Step 2 Reversal of Prior Year Accruals The following accounts

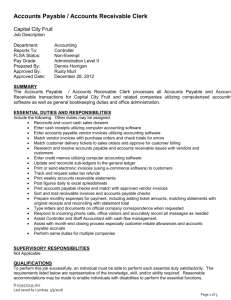

advertisement

Step 2 Reversal of Prior Year Accruals The following accounts should be reviewed from your prior year working paper file and reversed in the current year as required: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 1300 – Trade accounts receivable 1350 – Other accounts receivable 1400 – Accrued interest receivable 1600 – Inventory 1700 – Prepaid expenses 1750 – Long-term prepaid 1799 & 1999 Current portion of long-term receivables 4050 – 4059 Accounts payable (there may be individual accounts used for individual accounts payable, these accounts have to be reviewed on an individual basis to find out if they need to be reversed) 4090 – Wages payable 4125 – Revenue received in advance 4130 – Management fees payable 4200 – 4201 – Current portion of long-term debt 4202 – 4203 – Current portion of capitalized lease To reverse the adjusting journal entry, look at last year’s entry and reverse accordingly. The cross-reference will be PRIOR A?? Quirks to watch for If dividends were recorded in the prior year (account 5909) an adjusting entry is required to close the dividends to retained earnings (account 5901) When reversing prepaid expenses watch any item in the adjustment column in the prior year working paper file should not be reversed in the current year. When reversing wages payable the portion that goes to the shareholder loan or the drawings account is the amount payable for the employee portion of CPP. Accrued interest payable can have both a bank charge portion as well as a long-term debt portion. 1 The following accounts are only in the chart of accounts to ensure the financial statements work correctly. Please ensure that these accounts are never used in any portion of your working paper file, and that no adjustments are posted to these accounts. 1500 – SS tax receivable – should not be used 1510 – Corporate income tax receivable should not be used 1515 – Corporate capital tax receivable should not be used 1520 – BC logging tax receivable should not be used 1530 – GST receivable should not be used 1575 – 1577 Shareholder loan receivable should not be used 4010 – Bank indebtedness Follow last year’s working papers and ensure you present your working papers in the same manner. 2