1, 3, 6-8, 10-19 - Faculty

advertisement

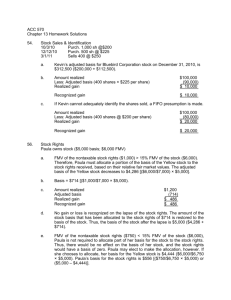

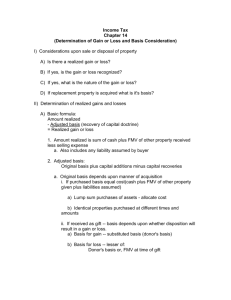

CHAPTER 7 PROPERTY TRANSACTIONS: BASIS, GAIN AND LOSS, AND NONTAXABLE EXCHANGES SOLUTIONS TO PROBLEM MATERIALS Question/ Problem 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Topic Amount realized and basis determination Basis and cost recovery Personal use asset sale and exchange Recognition and condemnation Issue recognition Basis and cost identification Allocation of purchase price to goodwill Gift basis Ethics problem Gift basis Gift basis and effect of gift tax Issue recognition Gift basis Alternate valuation date for inherited property Alternate valuation date for inherited property Related party loss disallowance Wash sales Property converted from personal use Property converted from personal use Like-kind exchange: recognition and basis Like-kind exchange: related party Like-kind exchange: like-kind property Like-kind exchange: boot received Issue recognition Like-kind exchange: basis Like-kind exchange: like-kind property Form of the transaction Like-kind exchange: boot given that has declined in value 7-1 Status: Present Edition Q/P in Prior Edition Unchanged Modified Unchanged Modified Unchanged Unchanged New Unchanged Unchanged Unchanged New Modified Unchanged Unchanged Unchanged Unchanged New Unchanged Modified Unchanged Unchanged Unchanged Modified Unchanged Unchanged Unchanged Unchanged Unchanged 1 2 3 4 5 6 8 9 10 12 13 14 15 16 18 19 20 21 22 23 24 25 26 27 28 7-2 2003 Entities Volume/Solutions Manual Question/ Problem 29 30 31 32 Topic Like-kind exchange and mortgage assumed Like-kind exchange: recognition, boot, and basis Like-kind exchange and mortgage assumed Involuntary conversion: qualifying replacement property Ethics problem Involuntary conversion: recognition and basis Involuntary conversion: recognition and basis Involuntary conversion: recognition and basis Sale of residence: calculation and maximum § 121 exclusion Transfer of property between spouses or incident to divorce 33 34 35 36 37 38 Status: Present Edition Q/P in Prior Edition Unchanged Unchanged Unchanged Modified 29 30 31 32 Modified Unchanged Modified Unchanged Unchanged 33 34 35 36 37 Unchanged 38 Depreciation Depreciation Like-kind exchanges Unchanged Unchanged Modified 1 2 3 Stock sale identification § 1045 transactions Deferred like-kind exchange Internet activity Internet activity Unchanged Unchanged New Unchanged Unchanged 1 2 Bridge Discipline Problem 1 2 3 Research Problem 1 2 3 4 5 4 5 PROBLEM MATERIAL 1. a. b. Original basis of land Original basis of house Less: Depreciation Adjusted basis of house and land $ 10,000 70,000 ( 32,200) $ 47,800 Original basis of tennis court Less: Depreciation Adjusted basis of tennis court $ Amount realized Less: Adjusted basis ($47,800 + $3,700) Realized gain $ 125,000 ( 51,500) $ 73,500 Amount realized [$125,000 (cash) + $20,000 (mortgage)] Less: Adjusted basis Realized gain $ 145,000 ( 51,500) $ 93,500 5,000 ( 1,300) $ 3,700 Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges c. Same answer as in part (b.) above. pp. 7-3 to 7-5 and Concept Summary 7-1 2. a. Black must report on her income tax return the greater of the depreciation allowed of $20,000 ($24,000 X 10/12) or allowable of $24,000. The depreciation allowed is the amount actually deducted, whereas the depreciation allowable is the amount that should have been deducted under the depreciation convention. Black should amend her 2002 income tax return and deduct the correct amount of depreciation ($24,000). b. Adjusted basis on January 1, 2002 Less: Depreciation allowable Adjusted basis on December 31, 2002 $375,000 ( 24,000) $351,000 pp. 7-4 and 7-5 3. a. Amount realized Less: Adjusted basis Realized loss Recognized loss $34,500 (38,000) ($ 3,500) $ -0- Realized losses on personal use assets are not deductible. b. Same result as in part (a) above. p. 7-7 4. a. Amount realized Less: Adjusted basis Realized loss Recognized loss $270,000 (290,000) ($ 20,000) $ -0- A realized loss on the condemnation of a personal use asset is not recognized. b. Amount realized Less: Adjusted basis Realized gain Recognized gain $300,000 (290,000) $ 10,000 $ 10,000 A realized gain on the condemnation of a personal use asset is recognized if similar property is not