- International Aid Transparency Initiative

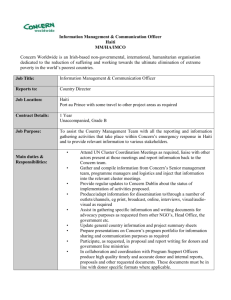

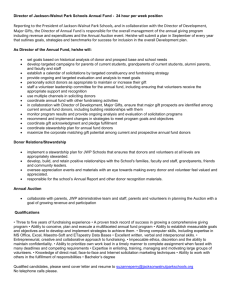

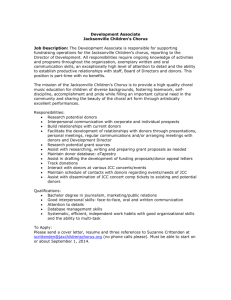

advertisement