Tutorial CaitalBudgetingTechnique

advertisement

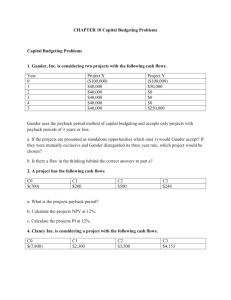

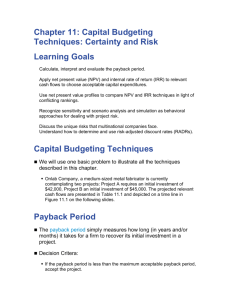

Chapter IX Tutorial Capital Budgeting Techniques Capital Budgeting Techniques • Calculate, interpret, and evaluate the payback period. • Calculate, interpret, and evaluate the present value (NPV). • Calculate, interpret, and evaluate the internal rate of return (IRR). Exercise 9 - 3 • Project Kelvin will cost $45,000 and generate cash inflows of $20,000 per year for the next 3 years • Project Thompson will cost $275,000 and generate cash inflows of $60,000 per year for 6 years. • Using an 8% cost of capital, calculate each project’s NPV and make a recommendation based on your findings Exercise 9 - 3 Solution Exercise 9 - 4 • Calculate the IRR for each of the following projects and recommend best project. • Project T-shirt requires initial investment of $15,000 and generates cash inflows of $8,000 per year for 4 years. • Project Board Shorts requires an initial investment of $25,000 and produces cash inflows of $12,000 per year for 5 years. Exercise 9 - 4 Solution Project T-Shirt • PV = -15,000 • N=4 • PMT = 8,000 • Solve for I IRR = 39.08% Problem 9 - 1 • Payback period • Jordan Enterprises is considering a capital expenditure that requires an initial investment of $42,000 and returns after-tax inflows of $7,000 per year for 10 years. The firm has maximum acceptable payback period of 8 years. a) Determine the payback period for this project. b) Should the company accept the project? Why? Problem 9 - 1 Solution (a) $42,000 / $7,000 = 6 years (b) The company should accept the project, since 6 < 8. Problem 9 - 3 • Choosing between 2 projects with acceptable payback periods • Each project requires $100,000 investment • Maximum payback period 4 years a) Determine payback period of each project. b) Which one should they choose? c) Explain why is one of the projects a better choice. Year Project A Project B 1 $10,000 $40,000 2 $20,000 $30,000 3 $30,000 $20,000 4 $40,000 $10,000 5 $20,000 $20,000 Problem 9 - 3 Solution Problem 9 - 4 • NPV • Calculate the NPV for the following 20-year projects. Comment on the acceptability of each • Opportunity cost is 14% a) Initial investment is $10,000; cash inflows are $2,000 per year. b) Initial investment is $10,000; cash inflows are $2,000 per year. c) Initial investment is $10,000; cash inflows are $2,000 per year. Problem 9 - 4 Solution Problem 9 - 7 • NPV • Car inventor has offered Simes choice of either one time payment $1,500,000 today or a series of 5 year-end payments of $385,000 a) If Simes has cost of capital 9%, which form of payment would they choose? b) What yearly payment would make the two offers identical in value at a cost of capital of 9% c) Would your answer be different if the yearly payments were made at the beginning of each year? Show the difference. d) The after-tax cash inflows are projected to $250,000 per year for 15 years. Will this factor change the decision? Problem 9 - 7 Solution Problem 9 - 9 • NPV- exclusive projects • Hook industries is considering the replacement of a drill press • Cost of capital is 15% a) Calculate NPV of each press. b) Evaluate acceptability. c) Rank the presses best to worst A Init. Inv. $85,00 0 Year B C $60,00 0 130,00 0 Cash Inflows (CFt) 1 $18,00 0 $12,00 0 $50,00 0 2 $18,00 0 $14,00 0 $30,00 0 3 $18,00 0 $16,00 0 $20,00 0 4 $18,00 0 $18,00 0 $20,00 0 5 $18,00 0 $20,00 0 $20,00 0 6 $18,00 $25,00 $30,00 Problem 9 - 9 Solution Problem 9 - 9 Solution cont. Problem 9 - 13 • IRR, investment life and cash inflows • Oak enterprises accepts projects earning more than 15%. Oak is considering a 10 year project that provides $10,000 annual cash inflows and requires $61,450 initial investment. a) Determine IRR. Is it acceptable? b) Assuming cash inflows stay same how many additional years would the flows have to continue to make IRR 15%? c) With given life, initial investment, and cost of capital what is the minimum annual cash inflow the firm should accept? Problem 9 - 13 Solution Problem 9 - 21 • Integrative - Complete investment decision • Existing – 10yrs ago at $1,000,000 – Sells $1,200,000 • New – Cost $2,200,000 – 5yrs, MACRS – Sales $1,600,000 increase per year – Costs 50% of Sales • Cost of Capital 11% • Tax 40% MACRS Year Percentage 1 20% 2 32% 3 19% 4 12% 5 12% 6 5% a) Calculate initial investment. b) Determine incremental operating cash flows. c) Determine the terminal cash flow. d) Depict on a time line the relevant cash flows. Problem 9 - 21 Solution Problem 9 - 21 Solution cont.