acquired. However, as discussed in Chapter 15 under “Sale of a Residence – § 121,” the recognized gain of $10,000 can be avoided if the § 121 requirements are satisfied. c. If the house were income-producing property, the realized loss of $20,000 would be recognized. pp. 7-6 and 7-7 7-3 7-4 2003 Entities Volume/Solutions Manual 5. Marmot & Squirrel should defer the realized gain on the disposition of the warehouse. Therefore, the partnership should structure the transaction to qualify as an involuntary conversion. Thus, the associated issues are whether the form of the disposition qualifies and whether the replacement qualifies. The acquisition by the condemning authority would qualify. Since the city is condemning the property, the sale to the real estate broker also would qualify. Replacing the warehouse with the office building will qualify since the form of the involuntary conversion is the condemnation of real property used in a trade or business. Unless the firm via the negotiation process can get more from the city than the real estate broker, it should sell the land to the real estate broker and replace it with the office building within the qualified replacement period (i.e., three years from the end of the tax year in which a proceeds inflow is received that is large enough to produce a gain). pp. 7-27 to 7-30 6. a. Finch, Inc.’s adjusted basis for Bluebird Corporation stock on December 31, 2002 is $210,000 ($150,000 + $60,000). b. Amount realized Less: Adjusted basis (60 shares X $1,500 per share) Realized loss Recognized loss c. If Finch cannot adequately identify the shares sold, a FIFO presumption is made. Thus, the 60 shares sold are presumed to come from the 100 shares purchased on June 3, 2002 for $150,000 (i.e., $1,500 per share). Therefore, Finch has a recognized loss of $39,000 as calculated in (b) above. $51,000 (90,000) ($39,000) ($39,000) p. 7-8 7. a. Marco’s recognized gain on the sale of his business is calculated as follows: Amount realized ($650,000 - $30,000) Less: Adjusted basis Realized gain Recognized gain b. $620,000 (427,000) $193,000 $193,000 The $25,000 excess of the purchase price of $650,000 over the fair market value of the listed assets of $625,000 is assigned to goodwill. Thus, the adjusted basis for each of the assets for Stella is as follows: Production equipment Packaging equipment Distribution equipment Building and land Goodwill c. Hoffman, Smith, and Willis, CPAs 5191 Natorp Boulevard Mason, OH 45040 June 3, 2002 Ms. Stella Simson 300 Woodland Drive Cincinnati, OH 45207 $ 93,750 156,250 187,500 125,000 87,500 $650,000 Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges Dear Ms. Simson: I am responding to your inquiry regarding your proposal to purchase the assets of Marco’s sole proprietorship. Your $650,000 purchase price is allocated among the assets to produce the following adjusted basis for each asset: Production equipment Packaging equipment Distribution equipment Building and land Goodwill $ 93,750 156,250 187,500 125,000 87,500 $650,000 The goodwill of $87,500 represents the difference between the $650,000 purchase price and the total fair market value of each of the other assets. Since the building is depreciable and the land is not, the $125,000 adjusted basis for the building and land needs to be allocated between these two assets. If you have not already done so, I suggest that an appraisal be obtained for this purpose. If I can be of further assistance, please let me know. Steve Wills, CPA Tax Partner pp. 7-8, 7-9, and Example 13 8. a. Basis for loss = $62,000; $58,000 (amount realized) - $62,000 (adjusted basis) = $4,000 (recognized loss). b. $0. The proceeds of $59,000 are between the gain basis of $65,000 and the loss basis of $50,000. Therefore, neither gain nor loss is recognized. pp. 7-11 to 7-13 9. The issue is whether Holly will have a carryover basis of $2,500 for the stock inherited from Alice or a stepped-up basis (FMV at date of Alice's death) for the inherited stock. Section 1014(a) provides the general rule that the basis for inherited property is the fair market value of the property on the date of the decedent's death. However, § 1014(e) provides an exception to this FMV basis (the so-called deathbed gift rule). Under this provision, if appreciated property is inherited by a taxpayer (or the taxpayer's spouse) and the property was acquired by the decedent by gift from that taxpayer, a carryover basis may be required. Such a carryover basis is required if the time period between the date of the gift and the date of the donee's death is not greater than one year. If Alice lives for over one year after she receives the gift of the stock from Holly, they will be able to achieve their objective to "beat the tax system." Under this assumption, Holly's basis for the inherited stock will be the FMV on the date of Alice's death. Conversely, if Alice does not live for over a year, then Holly's basis for the stock will be a carryover basis of $2,500. 