221 Wiley Plus Ch.3 HW Hints S16

advertisement

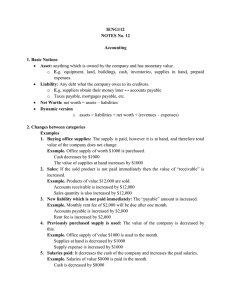

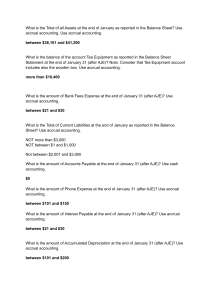

CHAPTER 3 WILEY PLUS HW Helpful Hints: E3-17 & BE 3-9, E3-5, and BE 123- No special hints should be necessary. E3-6 & E3-8 – Since there is no “Utilities Payable” account in your list of accounts, just use Accounts Payable instead. In E3-8, notice that in addition to the Utilities Expenses account, there is also a Telephone & Internet Expenses account. E3-11 & E 127 - You must complete Part (a) successfully before you will be able to progress to Part (b), etc. Be sure to pay careful attention to the instructions in red print for each part (e.g., listing negative amounts (like Net Losses) using a “-“sign and listing Current Assets in order of liquidity. Use our in-class work on Exercise 3-12 (a) to assist you. BE 3-11 Use our in-class work on Exercise 3-16 to help you with this exercise P 133 You must complete Part (a) successfully before you will be able to progress to Part (b). Use your work on previous WP+ AJE exercises to help with Part (a). Pay careful attention to the instructions in red print for each part and if you need help with account classifications in Part (b), please review the listing I provided for you at the end of Chapter 3 Notes. Remember, if the account is on the I/S you are to select “Not Applicable.” P 135 You must complete Part (a) successfully before you will be able to progress to Part (b). Be sure to pay careful attention to the instructions in red print for each part. In Part (a), adjustment (b), you are being asked to make the AJE for Bad Debts based on the Percentage of SALES approach. The percentage of sales approach does NOT require that you factor in any pre-existing balance in the ADA account but rather just calculate the amount based on whatever is given as the % multiplied times the Sales figure given. That amount is the amount for the AJE. No further calculation necessary. In Part (a) letter (d), you will be calculating interest on a Note Receivable instead of a Note Payable (which is what we reviewed in class). You will still calculate interest in the same manner (P x I x T) but rather than OWING interest, you will be recording interest being EARNED. Therefore, the accounts you will need to use are Interest Receivable and Interest Revenue rather than Interest Expense/Payable. In Part (a), letter (e), since the rent paid in advance by Fisk was originally charged to the Rent Expense account rather than to the Prepaid Rent account, you will need to do the opposite of what you would normally do in making a prepaid expense type adjustment. For Part (b), use our in-class work on Exercise 3-16 & WP BE 3-11 and don’t forget to update the balances in the accounts you are closing for any increases or decreases that occurred as a result of making the adjustments in Part (a) E125 – In #2, be careful in making your interest calculation. The interest rate given is an annual rate and the period of time that the Note Receivable has been outstanding is LESS than a year. Therefore, don’t forget to make sure you use the # of months/12 as the “T” in making your P x I x T calculation. Also, like (d) in P 135 above, we are recording interest EARNED, so be sure to use the correct interest accounts. In #3, refer to my hint for Part (a) letter (e) in P 135 above and see if you can apply the same concept to an unearned revenue situation. Be sure to pay careful attention to the dates!