Accounting Cycle Exercise: Arrow Accounting Services

advertisement

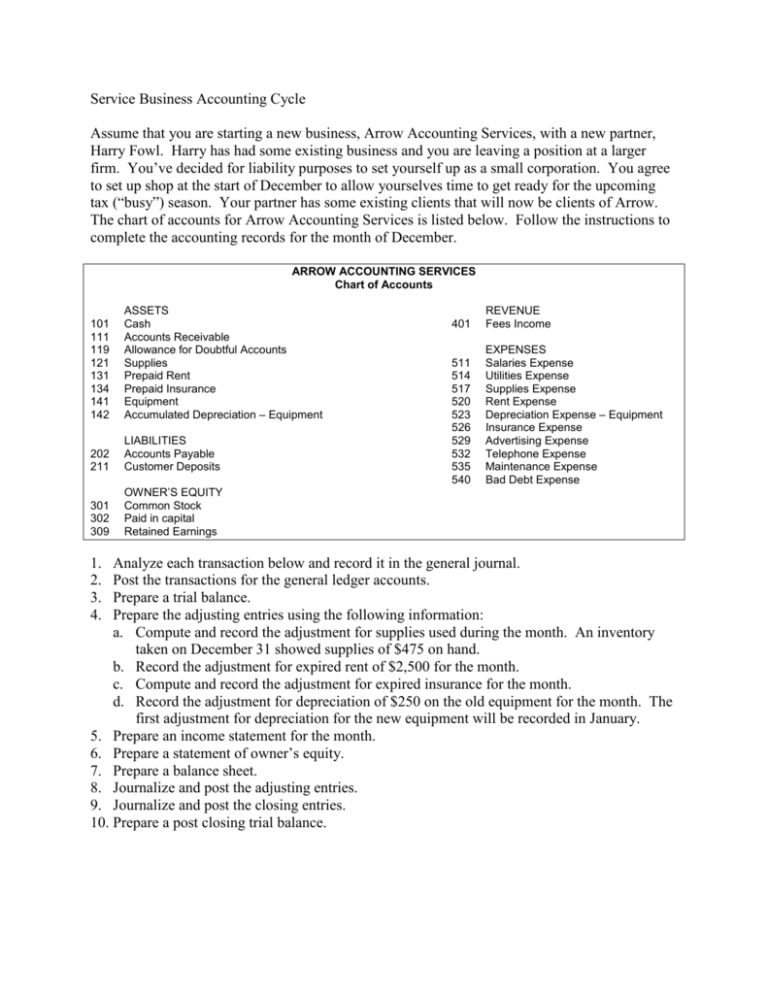

Service Business Accounting Cycle Assume that you are starting a new business, Arrow Accounting Services, with a new partner, Harry Fowl. Harry has had some existing business and you are leaving a position at a larger firm. You’ve decided for liability purposes to set yourself up as a small corporation. You agree to set up shop at the start of December to allow yourselves time to get ready for the upcoming tax (“busy”) season. Your partner has some existing clients that will now be clients of Arrow. The chart of accounts for Arrow Accounting Services is listed below. Follow the instructions to complete the accounting records for the month of December. ARROW ACCOUNTING SERVICES Chart of Accounts 101 111 119 121 131 134 141 142 ASSETS Cash Accounts Receivable Allowance for Doubtful Accounts Supplies Prepaid Rent Prepaid Insurance Equipment Accumulated Depreciation – Equipment 202 211 LIABILITIES Accounts Payable Customer Deposits 301 302 309 OWNER’S EQUITY Common Stock Paid in capital Retained Earnings 1. 2. 3. 4. 401 REVENUE Fees Income 511 514 517 520 523 526 529 532 535 540 EXPENSES Salaries Expense Utilities Expense Supplies Expense Rent Expense Depreciation Expense – Equipment Insurance Expense Advertising Expense Telephone Expense Maintenance Expense Bad Debt Expense Analyze each transaction below and record it in the general journal. Post the transactions for the general ledger accounts. Prepare a trial balance. Prepare the adjusting entries using the following information: a. Compute and record the adjustment for supplies used during the month. An inventory taken on December 31 showed supplies of $475 on hand. b. Record the adjustment for expired rent of $2,500 for the month. c. Compute and record the adjustment for expired insurance for the month. d. Record the adjustment for depreciation of $250 on the old equipment for the month. The first adjustment for depreciation for the new equipment will be recorded in January. 5. Prepare an income statement for the month. 6. Prepare a statement of owner’s equity. 7. Prepare a balance sheet. 8. Journalize and post the adjusting entries. 9. Journalize and post the closing entries. 10. Prepare a post closing trial balance. TRANSACTIONS Dec. 1 You contribute $16,000 for 100 shares of common stock in the new company ($1 par value). 1 Harry Fowl contribution to the business is $2,000 due on existing credit accounts, $15,000 of new equipment. He also receives 100 shares of $1 par common stock. 2 Purchase supplies for $1,500. Check 1009. 7 Sold services for $5,800 in cash and $745 on credit during the first week of December. 9 Purchased a one-year insurance policy for $3,600; issued Check 1010 to pay the full amount in advance. 11 Collected a total of $395 on account from credit customer during the first week of December. 12 Issued Check 1011 for $395 to pay for advertising on the local radio station during the month. 13 Collected a total of $500 on account from credit customers during the second week of December. 14 Returned some supplies that were damaged for a cash refund of $40. 15 Sold services for $8,500 in cash and $400 on credit during the second week of December. 18 Purchased supplies for $800 from Fellowes, Inc. received Invoice 3284, payable in 30 days. 19 Sold services for the $3,890 in cash and $2,560 on credit during the third week of December. 20 Collected a total of $750 on account from credit customers during the third week of December. 21 Issued Check 1012 for $1,275 for pay for maintenance work on the office equipment. 22 Issued Check 1013 for $150 to pay for advertisements in the local newspaper. 23 Received the monthly telephone bill for $215 and paid it with Check 1014. 23 Collected a total of $1,560 on account from credit customers during the fourth week of December. 26 Driving through town you notice that one of your new customers, a used book store, has put up a going out of business sale sign in its window. You look and notice that the business still owes you approximately $500 for work you’ve completed. 28 Sent Check 1016 for $235 in payment of the monthly bill for utilities. 29 Sold services for $5,890 in cash and $675 on credit during the fourth week of December. 30 Issued Checks 1017-1022 for $5,400 to pay the monthly salaries of the regular employees and three part-time workers. 31 Issued Check 1023 for $415 to pay for cleaning services for the month. 31 Purchased additional equipment for $6,000 from Master Equipment Company; issued Check 1024 for $1,250 and bought the rest on credit. The equipment has a five-year life and no salvage value. 31 Received advance payment for tax work for new clients in the amount of $2,500. 31 Sold services for $545 in cash and $325 on credit on December 31.