7-5 7-6 2003 Entities Volume/Solutions Manual There are risks involved for Holly in attempting to step-up the basis of the stock free of Federal income tax. First, Alice could decide not to will the stock to Holly. Second, Alice's medical costs or other aspects of her life style could result in the consumption of the stock. In both of these situations, Holly will receive nothing. If the stock were a painting, the tax consequences and the risks would be the same. pp. 7-14 to 7-16 10. a. $5,000 ($27,000 cost - $22,000 accumulated depreciation). b. $2,500 ($5,000 basis/2 years). c. Gain basis = $5,000 (Barbara’s original basis) - $2,500 (depreciation allowed) = $2,500; $20,000 (selling price) - $2,500 (adjusted basis) = $17,500 (realized gain). d. Gain basis = $5,000 (Barbara’s original basis) - $2,500 (depreciation for one year) = $2,500. $24,000 (selling price) - $2,500 (adjusted basis) = $21,500 (realized gain). pp. 7-11 to 7-13 11. a. Jessica’s gain basis for the stock is increased as a result of Kirk’s payment of gift tax. This eliminates some of the taxation that Jessica would face upon the disposal of the appreciated property. Jessica’s gain basis for the stock is $10,563 [$10,000 + (($6,000/$16,000) X $1,500)]. b. If the transaction were completed in 1976, the full amount of the gift tax paid by Kirk would be added to the carryover basis to determine the donee’s gain basis. Thus, Jessica’s gain basis would be $11,500 ($10,000 + $1,500). pp. 7-12 and 7-13 12. Either Simon or Fred should receive the benefit of deducting the realized loss on the sale of the stock. On the surface, it appears that Simon should give the stock to Fred and let Fred sell it, since Fred is in the higher tax bracket (i.e., 27% versus Simon’s 15%). However, a taxpayer cannot deduct another taxpayer’s loss. For gift property, this is achieved by the loss basis to the donee being the lower of (1) the donor’s adjusted basis, or (2) the fair market value on the date of the gift. Therefore, since the stock has declined in value (i.e., adjusted basis is greater than the fair market value at the date of the gift), Simon should sell the stock, deduct the realized loss, and give the sales proceeds to Fred). pp. 7-11 and 7-12 13. Liz has generated zero recognized gain or loss, since the amount realized ($54,000) falls between the basis for gain ($70,000) and the basis for loss ($50,000). In this case, the gift tax paid does not affect basis. Example 18 and pp. 7-11 and 7-12 Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges 14. a. b. No, the executor cannot elect the alternate valuation date. In order to be permitted to do so, the following requirements must be satisfied: The election results in the reduction of the value of the gross estate. The election results in the reduction of the estate tax liability. Denise's basis for the property is the fair market value on the date of Martha's death (primary valuation date) of $825,000. pp. 7-14 and 7-15 15. a. If the primary valuation date and amount apply, Robert's basis for the assets would be the fair market value at the date of Earl's death. Cash Stock Apartment building Land b. $ 10,000 125,000 300,000 100,000 $535,000 The election of the alternate valuation date by the executor would produce the following basis for each asset distributed to Robert. Cash Stock Apartment building Land $ 10,000 85,000 325,000 110,000 $530,000 Since the stock was distributed prior to the alternate valuation date, Robert's basis for it would be the fair market value on the date of its distribution to him. pp. 7-14 and 7-15 16. a. Sale by Susan Amount realized Adjusted basis Realized gain Recognized gain $ 140,000 ( 125,000) $ 15,000 $ 15,000 Sale by Jerry Amount realized Adjusted basis Realized gain Recognized gain $ 143,000 ( 140,000) $ 3,000 $ 3,000 Jerry’s gain basis of $140,000 is the same as Ellen’s adjusted basis. 