy Milk sales. A new variant of the Perk costs Rs 5 for two pieces and Rs 2 for a single piece. To keep prices low, the company has reduced its dependence on imported cocoa by backing domestic producers. It encourages farmers to grow cocoa by providing them with saplings, technical expertise and advice on where they can get free government inputs such as fertilisers. It later buys cocoa beans from them. Cadbury meets 50 per cent of its requirement through imports. A 30 per cent tariff on imports makes local cocoa cheaper. Slackening growth at home makes India and the other emerging markets increasingly important for Cadbury. Last year, emerging markets accounted for 35 per cent of sales and around 60 per cent of sales growth. At 54 grams, the per-person consumption in India is still very low compared with the UK and US where it stands at 10.5 kg and 10 kg, respectively. The British candy maker, which has been in India for more than 60 years, is looking to create opportunities outside homes. “For the school and college-goers, who want to share a piece of chocolate with friends or grab a quick snack between lectures, affordable price and small packaging are convenient,” Chandramouli said. Cadbury is also trying to shift the consumer perception of chocolate from being an indulgence to a healthy snack. http://www.telegraphindia.com/1091116/jsp/business/story_11745599.jsp Kraft seeks new path to growth By DAILY MAIL REPORTER and RUPERT STEINER UPDATED: 09:28, 18 September 2009 Read more: http://www.thisismoney.co.uk/money/markets/article-1680529/Kraft-seeks-new-path-to-growth.html#ixzz1rjc8VOrb Their famous confectionery brands line the shelves of supermarkets from London to New York. But the key to Toblerone maker Kraft's £10.2bn bid for Dairy Milk owner Cadbury lies in the distant climes of India, Russia, and Mexico. In short, the real reason Kraft - which owns Dairylea, Maxwell House and Kenco - wants Cadbury is to increase its scale in emerging markets. The American food group claims Cadbury would benefit from Kraft's strength in Russia, while Kraft would benefit from Cadbury's strength in Mexico, Latin America and the subcontinent. But Britain's biggest chocolate maker, which rejected a bid from the world's second largest food group last week, insists it can create more value as a stand-alone business. The issue of whether Cadbury stands to grow faster as part of a wider conglomerate or as a pure confectionery firm is now crucial to investors. The initial 745p-a-share bid would come in a mix of cash and Kraft paper and cash. While there will be some flow back from investors barred from investing in US firms, a sizable portion would end up owning a slice of Kraft. Irene Rosenfeld, Kraft's chairman and chief executive, has said: 'I'd like to see someone else come up with another price - we believe this is a very good offer.' But Roger Carr, the Cadbury chairman, stuck the knife in with a caustic rebuke. He said the plan to absorb the chocolate maker into a 'low growth, conglomerate business' was an ' unappealing' and 'unattractive prospect'. A quick look at Kraft's past performance seems to bear this out. In 1988 it was bought by Philip Morris for $12.9bn and was lumped together with biscuit giant Nabisco. The newly enlarged firm was refloated on the New York Stock Exchange in 2001 where it has limped along with few highlights. Since relisting, Kraft has shown average organic revenue growth of 2.5% less than the 4.6% Cadbury has managed. Since the Adams gum acquisition in 2003, Cadbury confectionery has averaged growth of 6.1%. The jewel in Cadbury's crown is the Mexican and Brazilian arm of its chewing gum business, Adams, which produces Trident, Hollywood and Dentyne. These emerging markets comprise of small family run shops. Cadbury has developed a sophisticated distribution network and Kraft wants to use it to sell all its other brands. Kraft, meanwhile, says that things are about to get a lot more exciting. Rosenfeld, a Kraft lifer save a short sojourn with Pepsi, is on a mission to lift the business out of its torpor by revamping tired brands and selling off stale product lines. It claims the combined group would bring approximately £30bn in revenues. Robert Moskow, an analyst at City firm Credit Suisse, says that when it comes to emerging markets the two firms are strong in different areas. 'Cadbury would benefit from Kraft's strength in Russia while Cadbury's success in India and Mexico would boost Kraft,' he said. 'By our math, Kraft's sales in developing markets would increase from 18% to 24% of the portfolio and snacks would increase from 38% to 50%.' Cadbury has benefited from breaking into the Indian market from years in the country from the days of the empire, and now the British Commonwealth. Moskow said: 'With a clear run at Cadbury, Kraft will think it has timed its approach well. 'We believe Cadbury shareholders will want to hold out for 860p per share, and they would like to see a greater proportion of cash, currently only 40% of the approach.' Kraft argues that being part of a larger group will give Cadbury much needed muscle as it faces the combined force of the newly created Mars/Wrigley combination. But the US company's pledge to save the Bristol factory Cadbury plans to close, and its promise to safeguard Cadbury's British heritage, should be treated with some cynicism. Back in 1993 Kraft had bought Terry's of York, famous for its chocolate orange. But by 2005 it had decided to close the factory and move production abroad. Terry's has all but disappeared amid the sea of Kraft brands. This is not a fate Cadbury management, led by boss Todd Stitzer, workers, or for that matter the British public, would relish. Read more: