Credit Suisse Said to Face SEC Probe of Accounting Moves

advertisement

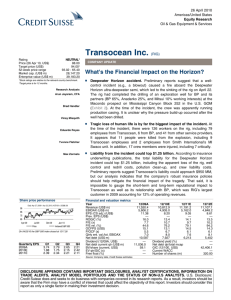

Credit Suisse Said to Face SEC Probe of Accounting Moves By Alan Katz and David Voreacos Feb 26, 2014 5:55 PM GMT+0700 http://www.bloomberg.com/news/2014-02-26/credit-suisse-said-to-face-sec-probe-ofaccounting-moves.html Photographer: Gianluca Colla/Bloomberg A tram passes the illuminated headquarters of Credit Suisse Group AG in Zurich. U.S. regulators are investigating whether Credit Suisse Group AG (CSGN) improperly shifted money in its private banking unit to obscure a drop in asset growth amid a U.S. probe of tax evasion at Swiss banks, a person familiar with the matter said. The shares slid. The Securities and Exchange Commission began investigating the conduct last year, said the person, who asked not to be identified because the matter isn’t public. The bank is also conducting an internal investigation to determine whether it violated accounting rules in the U.S. or Switzerland, according to a Senate report released yesterday. Credit Suisse touted the amount of “net new assets,” or net cash inflows, to its private banking business as a key gauge of the lender’s ability to generate earnings, the Senate Permanent Subcommittee on Investigations said in the report. Those inflows began to dry up in 2011 and 2012 as Swiss banks faced growing scrutiny for helping tax evaders, according to an internal e-mail cited by the report. The shares declined as much as 3.5 percent, the biggest loss since Nov. 4, and dropped 2.4 percent to 27.53 euros at 11:31 a.m. in Zurich, paring this year’s gains to 1 percent. The Bloomberg Europe Bank & Financial Services Index dropped 0.3 percent today. ‘Bad Sign’ The committee’s suggestion that “multiple management and accounting officials at Credit Suisse did not follow the bank’s policies regarding net new assets recognition is not accurate,” according to the written testimony of Chief Executive Officer Brady Dougan to be delivered at the committee hearing later today. Top management weren’t aware of the fostering of tax evasion by bankers based in Switzerland, it said. Credit Suisse didn’t follow its own policies for determining the value of new assets, and shifted them between regions to hide a decline in the Switzerland-based unit, the subcommittee said. Dougan acknowledged in a December interview with the subcommittee that the Zurich-based bank may not have followed those policies in at least one instance, according to the Senate report. “It’s a very bad sign when a company sets up a policy and then ignores it,” said Lynn Turner, a former chief accountant at the SEC. Calvin Mitchell, a spokesman for Credit Suisse, declined to comment on the investigation. Deborah Primiano, a spokeswoman for KPMG LLP, the bank’s auditor, declined immediate comment. Key Measure The subcommittee, led by Michigan Democrat Carl Levin, published the report yesterday detailing Credit Suisse’s role in aiding American tax evasion. The committee will hold a hearing today attended by Dougan, three other bank executives and two Justice Department officials. Credit Suisse reports net new assets each quarter. The figure is a key metric used to judge the health of the bank, showing the ability to earn income from managing client assets, the report said, citing an interview with Philip Vasan, head of private banking Americas at Credit Suisse. The private banking unit had a target of increasing net new assets by 6 percent, according to a 2009 Credit Suisse presentation cited by the Senate report. Within two years, asset growth was declining. The inflows slowed in each quarter of 2011 and followed the same trend in early 2012, an internal e-mail cited by the report shows. Client 5 At that time, a Swiss customer living in the U.S. -- referred to in the report as Client 5 -sold an investment worth as much as 8 billion Swiss francs ($9 billion). He told the bank he would convert the funds to cash and investments in publicly traded securities, the Senate report says. Before Credit Suisse could account for the funds as new assets under management, it should have had a signed agreement with the customer, which it didn’t have, according to several executives interviewed by the committee. Nevertheless, the bank classified about 4.3 billion Swiss francs of Client 5’s funds as net new assets, raising the total for wealth management to 5.8 billion Swiss francs for the first quarter of 2012. One executive, Carlos Onis, said the agreement wasn’t required for the accounting move. ‘Very Objectionable’ At the end of that year, the bank reclassified another 900 million Swiss francs of Client 5’s money, even though most of it hadn’t been invested, the report says. Rolf Boegli, former chief operating officer of the Swiss private banking operation, said the funds “would be a great favor for our division,” according to an e-mail cited in the Senate report. Credit Suisse said Swiss law firm Schellenberg Wittmer and U.S. law firm Simpson Thacher & Bartlett are conducting a review for the bank of the internal process relating to net new assets to ensure compliance with the Swiss rules and the bank’s internal policy. “The bank’s senior finance official with responsibility for net new assets confirmed, based on all information he has learned to date, that he remains comfortable with his net new asset determinations for Client 5 in 2012,” Dougan’s written testimony said. Dougan, in the December interview, called Boegli’s e-mail “disturbing” and “very objectionable,” according to the Senate report. Dougan said the decision to reclassify assets based on a desire to help the appearance of the private banking division’s financial condition didn’t seem to follow the bank’s principles. Dougan said he “relies on the process and people who make sure this is done right,” according to the report. To contact the reporters on this story: Alan Katz in Washington at akatz5@bloomberg.net; David Voreacos in Washington at dvoreacos@bloomberg.net To contact the editors responsible for this story: Sara Forden at sforden@bloomberg.net; Michael Hytha at mhytha@bloomberg.net; Frank Connelly at fconnelly@bloomberg.net