7-7 7-8 2003 Entities Volume/Solutions Manual b. Sale by Susan Amount realized Adjusted basis Realized loss Recognized loss $140,000 ( 150,000) ($ 10,000) $ -0- Since Susan and Ellen are related parties, the realized loss of $10,000 is disallowed by § 267. Sale by Jerry Amount realized Adjusted basis Realized gain Recognized gain $ 143,000 ( 140,000) $ 3,000 $ 3,000 Jerry is not eligible to use any of Susan’s disallowed loss of $10,000 under the right of offset since he is not the original transferee (i.e., Ellen is the original transferee). p. 7-16 17. a. Amount realized Less: Adjusted basis Realized loss Recognized loss $3,600 (4,000) ($ 400) ($ 100) The sale of 300 of the 400 shares is a wash sale, as the purchase of 300 shares of Amber stock on January 19th is within 30 days of the sale of Amber stock on December 28th. Consequently, $300 of the realized loss of $400 is disallowed [$400 X (300 shares/400 shares)]. b. Purchase price Plus: Disallowed loss on wash sale Adjusted basis $2,850 300 $3,150 The disallowed loss of $300 on the wash sale is added to the purchase price of $2,850. c. The wash sale provision will prevent Redwood Company from recognizing $300 of the realized loss of $400 ($3,600 amount realized - $4,000 adjusted basis). Redwood Company can avoid the wash sale provision by not acquiring substantially identical stock within 30 days before or after the date of the sale. Therefore, they should not purchase shares of stock in Amber within this time period. Redwood could purchase Amber stock outside this 60-day window or purchase the stock of another corporation. pp. 7-17 and 7-18 Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges 18. a. Amount realized Less: Adjusted basis (date of sale) Realized gain (loss) Recognized gain (loss) Personal Use $33,000 (42,000) ($ 9,000) $ 7-9 Office $ 11,000 (11,370)* ($ 370) -0- ($ 370) The realized loss on the personal use portion is not recognized. b. Amount realized Less: Adjusted basis (date of sale) Realized gain Recognized gain Personal Use $52,500 (42,000) $10,500 $ Office $ 17,500 (11,370)* $ 6,130 -0- $ 6,130 *$11,370 = 14,000 basis at conversion - $2,630 cost recovery. The $10,500 personal use residence gain may be excluded under sec. 121. pp. 7-17 and 7-33 19. a. Surendra's basis for loss is $150,000, the lower of the adjusted basis of $180,000 or the fair market value at the date of the conversion of $150,000. b. Surendra's basis for depreciation is $150,000, the same as the basis for loss. c. Surendra's basis for gain is the adjusted basis of $180,000. p. 7-17 20. a. Amount realized Adjusted basis Realized gain $ 260,000 (190,000) $ 70,000 Recognized gain $ -0- The exchange qualifies for § 1031 postponement treatment. 21. b. Because of the postponed gain, the basis in the land is $190,000 ($260,000 $70,000). p. 7-19 a. October 7, 2002 Amount realized Adjusted basis Realized gain Recognized gain $250,000 (175,000) $ 75,000 $ -0- The transaction qualifies as a like-kind exchange. Tex's basis for the land received is $175,000 ($250,000 - $75,000). 7-10 2003 Entities Volume/Solutions Manual February 15, 2003 Amount realized Adjusted basis Realized gain Recognized gain $300,000 (175,000) $125,000 $125,000 The sale of the land by Tex results in the realized gain of $75,000 previously postponed being recognized plus an additional $50,000 of appreciation. b. October 7, 2002 Amount realized Adjusted basis Realized gain $250,000 (175,000) $ 75,000 Recognized gain $ -0- The transaction qualifies as a like-kind exchange. Tex's basis for the land received is $175,000 ($250,000 - $75,000). February 15, 2003 Only Paige is involved in the sales transaction on February 15, 2003. However, since Tex and Paige are related parties, neither party must dispose of the like-kind property received for two years. Since Paige sold her land prior to the expiration of the two-year period, Tex's postponed gain of $75,000 on the October 7, 2002 exchange is recognized on February 15, 2003. As a result of this, Tex's adjusted basis for his land is increased to $250,000 ($175,000 adjusted basis + $75,000 recognized gain). c. Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 November 1, 2002 Mr. Tex Wall The Corral El Paso, TX 79968 Dear Mr. Wall: You have asked me to provide you with the tax consequences of the October 7, 2002 land exchange with your daughter, Paige. Based on the data you provided, the tax consequences to you are as follows: Amount realized Less: Adjusted basis Realized gain Recognized gain $250,000 (175,000) $ 75,000 $ -0- Since the transaction qualifies for nontaxable exchange treatment as the exchange of like-kind property, your potential gain of $75,000 is postponed. The adjusted basis for the land you received is $175,000 ($250,000 fair market value - $75,000 postponed gain). Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges 7-11 Section 1031 of the Internal Revenue Code provides for the aforementioned treatment. However, since the exchange was with a related party (i.e., Paige), the Code provides that neither you nor Paige should dispose of the land you received in the exchange prior to two years after the date of the exchange (i.e., October 8, 2004). Such a disposition by either of you would make the exchange transaction on October 7, 2002 taxable for both Paige and you as of the date of the disposition. I suggest that you communicate this information to Paige. If I can be of further assistance, please let me know. Sincerely, Margaret Ryan, CPA Tax Partner pp. 7-23 and 7-24 22. a. Amount realized Adjusted basis ($3,000 + $5,000) Realized gain $ 14,000 ( 8,000) $ 6,000 Recognized gain $ -0- The personal computer and the laser printer are depreciable tangible personal property which are in the same general business asset class. Therefore, the exchange qualifies as the exchange of like-kind property. pp. 7-22 to 7-24 b. 23. Because the realized gain of $6,000 is postponed, Starling's basis for the printer is $8,000 ($14,000 fair market value - $6 ,000 postponed gain). pp. 7-25 and 7-26 a. Amount realized ($175,000 + $100,000) Adjusted basis Realized gain $275,000 (125,000) $150,000 b. Recognized gain $100,000 The exchange qualifies for like-kind exchange treatment. However, since boot (i.e., the stock) is received, the realized gain is recognized to the extent of the boot received. As the boot received of $100,000 is less than the realized gain of $150,000, only $100,000 of the $150,000 realized gain is recognized. c. The basis of the land is $125,000 (fair market value of $175,000 minus postponed gain of $50,000). The basis of the stock is the fair market value of $100,000. pp. 7-22 to 7-26 24. The critical question is whether the transactions qualify for § 1031 deferral treatment. Tulip, Inc.’s preference probably is to have the gain on the land deferred and the loss on the stock recognized. Therefore, the key is to be aware of whether the land and the stock to be received qualify as like-kind property. Since only the land qualifies, Tulip can exchange the land (i.e., defer the realized gain) and either sell or exchange the stock (i.e., recognize the realized loss). However, Tulip may want to sell the land in order to avoid § 1031 7-12 2003 Entities Volume/Solutions Manual treatment and recognize the gain. This could be the case if Tulip has no other recognized gains and current year deductibility of the stock loss would otherwise be limited to $0. pp. 7-21 to 7-23 25. a. Because the postponed gain is $50,000, the basis equals $150,000 ($200,000 $50,000). b. Because the postponed gain is $320,000, the basis equals $30,000 ($350,000 $320,000). c. The transaction does not qualify as a like-kind exchange. Therefore, the basis of the newly acquired asset (the bulldozer) is equal to its fair market value, or $42,000. d. The transaction does not qualify as a like-kind exchange. Therefore, the basis of the newly acquired asset (ExxonMobil common stock) is equal to its fair market value, or $18,000. e. The transaction does not qualify as a like-kind exchange. Therefore, the basis of the personal use mountain cabin is equal to its fair market value, or $115,000. pp. 7-21 to 7-23 26. Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 November 21, 2002 Hyacinth Realty Co. 2501 Longview Lane Des Moines, IA 50311 Dear President of Hyacinth Realty Co.: You have asked us about the tax consequences of an all-cash sale vs. an exchange for land located overseas. Nonrecognition treatment is not available for the land swap, because § 1031(h) states foreign land and U.S. land are not like-kind property despite their similarity. Thus, an exchange of land in Iowa for land in Italy would be taxable in full, just like an all-cash sale. Should you need additional information, please do not hesitate to contact me. Sincerely yours, Marilyn Pierce, CPA Partner pp. 7-22 and 7-23 Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges 27. a. Amount realized Adjusted basis Realized gain $15,000 (12,000) $ 3,000 Recognized gain $ 3,000 7-13 b. The basis for Machine B is its cost of $15,000. c. Such an exchange would have resulted in the realized gain being postponed under § 1031. However, this would cause Redbud’s basis in the machine received to be $12,000 ($12,000 adjusted basis + $0 gain recognized + $0 boot given or $15,000 fair market value - $3,000 postponed gain). Because the sale transaction is fully taxable, the recognition of gain permits Redbud to have a higher basis for the new machine. In addition, Redbud may have some losses with which they can offset the $3,000 recognized gain. d. Amount realized Adjusted basis Realized loss $12,000 (15,000) $ 3,000 Recognized loss $ 3,000 The basis for Machine B is its cost of $12,000. Avoiding § 1031 treatment enables Redbud to recognize the $3,000 realized loss. pp. 7-23 to 7-26 28. a. Realized gain = $50,000 [$60,000 (gain on like-kind property) - $10,000 (loss on property given up that is not like-kind)]. b. Recognized loss = $10,000 (on property given up that is not like-kind). c. New basis = $50,000 [$110,000 (fair market value of new real estate) - $60,000 (postponed gain on the like-kind property)]. Example 38 and pp. 7-24 and 7-25 29. a. The exchange qualifies as a like-kind exchange. Amount realized ($410,000 + $90,000) Adjusted basis Realized gain $500,000 (420,000) $ 80,000 Recognized gain $ 80,000 The mortgage assumed by Indigo, Inc. is treated as boot received by Avocet Management Co. Therefore, Avocet’s recognized gain is $80,000, the lower of the boot received of $90,000 or the realized gain of $80,000. b. Fair market value of office building and land Less: Postponed gain Adjusted basis c. The alternative would produce the following tax consequences: $410,000 -0$410,000 7-14 2003 Entities Volume/Solutions Manual Amount realized ($410,000 + $90,000) Adjusted basis Realized gain $500,000 (420,000) $ 80,000 Recognized gain $ 80,000 Since the cash is treated as boot, the recognized gain of $80,000 would be the same as in (a). Avocet’s adjusted basis for the office building and land of $410,000 would be the same as in (a). Therefore, the tax consequences to Avocet under the alternative proposal are the same as under the original proposal. pp. 7-21 to 7-27 30. a. Realized gain = $9,000 [($12,000 fair market value of new asset + $4,000 boot received) - $7,000 adjusted basis of old asset]. Recognized gain = $4,000. Postponed gain = $5,000. New basis = $7,000 ($12,000 fair market value of new asset - $5,000 postponed gain). b. Realized loss = $1,000. Recognized loss = $-0-. Postponed loss = $1,000. New basis = $16,000 ($15,000 fair market value of new asset + $1,000 postponed loss). c. Realized loss = $1,500. Recognized loss = $-0-. Postponed loss = $1,500. New basis = $9,500 ($8,000 fair market value of new asset + $1,500 postponed loss). d. Realized gain = $10,000. Recognized gain = $-0-. Postponed gain = $10,000. New basis = $22,000 ($32,000 fair market value of new asset - $10,000 postponed gain). e. Realized gain = $2,000. Recognized gain = $1,000. Postponed gain = $1,000. New basis = $10,000 ($11,000 fair market value of new asset - $1,000 postponed gain). f. Realized loss = $2,000. Recognized loss = $-0-. Postponed loss = $2,000 New basis = $10,000 ($8,000 fair market value of new asset + $2,000 postponed loss). Example 41 and pp. 7-21 to 7-26 Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges 31. a. Amount realized [$150,000 (cash) + $975,000 (office building) + $240,000 (mortgage)] Adjusted basis of apartment house given up Realized gain 7-15 $1,365,000 ( 950,000) $ 415,000 b. Recognized gain = $390,000 [$150,000 (cash) + $240,000 (mortgage assumed by Dove is treated as boot received); lower of boot received of $390,000 or realized gain of $415,000]. Postponed gain = $25,000. c. New basis = $950,000 [$975,000 (fair market value of