Individual Income Tax

advertisement

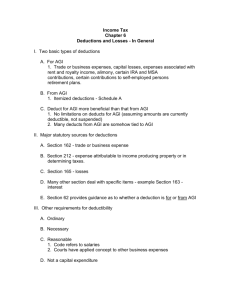

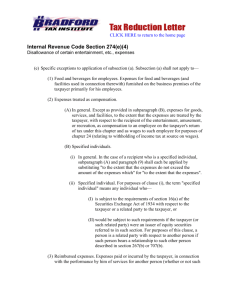

Revised 1-9-2012 Individual Income Tax ACC 221 Chapter 6 Deductions & Losses Deductions and Losses that reduce gross income to adjusted gross income are referred to in this text as adjustments for adjusted gross income. Many practitioners refer to these deductions as adjustments to gross income. These deductions and losses are allowed in addition to the standard deduction. The More Common Deductions from Gross Income: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. All allowable trade and business expenses incurred in a taxpayer’s trade or business except un-reimbursed employee business expenses Expenses related to investment activities involving rents and royalties Reimbursed employee business expenses Losses from sale or exchange of business or investment property Expenses attributable to the production of rent or royalty income Moving expenses Certain retirement payments (IRA, Keogh, 403(b), etc) Penalties on early redemption of CD’s or other savings account arrangements Alimony Paid Interest on some Educational loans Contributions to qualified medical savings accounts. ½ of the Self employment tax paid by self employed individuals 100% of Self employed individuals health insurance costs (limited to business profit). Tuition and fees deduction (must have modified AGI of less than $80,000, 160,000 joint.with AGI of more than $65,000, $130,00 Joint, the deduction is smaller) Itemized Deductions (and Losses) (Other than the exemption amounts) that reduce adjusted gross income to taxable income are referred to as itemized deductions. These deductions and losses are allowed in place of the standard deduction The More Common Itemized Deductions (most of these are covered in Chapter 7) Deductions and Losses that reduce adjusted gross income to taxable income are referred to as itemized deductions. These deductions and losses are allowed in place of the standard deduction 1. Medical Deductions 2. Tax Deductions 3. Donations 4. Miscellaneous Itemized Deductions -2Criteria for Business and Investment Expenses 1. 2. 3. 4. 5. The expense must be related to a business or investment activity that has a profit motive. The expense must be ordinary and necessary The expense must be reasonable in amount There must be proper documentation The expense must be the expense of the taxpayer - not of someone else Restrictions on Deductibility - the expenditure can not be: 1. 2. 3. 4. A Capital Expenditure Expenditures related to tax exempt income Expenditures that are illegal or in violation of public policy Specifically disallowed by the tax law Profit Motive The activity must be engaged in for profit. No standard test applies. A case-bycase fact and circumstances approach is used by the IRS. Factors include good record keeping, time and capital devoted to activity. Trade or Business No precise IRS definition is available. One court defined a trade or business as: AHolding one’s self out to others as engaged in the selling of goods or services.@ A trade or business activity is different than an investment activity. But the text indicates that one taxpayer was treated as being engaged in a trade or business when the taxpayer was engaged in short term trades in the market place. Trade or Business income is subject to self employment tax. Investment Activity An activity where the taxpayer attempts to make a profit on invested capital (Instructor’s Definition). Rental Activity (but there are exceptions) , investments in stocks, bonds, other securities, land, mineral rights, etc. represent investment activities. Only deductions related to rental and royalty activities represent deductions from gross income. Deductions for other investment activities are only deductible (within limits) as itemized deductions. Investment income is not subject to self employment tax. Ordinary Expense Sec 212 indicates that for an expense to be ordinary it must be reasonable in amount and it must bear a reasonable and proximate relationship to the income producing activity or property. This means that there must be more than a remote connection between the expenditure and the anticipated income. However, the Supreme Court ruled that an expense is ordinary if it is customary or usual in the context of a particular business or business community. It would appear that the Supreme Court ruling is broader in scope than a literal reading of Sec 212. -3Necessary Expense Not only must an expense be ordinary but it must also be necessary. The Supreme Court has ruled that an expense is necessary if it is appropriate and helpful in the taxpayer’s business. The expense does not have to be indispensable - it only needs to be an expense that a reasonable or prudent person would incur under similar circumstances. Reasonable Expense An expense must be reasonable in amount to be deductible. This standard is already implied by the ordinary and necessary rules. The IRS and Congress do not want taxpayers deducting items as expense that may in fact represent something else like a dividend. There is a one million dollar cap (only 1 million is deductible) on