ACC 475

advertisement

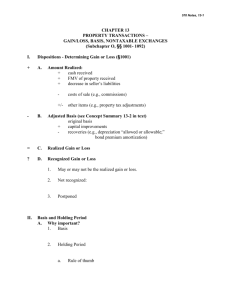

ACC 570 Chapter 13 Homework Solutions 54. Stock Sales & Identification 10/3/10 Purch. 1,000 sh @$200 12/12/10 Purch. 500 sh @ $225 3/1/11 Sells 400 @ $250 a. Kevin’s adjusted basis for Bluebird Corporation stock on December 31, 2010, is $312,500 ($200,000 + $112,500). b. Amount realized Less: Adjusted basis (400 shares × $225 per share) Realized gain $100,000 (90,000) $ 10,000 Recognized gain $ 10,000 c. 56. If Kevin cannot adequately identify the shares sold, a FIFO presumption is made. Amount realized Less: Adjusted basis (400 shares @ $200 per share) Realized gain $100,000 (80,000) $ 20,000 Recognized gain $ 20,000 Stock Rights Paula owns stock ($5,000 basis; $6,000 FMV) a. FMV of the nontaxable stock rights ($1,000) > 15% FMV of the stock ($6,000). Therefore, Paula must allocate a portion of the basis of the Yellow stock to the stock rights received, based on their relative fair market values. The adjusted basis of the Yellow stock decreases to $4,286 [($6,000/$7,000) × $5,000]. b. Basis = $714 [($1,000/$7,000 × $5,000). c. Amount realized Adjusted basis Realized gain Recognized gain d. No gain or loss is recognized on the lapse of the stock rights. The amount of the stock basis that has been allocated to the stock rights of $714 is restored to the basis of the stock. Thus, the basis of the stock after the lapse is $5,000 ($4,286 + $714). e. FMV of the nontaxable stock rights ($750) < 15% FMV of the stock ($6,000), Paula is not required to allocate part of her basis for the stock to the stock rights. Thus, there would be no effect on the basis of her stock, and the stock rights would have a basis of zero. Paula may elect to make the allocation, however. If she chooses to allocate, her basis for the Yellow stock is $4,444 ($6,000/$6,750 × $5,000). Paula’s basis for the stock rights is $556 [($750/$6,750 × $5,000) or ($5,000 – $4,444)]. $1,200 (714) $ 486 $ 486 60. Gift Basis a. Natalie’s adjusted basis for the painting: Aunt’s adjusted basis Gift tax paid on appreciation: $295,000 . X $392,000 = $1,120,000 - $13,000 Natalie’s adjusted basis b. 63. $825,000 104,462 $929,462 Dual basis exists. Gain = $825,000; Loss = $824,000 Inheritance Basis a. If the primary valuation date applies, Robert’s basis for the assets would be the fair market value at the date of Earl’s death. Cash Stock Apartment building Land b. $ 10,000 125,000 300,000 100,000 $535,000 The election of the alternate valuation date will produce the following basis for each asset distributed to Robert. Cash Stock Apartment building Land $ 10,000 85,000 325,000 110,000 $530,000 Since the stock was disposed of prior to the alternate valuation date, Robert’s basis will be its the fair market value on the date of distribution to him. 64. Deathbed Gift Rule a. The inherited stock is subject to the deathbed gift rule in that the period between the date of the gift and the date of the donee’s death (i.e., Uncle George) is not greater than one year. The basis per share is $30 ($3,150/105 shares) as a result of the 5% stock dividend. Therefore, Emily’s basis for the 100 shares she inherited is $3,000 ($30 × 100 shares). b. Since the deathbed gift rule would not be applicable, Emily’s basis for the inherited stock would be $5,500 ($55 × 100 shares). 69. Conversion & sale of mixed use property a. Jean’s basis for gain, loss, and cost recovery for the business use portion (50%) of the house is as follows: House b. Land Gain basis $100,000 ($200,000 × 50%) $30,000 ($60,000 × 50%) Loss basis $95,000 ($190,000 × 50%) $30,000 ($60,000 × 50%) Cost recovery basis $95,000 (same as loss basis) The cost recovery for the 5-year period is calculated as follows: Year 1 Year 2 Year 3 Year 4 Year 5 Total $95,000 × 2.461% $95,000 × 2.564% $95,000 × 2.564% $95,000 × 2.564% $95,000 × 2.564% x (11.5/12) = = = = $ 2,338 2,436 2,436 2,436 2,334 $11,980 Note: A bed and breakfast is 39-year nonresidential real property. c. The recognized gain on the sale of the business use portion of the house and land is: House (50%) Land (50%) Amount realized Less: Adjusted basis* Realized gain $150,000 (88,020) $ 61,980 $37,500 (30,000) $ 7,500 Recognized gain $ 61,980 $ 7,500 *Original basis for gain Less: Cost recovery Adjusted basis $100,000 (11,980) $ 88,020 A few other good problems if you’re interested in additional practice &/or topic. 