checking-accounts

Checking Account Unit

Mrs. Lewis

Kentucky Core Content

Financial Management practices (e.g. maintaining bank accounts, budgeting, saving, using credit cards wisely, financing large purchases) are methods of achieving short and longterm goals.

Checking Account Definition:

An account that allows depositors to write checks to make payments.

CHECK

Written order to a bank to pay the stated amount to the person or business (payee) named on it.

Benefits of a Checking Account

Provides a Convenient way to pay your bills.

Safer than using Cash and handling your money.

Built-in Proof of Payment system that you can use to track your expenses.

Opening a Checking Account:

Provide the Bank with Appropriate Info

Fill out and sign a Signature Card

–

Purpose of a Signature Card Provides an official signature that the bank can compare to the signature you write on your checks.

– Use your full name (nicknames should be avoided)

Make a deposit

–

You need money in the bank to spend it!!

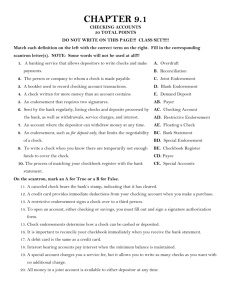

Drawer

Parts of a Check

Date Check

Number

Kris Garza

541 Crestwood Avenue

Norman, Oklahoma 73070-5549

555-1212

Payee

Memo

Line

Pay to the

Order of

Jeans and Me, Ltd.

Fifteen and 95/100

Second National Bank

Drawee

Norman, Oklahoma

FOR

Jeans

:103101712: 101 “16487214:”

April 13, 20-

101

ABA

No.

Amount in

Figures

$15.95

86-171

1031

Kris Garza

DOLLARS

Amount in Words

Drawer’s Signature

Routing

Number

Check

Number

Account Number

Deposit Ticket/Slip Definition:

Forms in the back of your checkbook that allows you to put money into your checking account.

Making a Deposit

Fill in the Current Date

In the Cash Section: Write the total amount of Currency (paper money) and coins you are depositing

In the Checks Section: List any checks you are depositing with ABA number and

Amount of each check individually.

Total Deposit (Cash + Checks)

Continued…..

If you would like cash at the time of the deposit, fill in the desired amount on the

“Less Cash Received” line

Sign name on Line if you are receiving cash back from deposit.

Subtract Total Deposit and Less Cash

Received to determine NET DEPOSIT

Always keep a receipt of Deposit

Check Writing Tips:

Fill out ALL parts of the check completely.

Always use a Pen!!

Write legibly!

Sign your name same as the signature card.

Never Post Date a check.

Always have funds in the account before you write a check!

Checking Account Tips:

Always record every check you write and deposit you make in the Check Register!

When you make a mistake, write VOID in large letters across the check & write a new one (keep VOIDED Check for Records)

Always keep track of your checkbook and secure your checking account number!!

Check Register Definition:

A booklet provided by your bank for recording your checking account transactions.

Guidelines for a Check Register

Record the Current Amount in your

Account at the top of the “Balance Column”

As soon as you write a check or make a deposit, record it in the register.

Checks:

• Write Check number

• Write Date

• Enter the Payee

•

Write the amount of Check in the Debit Column

•

Subtract from Previous Balance

Check Registers:

Deposits

•

Put a Slash or Mark through the Number Line

•

Write the Date

• Write “Deposit” with Detail on the Description Line

• Enter the amount of Net Deposit in Credit Column

• Add to Previous Balance

Checkmark Column will be used for Bank

Reconciliation later…..

Endorsing Checks:

Blank Endorsement

Restrictive Endorsement

Special Endorsement

– Also called an Endorsement-in-Full

–

**Never sign a check until you are at the Bank*

Blank Endorsement

Endorsement that only has the Payee’s name Susan K. Williams

Sign your name on the top of the back of the check.

Do not write below this line

Restrictive Endorsement

Endorsement that restricts the check

“FOR DEPOSIT

ONLY”

For Deposit Only

Susan K. Williams

Do not write below this line

Check can only be deposited into your account, makes it very safe.

Endorsement in Full (Special)

Endorsement used to transfer a check from one person to another.

Both names must be on the back.

Pay to the Order of

Susan K. Williams

Mary Griffen

Do not write below this line

Other Banking Services

Debit Card Purchases/Credit

ATM Cash Withdrawals

Pay by Phone or Internet Payments

Transfers: Wire or ATM

Pre-Authorized Payments

Stop Payment Orders

Check Returned for Insufficient Funds

The End…..For Now…