office building received) $25,000 (postponed gain)]. Example 41 and pp. 7-23 to 7-26 32. a. Since the taxpayer is an owner-investor, the taxpayer use test applies. Replacing the warehouse that is rented to various tenants with a shopping mall that is rented to various tenants in a different location qualifies as replacement property. b. Since the taxpayer is an owner-user, the functional use test applies. Replacing the warehouse used in his business with another warehouse in a different state which is to be used in his business qualifies as replacement property under the functional use test. c. Since Swallow was an owner-user of the building, the functional use test applies. Thus, Swallow's use of the replacement property and of the involuntarily converted property must be the same. Since Swallow’s use of the four-unit apartment building is different from the use of the building in her retail business, the apartment building does not qualify as replacement property. d. Since Susan and Rick are owner-users, the functional use test applies. The rental duplex does not qualify as replacement property under this test. pp. 7-27 to 7-29 33. There are two issues that need to be addressed. The first is whether both Steve and Ross can qualify for deferral treatment under § 1033. The second is the manner in which Ross behaved in acquiring the property. The resolution of the first issue for Ross is straightforward. As he is aware that the property is going to be condemned, he could qualify for deferral under § 1033(a)(2) even if he sold the property to someone other than the condemning authority. Since his intent is to sell to the condemning authority, he obviously qualifies. For Steve, the earliest date he can sell his property to Ross and qualify for deferral treatment is the date of the threat or imminence of requisition or condemnation of the property. Even though he does not appear to be aware of such a threat or imminence at the time of the sale to Ross, unless Ross informs him, it is unlikely the IRS would question his qualification for § 1033. However, he does not need to use § 1033. He can qualify for exclusion under § 121 since the house is his principal residence. The manner in which Ross conducted his affairs initially raises serious questions. At the least, Ross has been less than truthful. While the property is being purchased by a 7-16 2003 Entities Volume/Solutions Manual corporation, Ross failed to disclose that he and his spouse own the corporation. In addition, Ross failed to disclose that the property is going to be subject to condemnation proceedings. Finally, Ross may be violating realtors' ethical standards which could result in sanctions. Making another proposal based on his “second thoughts” would put Ross in a much better ethical position. In all likelihood, Steve will sell the property to him anyway. pp. 7-27 to 7-31 34. a. Amount realized Adjusted basis Realized gain $390,000 (210,000) $180,000 Recognized gain $ -0- The transactions qualify for § 1033 involuntary conversion treatment. Thus, since Lark Corporation reinvested the $390,000 of insurance proceeds received in qualifying property, all of the $180,000 realized gain is postponed. Lark’s basis for the replacement office building is $210,000 [$390,000 (cost) $180,000 (postponed gain)]. b. Amount realized Adjusted basis Realized gain $390,000 (210,000) $180,000 Recognized gain $180,000 The transactions do not qualify for § 1033 involuntary conversion treatment. Lark did not reinvest any of the insurance proceeds received in qualifying property (i.e., an office building and a warehouse are not similar property under the functional use test). Lark’s basis for the replacement office building is $350,000. c. Amount realized Adjusted basis Realized gain $390,000 (210,000) $180,000 Recognized gain $180,000 None of the realized gain is postponed because Lark did not acquire qualifying replacement property. pp. 7-27 to 7-31 Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges 35. a. 7-17 Magenta’s realized gain is calculated as follows: Amount realized Adjusted basis Realized gain $450,000 (300,000) $150,000 Since the form of the involuntary conversion is a direct conversion (i.e., a warehouse for a warehouse), § 1033 nonrecognition is mandatory. Thus, none of the realized gain of $150,000 is recognized. Magenta 