executive compensation for the CEO and four highest paid officers of a publicly held corporation (performance based exceptions apply and are widespread). Taxpayer Entity Concept Only expenses and losses that belong to the taxpayer can be deducted by the taxpayer. The taxpayer can not deducted expenses and losses that belong to another taxpayer. You can not deduct losses or expenses, even if you paid them yourself, if they are properly allocable to another person. Capital Sec 263 indicates that current deductions may not be taken for Capital Expenditures Expenditures. Capital expenditures add to the value, increase the usefulness, or prolong the life of an asset. (Except for land, Capital expenditures are deducted through the depreciation, amortization, or depletion process) Election to Capitalize Expenses Sec 266 is elective not mandatory. It allows a taxpayer to capitalize otherwise allowable current deductions for taxes, interest, and carrying charges on unimproved and unproductive real estate and on real estate under development. Expenses Related to Expenses related to tax exempt income are not deductible. Interest on money Tax Exempt borrowed to carry tax exempt income is not deductible (Even home equity debt). Income Expenses Contrary to Public Policy Illegal payments, bribes, kickbacks to government officials. Even Lawful fines and penalties paid by taxpayers in the ordinary course of business if related to an unlawful act. These payments are not deductible. Bribes to officials of Foreign governments are not always disallowed - if the payment is customary within the country where it is made and if it is not unlawful under the Foreign Corrupt Practices Act, it may be deducted. -4- Expenses Specifically Disallowed 1. 2. Political contributions and expenses related to influencing political issues or legislation. These expenses are not necessarily illegal – they are just not deductible. Business Start up expenditures including business investigation expenses and pre-opening start up costs (usually these amounts can be capitalized and expensed later through amortization). These expenditures are for taxpayers who are not already engaged in the trade or business. Substantiation for Deductions The burden of proof is on the taxpayer to substantiate with appropriate checks, invoices, receipts, and other records, the amount and nature of each deductible expenses 1. 2. 3. In general appropriate records are required. Cohen rule. (We’ll I’ll be a Yankee Doodle Dandy) Where appropriate records are not kept, a deduction for a reasonable amount may nevertheless be allowed if it is evident that expenditure has been made. Special rules for travel, entertainment, business use of personal auto, business gifts, computers, autos, and other business vehicles. For these items, records must include: (1) Amount of expense (2) Time and place of travel or entertainment (3) Date and description of gift (4) Business Purpose (5) Business Relationship to the taxpayer (6) For lodging, a receipt is mandatory (7) The Cohen rule does not apply to the above 6 items. When an Expense is Deductible (Cash Basis Taxpayers) 1. 2. 3. 4. When it is paid in cash When it is paid by check. You go to New Years Eve Church Services. During the service an offering is collected 10 seconds before midnight - your contribution is deductible. But if the offering is collected 10 seconds after midnight - your offering is not deductible until the next year. When you charge the item on a credit card (Bank Credit Card: Visa, MasterCard, Discover Card, American Express, etc.) but a charge on an open account (Sears, JC Penny’s, Dillards, Texaco, etc.) is not a payment. Prepaid expenses are not usually deductible but there are exceptions (especially for farmers. Exceptions also apply when you purchase a primary residence) -5- 5. Points (Prepaid Interest) paid in connection with the purchase or improvement of a principal residence may be deductible in the year paid if: (1) the closing agreement clearly identifies the points (2) the points are computed as a percent of the amount borrowed (3) the charging of the points is a common business practice in that area (4) the points must be paid from funds other than those borrowed (5) points paid by the seller are Adeemed@ paid by the buyer and the amount is subtracted from the purchase price of the property Accrual Method Taxpayers - this method is so rare in individual income taxation that it will not be covered in this course. Wash Sales No deduction for a loss is allowed on a Wash Sale. A Wash Sale occurs when: 1. A taxpayer realizes a loss on the sale of stock and securities. 2. Substantially identical securities are acquired by the taxpayer within a 61 day period that extends from 30 days before the date of sale until 30 days after the date of sale. 3. Related Parties rules apply 4. Dealers in securities are exempt from the Wash Sale rules. 5. Limited other exceptions apply. Transactions Between Related Parties - Recognition of gains between related parties is ok but some losses and expenses between related parties are not allowed. 