Practice Questions

advertisement

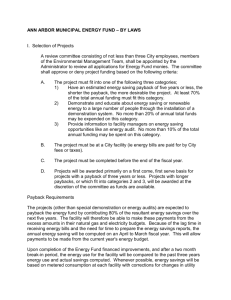

Practice Questions A. Sandra is in the drapery business. She is contemplating the purchase of an automatic drape-making machine. The machine costs $100,000, and Sandra estimates that it would save labor costs each year. That will count as a cash inflow. She also assumed the machine would last 5 years. Because of the risk involved, Sandra’s cost of capital is at 20 percent per year. She will need a payback in three years to justify a purchase. Year 1 2 3 4 5 Inflow 20,000 35,000 40,000 40,000 40,000 1. Compute the payback period for the machine. 2. Compute the Net Present Value of the machine. 3. Should she buy the machine? B. Mr. Blochirt is creating a college investment fund for his daughter. He will put in $850 per year for the next 15 years and expects to earn 8% annual rate of return. How much money will his daughter have when she starts college? C. How much will you pay for a $20,000 automobile in 10 years if the inflation rate is 20%? D. A balloon payment of $21,000 on your house is due in 10 years. If you can average 5% interest per year, how much will you have to place into an account today to have the $21,000 in ten years? E. Home Security Systems is analyzing the purchase of manufacturing equipment that will cost $40,000. The annual cash inflows for the next three years will be $18,100. If the company’s cost of capital is 10%, should they purchase the machine? (Use IRR) F. X-treme Vitamin Company is considering two investments, both of which cost $10,000. The cash flows are as follows: Year Project Project A B 1 $12,000 10,000 2 8,000 6,000 3 6,000 16,000 a. Which of the two projects should be chosen based on the payback method? b. Which of the two projects should be chosen based on the net present value method? Assume a cost of capital of 10 percent. c. Should a firm normally have more confidence in answer a or answer b? Answers A.1. Investment = 100,000 Inflow in year 1 = 20,000 2 = 35,000 3 = 40,000 4 = 40,000 2. Year 1 2 3 4 5 In the 4th year, you’ll reach the payback. 20,000 + 35,000 + 40,000 = 95,000, so it’s shortly into year 4 that you’ll reach the 1000,000 Inflow 20,000 35,000 40,000 40,000 40,000 PVIF 0.833 0.694 0.579 0.482 0.402 PV 16,660 24,290 23,160 19,280 16,080 Total Inflows Outflow 99,470 100,000 Net Present Value = ( 530) 3. Do not invest in the machine. The NPV is negative and it will take more than 3 years to pay back. B. You are looking for the future value of a series of payments, so this is future value of an annuity. Annuity payment = 850 Time = 15 years Interest = 8% annually FVA = A x FV IFA = 850 x 27.152 = $23079.20 C. You’re looking for the value of an amount in the future, so you need to use Future Value. PV = 20,000 Interest rate = 20% Time = 10 years FV = A x FVif = 20,000 X 6.192 FV = $123,840 D. You want to know the value today for an amount of money in the future. That is present value. FV = 21,000 Interest Rate = 5% Time = 10 years PV = A x PVif = 21000 x .614 = $12,894 E. You are trying to figure out the internal rate of return. Investment = 40,000 Annuity = 18,000 Time = 3 years IRR = Investment / Annuity = 40,000 / 18,100 = 2.210 PVIF of 2.210 for 3 years is 17% The return is larger than the cost of capital by a substantial amount, so purchase the machine. F. Solution: X-treme Vitamin Company a. Payback Method Payback for Project A 10,000 .83 years 12,000 Payback for Project B 10,000 1 year 10,000 Under the Payback Method, you should select Project A because of the shorter payback period. b. Net Present Value Method Year 1 2 3 Cash Flow $12,000 $ 8,000 $ 6,000 Project A PVIF at 10% .909 .826 .751 Present Value of Inflows Present Value of Outflows Net Present Value Year 1 2 3 Cash Flow $10,000 $ 6,000 $16,000 Project B PVIF at 10% .909 .826 .751 Present Value of Inflows Present Value of Outflows Net Present Value Present Value $10,908 $ 6,608 $ 4,506 $22,022 10,000 $12,022 Present Value $ 9,090 $ 4,956 $12,016 $26,062 10,000 $16,062 Under the net present value method, you should select Project B because of the higher net present value. c. A company should normally have more confidence in answer b because the net present value considers all inflows as well as the time value of money. The heavy late inflow for Project B was partially ignored under the payback method.