http://www.thisismoney.co.uk/money/markets/article-1680529/Kraft-seeks-new-path-togrowth.html#ixzz1rjbyAT8U Change at the chocolate factory How Kraft is changing Cadbury India Fe 19th 2012 Soon after its contentious $19-billion acquisition of British confectioner Cadbury in February 2010, US multinational giant Kraft set Cadbury's Indian arm a challenge. Could the company raise its revenues from $400 million, in 2009, to $500 million within a year? Resources for advertising and distribution would not be a problem. Cadbury India pulled out all the stops, rose to the challenge and surpassed it. Sales grew by 30 per cent in 2010. A delighted Kraft pumped in more funds, which saw sales increase by another 40 per cent between January and September 2011. The development epitomizes the new aggression Kraft has brought in to its Indian arm. The relatively relaxed atmosphere at the company which, for many decades, was synonymous with chocolates in India, and which still holds around 70 per cent market share in chocolates, is history. "Kraft, being an American company, is definitely more aggressive," says Anand Kripalu, President, South Asia and IndoChina, and Managing Director, Cadbury India. "Ambitions are bigger." A Cadbury India employee, who quit after the Kraft takeover, but prefers not to be named, is blunt. "Targets were defined and raised after Kraft came in," he says. "With Cadbury you could get away with a growth plan, even if you did not achieve your numbers. With Kraft you have to deliver." There are other advantages of being part of a $50-billion corporation like Kraft. Slowdown or not, advertising spends will not be reduced. "We have almost locked consumer-and customer-facing investments, and that will not be touched," says Kripalu. The company increased its direct reach by 25 per cent in 2011 to more than 700,000 stores and added 5,000 substockists to penetrate deeper into smaller towns. It is building refrigeration in its entire supply chain and investing heavily in sales infrastructure like visi coolers and chocolate dispensers. "It feels good to be part of a really large company," says Narayan Sundararaman, Director, Powdered Beverages, Candy and Gum, at Cadbury India. "The resources, and, therefore, the horizons are much bigger and wider than they were before." Kraft is also putting in place a new organisational structure at Cadbury India - the process being called 'Project Leap' - aimed at integrating the company more closely with its new parent and moving it away from being primarily a chocolate manufacturer to producer of a wide range of snacks. "After the integration with Kraft, it was clear that we wanted to go beyond confectionery in the future," says Kripalu. To that end Kraft has separated Cadbury India into five divisions or 'category boards' - chocolates, biscuits, gum and candy, the wellknown malted drink Bournvita and the fruit-flavoured 'cold drink' Tang. Each board is headed by a director who has his separate sales, marketing, distribution and research and development teams and reports to the country managing director. "Each market has a different DNA," says Kripalu. Yet, the disruption has not been without its downside: many employees were far from pleased. Four key senior executives quit the company in 2010/11, including the marketing, finance and legal services heads. The main reason appears to be that while Cadbury relied greatly on inputs from the local managers to shape local strategies, Kraft does not. "Kraft has stringent decisionmaking processes in place and prefers that they are followed," says a former Cadbury India manager. So too, while Cadbury allowed local officials a fair degree of autonomy, Kraft believes it knows best. "Under Cadbury, we only got guidelines from the UK," says another former executive. "It gave the local management a lot of freedom. Kraft, on the other hand, is focused on controls." Kripalu responds candidly to the charges. "There are more reporting layers and some decisions take longer. But from a business perspective, Kraft is hugely empowering," he says. One of the crucial gains for Kraft from the acquisition - as many analysts have pointed out - is the entry it gave the corporation into India's vast, emerging market. It had made an initial push a decade ago, but with products inappropriately priced and lacking a good distribution network, failed to make a dent. But this time, riding in on Cadbury's brand reputation and network, the story is shaping out differently. Apart from growing Tang, it has already launched its billion-dollar biscuit brand Oreo in India. It has another 10 top global brands in its stable, but company officials said there are no immediate plans of putting them on Indian shelves. How has Oreo, launched last March, fared? So far, its share of the Rs 13,000-crore biscuit market, dominated by Parle and Britannia, is a miniscule 0.7 per cent, according to market tracker Nielsen, but given Kraft's clout, no one is writing it off yet. "They have got it right this time round," says Sunil Alagh, former CEO of Britannia. "Oreo is priced cheaper than ITC's Dark Fantasy and Britannia's Dark Magic biscuits, though the cookies are slightly smaller in size." But he adds that while Cadbury India has a sound distribution network for the premium segment in which chocolate falls, it needs to revamp if it hopes to take on the biscuit biggies. "A large part of the biscuit market is in lowmargin, low-price products," adds Pinakiranjan Mishra, Partner and National Leader, Retail and Consumer Products, Ernst & Young. "It is going to be very challenging for new and premium players entering this market." http://businesstoday.intoday.in/story/kraft-takes-over-cadbury-india-changes/1/21920.html