1A Recall 1

advertisement

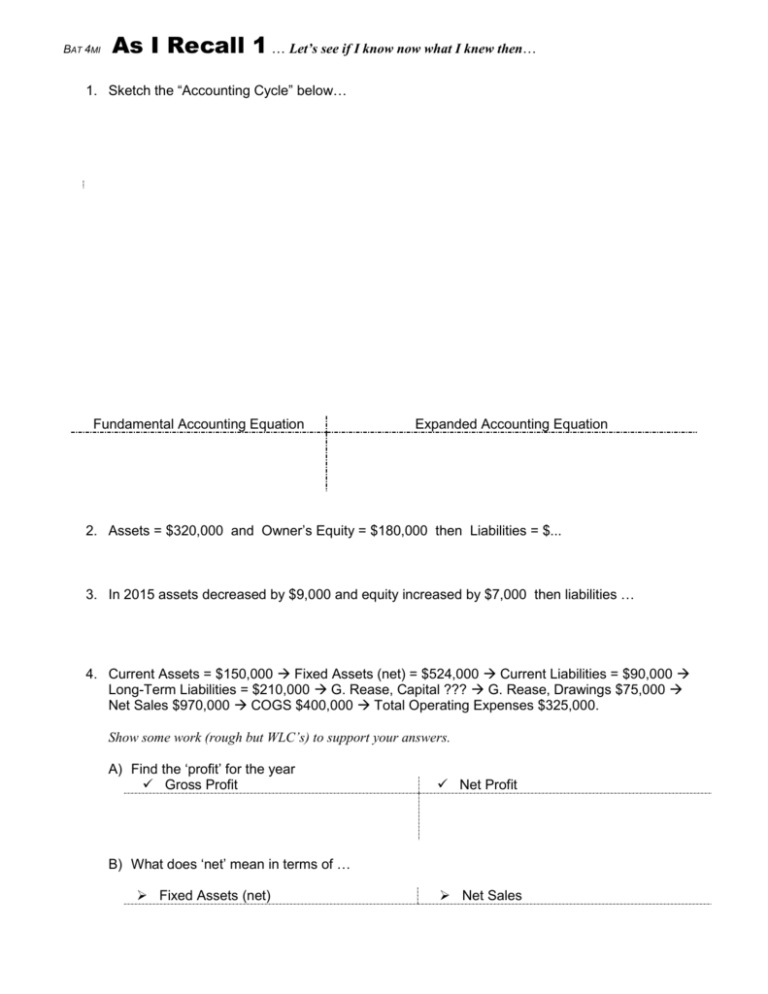

BAT 4MI As I Recall 1 … Let’s see if I know now what I knew then… 1. Sketch the “Accounting Cycle” below… Fundamental Accounting Equation Expanded Accounting Equation 2. Assets = $320,000 and Owner’s Equity = $180,000 then Liabilities = $... 3. In 2015 assets decreased by $9,000 and equity increased by $7,000 then liabilities … 4. Current Assets = $150,000 Fixed Assets (net) = $524,000 Current Liabilities = $90,000 Long-Term Liabilities = $210,000 G. Rease, Capital ??? G. Rease, Drawings $75,000 Net Sales $970,000 COGS $400,000 Total Operating Expenses $325,000. Show some work (rough but WLC’s) to support your answers. A) Find the ‘profit’ for the year Gross Profit Net Profit B) What does ‘net’ mean in terms of … Fixed Assets (net) Net Sales C) What will the balancing figure be on the balance sheet? D) What is the missing capital balance from the above list – that is the pre-closing capital balance – the balance that will be in the ledger prior to closing? E) What will the year-end capital balance be on the financial statements – the balance on the Statement of OE – the after closing capital balance? 5. The following is an alphabetical list of 2015 “pre-closing” ledger balances for Acme Services. (“pre-closing” refers to balances after all day-to-day, _______________ and ________________ have been completed) Accounts Payable Accounts Receivable Accumulated Amortization - Equip. Amortization Expense – Equip. Bank Loan Cash Equipment Equipment Rental Expense 15,000 64,000 127,200 54,000 70,000 27,000 300,000 34,500 Interest Expense Owen Nerr, Capital Owen Nerr, Drawings Rent Expense Sales Supplies Utilities Expense Wages 3,375 84,000 29,000 580,000 6,000 5,000 275,000 A) Calculate the missing capital account balance. Show some rough work above and/or below. B) Would the capital balance on January 1, 2015 have likely been higher, lower or the same? Explain. C) Complete a set of financial statements for 2015. For the statements, assume the owner made an investment of $12,000 on February 19, 2015. Start with the Income Statement below and use a separate sheet for the Statement of OE and Balance Sheet if necessary.