1. Losses on the Sale of property 2. Expenses that remain unpaid at the end of the tax year. Related Parties Include: 1. Individuals and their families (spouse, brothers and sisters including half brothers and sisters, ancestors, and lineal descendants) 2. An individual and a corporation in which the individual owns more than 50% of the value of the outstanding stock. 3. Various relationships between grantors and beneficiaries of trusts. 4. Various relationships between partnerships and related corporations. -6Hobby Losses When an activity is deemed to be a Hobby, only expenses up to the amount of gross income derived from the Hobby are deductible and then in a specific order. The IRS uses the following factors on a case by case approach to determine if an activity is a Business or a Hobby. 1. 2. 3. 4. 5. 6. 7. 8. Does the taxpayer conduct the activity in a Business like manner The expertise of the Taxpayer or the Taxpayer’s advisors Time and effort expended by the Taxpayer Whether the assets used in the activity are expected to appreciate in value Whether the assets used in the activity are expected to appreciate in value The taxpayer’s history of income or loss with the activity The amount of profits earned The taxpayer’s financial status Presumptive Test under the Code: 1. Where an activity generates a profit in three out of the last five years, the presumption under the code is that the activity is an activity engaged in for profit and the burden of proof shifts to the IRS to prove otherwise. 2. Where an activity does not generate a profit in three out of the last five years, the presumption is that the activity is a Hobby and the burden of proof shift to the taxpayer to prove the activity is engaged in for profit. Hobby Expenses are deductible to the extent of Hobby Income in the following order: 1. Expenses that may be deducted even though not incurred in a trade or business (some taxes and interest) 2. Other expenses related to the activity except depreciation and amortization 3. Depreciation and amortization Vacation Home Rules These rules apply to a residence that is used by the taxpayer as a residence and also rented out to others during the year. Where a property is used for both personal residence and rental activities, an allocation of the expenses must be made. A dwelling unit is considered to be a residence if the taxpayer uses it for more than the greater of 1. 14 days or 2. 10% of the number of days the property is rented at a fair rental. 3. Taxpayer includes family members, brothers & sisters, defendants & ancestors, and any individual who does not pay a fair rental (rental to a family member at a fair rental removes that person from the family) Nominal Rental Days Exception The vacation home rules do not apply, all rent received is tax free income, and no rental expense deductions are allowed where the rental use portion of the total use is less than 15 days during the tax year. -7Limitation on Expenses for Business Use of Home To deduct expenses related to the business use of a personal residence, the taxpayer must meet the following tests: 1. The home must be the principal place of business for a trade or business of the taxpayer or a place where the taxpayer meets with clients in the normal course of business. 2. The business use must be regular and exclusive of any personal use. 3. If the taxpayer is an employee, the use must be for the convenience of the employer. (The author will add more to these rules in Chapter 19) Self Employed Health Insurance Deduction Self employed individuals can deduct 100% of their Health Insurance Premiums as an adjustment to gross income subject to the following limitations (chapter 7-6) 1. The deductible amount cannot exceed the net income from self employment. (Exception – if one of the optional methods is used to computer self employment tax, use the amount subject to self employment tax rather than the net income) 2. If either the employee or the employee’s spouse is eligible to receive subsidized health insurance coverage from employment, the deduction is not allowed. (Note the key words eligible to receive and subsidized. If your employer or your spouse’s employer has a non subsidized optional health plan, you could deduct those premiums.) Health Savings Account Deduction (HSA) (Chapter 9-43) Individuals can deduct as an adjustment to gross income amounts contributed to a Health Savings account or Archer medical savings account. An employee purchases a high deductible health insurance policy. Then the employee contributes monies to the HSA account. The money in the account can be used to pay medical costs not covered by the high deductible health insurance. Requirements 1. High deductible means a minimum deductible equal to or greater than $1,150 single or $2,300 family. 2. The minimum deductible is $1,200 ($2,400 family) 3. The maximum deductible amount is $5,950 single ($11,90 family). 4. Taxpayer can not also be covered under non high deductible plans. 5. Taxpayer is not eligible for Medicare 6. Taxpayer may not be claimed as dependent. 7. Deductible contributions are determined monthly 8. Distributions for anything other than medical costs are includible in income and subject to a 10% penalty unless the taxpayer has attained the age of 65.