52. 62. 67. a. Buddy must treat the purchase of the land at a $70,000 ($280,000 – $210,000) discount as a bargain purchase, since it represents compensation for services. Thus, he must include the $70,000 in his gross income. b. Buddy’s adjusted basis for the land is the fair market value of $280,000 ($210,000 cost + $70,000 increase in gross income). a. No, the executor cannot elect the alternate valuation date and amount. In order to do so, the following requirements must be satisfied: The election must result in the reduction of the value of the gross estate. The election must result in the reduction of the estate tax liability. b. Dazie’s basis for the property is the fair market value on the date of Mary’s death (primary valuation date) of $3,820,000. c. In this case, the fair market value at the alternate valuation date is less than at the primary valuation date. Assuming the election also results in the reduction of the estate tax liability, it can be made. So, Dazie’s basis for the property now becomes $3,800,000. a. Amount realized Less: Adjusted basis Realized loss Less: Disallowed loss under § 707(b) Recognized loss $165,000 (200,000) ($ 35,000) 35,000 $ –0– The loss is disallowed under § 707(b) since Thad owns greater than a 50% capital or profits interest in the partnership. b. Thad’s basis is $165,000, the amount he paid for the property. c. Amount realized Less: Adjusted basis Realized gain Less: Amount of previously disallowed loss used to eliminate realized gain Recognized gain $187,000 (165,000) $ 22,000 $ (22,000) –0– The remainder of the disallowed loss of $13,000 ($35,000 – $22,000) can never be deducted either by Thad or the partnership. d. Amount realized Less: Adjusted basis Realized gain $187,000 (165,000) $ 22,000 Recognized gain $ 22,000 Since the property was received by gift, Donna’s carryover basis is $165,000. However, Donna is not permitted to use any of the partnership’s disallowed loss since she is not the original transferee (i.e., the related-party buyer is Thad). 68. 70. e. The results will be the same. The shareholder and the corporation are related parties under § 267(b)(2) since the shareholder owns greater than 50% of the corporation’s outstanding stock. a. Tyneka receives a stepped-up basis of $45,000 for the stock received on July 15, 2010. Selling the stock for $33,000 on July 30, 2011, creates a realized loss of $12,000 ($33,000 amount realized – $45,000 adjusted basis). Because she purchases 1,000 shares of Amber within 30 days of the sale, the transaction is a wash sale and the realized loss is disallowed. Her basis for the 1,000 shares of stock purchased on August 20, 2011, is $42,000 ($30,000 cost + $12,000 disallowed loss). b. Because Tyneka made a gift of the Amber stock to Joe within a year of his death, the inherited stock is treated as a deathbed gift. Her basis for the inherited stock received on July 15, 2010, is $35,000. c. The tax consequences would have been the same. Tyneka has a wash sale to the extent of the 1,000 shares purchased. To avoid the limitations of the wash sale, Tyneka should not purchase substantially identical stock within the 60-day window (30 days before and 30 days after the sale date) for a wash sale. Conversion of personal-use to business-use. a. Surendra’s basis for loss is $320,000, the lower of the adjusted basis of $340,000 or the fair market value at the date of the conversion of $320,000. b. Surendra’s basis for depreciation is $320,000, the same as the basis for loss. c. Surendra’s basis for gain is the adjusted basis of $340,000. d. No. The realized loss of $20,000 ($320,000 – $340,000) on the sale of his personal residence would be disallowed.