's basis for the replacement warehouse is $300,000 ($450,000 fair market value - $150,000 postponed gain). b. As indicated in part (a), since the form of the involuntary conversion is a direct conversion, § 1033 nonrecognition is mandatory. What Magenta should have done was not have accepted the surplus warehouse, but instead to have negotiated for cash. Then, they could have achieved their objective of recognizing gain by not electing § 1033 treatment. pp. 7-27 to 7-30 36. a. Postponed gain = $-0-. The $40,000 realized gain is recognized because the amount that the taxpayer reinvested is only $100,000. Basis = $100,000 - $0 = $100,000. b. Postponed loss = $-0-. The casualty loss is recognized. Basis = $200,000 - $0 = $200,000. c. Postponed gain = $50,000. Basis = $350,000 - $50,000 = $300,000. d. Postponed loss = $-0-. The $2,000 casualty loss is recognized, less the $100 floor = $1,900. The $1,900 must be reduced further by 10% of adjusted gross income. This 10% floor is applied to the total of casualty losses that are deductible for the taxable year rather than to each casualty. Basis = $17,000 - $0 = $17,000. e. Postponed gain = $80,000. Basis = $240,000 - $80,000 = $160,000. f. Postponed gain = $1,000. Basis = $19,000 - $1,000 = $18,000. Note that better tax consequences could be obtained if the § 121 exclusion requirements are satisfied. g. Loss is nondeductible. Basis = $26,000 - $0 = $26,000. h. Postponed gain = $50,000. Basis = $200,000 - $50,000 = $150,000. pp. 7-27 to 7-30 37. a. Milton’s amount realized is calculated as follows: Selling price Less selling expenses: Realtor’s commission Appraisal fee Exterminator’s certificate Recording fees Amount realized $245,000 $14,000 500 300 400 ( 15,200) $229,800 7-18 2003 Entities Volume/Solutions Manual Amount realized Adjusted basis Realized gain § 121 exclusion Recognized gain $229,800 (150,000) $ 79,800 ( 79,800) $ -0- Milton qualifies for the § 121 exclusion. b. Milton’s basis for his new residence is its cost of $210,000. c. Amount realized ($735,000 - $15,200) Adjusted basis Realized gain § 121 exclusion Recognized gain $719,800 (150,000) $569,800 (250,000) $319,800 Since Milton is single, his maximum § 121 exclusion is $250,000. Milton’s basis for his new residence is its cost of $210,000. p. 7-33 38. a. Amount realized Adjusted basis Realized gain Recognized gain $80,000 (35,000) $45,000 $ 0 Realized gains or realized losses on property transactions between spouses are not recognized. b. Sal’s adjusted basis for the Peach stock is a carryover basis of $35,000 (i.e., for basis purposes, the transaction is treated as a gift). c. The tax consequences would be the same as in (a) and (b) if Ruth had made a gift of the stock to Sal. Since the sale form and the gift form produce the same tax consequences, the key is whether Sal wants to transfer the $80,000 to Ruth. p. 7-33 BRIDGE DISCIPLINE PROBLEMS 1. a. Book depreciation [($100,000 - $12,000) 8 X ½] $ 5,500 The straight-line method is used for book purposes because the asset is expected to benefit Blue evenly throughout its 8-year life. Tax depreciation ($100,000 X .20) – see Table 4-1 b. $20,000 The book-tax difference in the year of acquisition is $14,500 ($20,000 - $5,500). That is, depreciation for tax purposes is $14,500 higher than depreciation expense for book purposes. Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges 2. Book depreciation Year 1 [($100,000 - $12,000) 8 X ½] Year 2 [($100,000 - $12,000) 8] Year 3 [($100,000 - $12,000) 8] Year 4 [($100,000 - $12,000) 8] Year 5 [($100,000 - $12,000) 8] Year 6 [($100,000 - $12,000) 8] Year 7 [($100,000 - $12,000) 8 X ½] Total accumulated depreciation $ 5,500 11,000 11,000 11,000 11,000 11,000 5,500 $ 66,000 Amount realized Adjusted basis for book purposes ($100,000 - $66,000) Gain for book purposes $ 40,000 ( 34,000) $ 6,000 Tax depreciation - See Table 4-1 Year 1 ($100,000 X .20) Year 2 ($100,000 X .32) Year 3 ($100,000 X .1920) Year 4 ($100,000 X .1152) Year 5 ($100,000 X .1152) Year 6 ($100,000 X .0576) Total accumulated depreciation $ 20,000 32,000 19,200 11,520 11,520 5,760 $100,000 Amount realized Adjusted basis for tax purposes ($100,000 - $100,000) Gain for tax purposes $ 40,000 ( 0) $ 40,000 7-19 Therefore, because the gain for book purposes is $6,000 and the gain for tax purposes is $40,000, the book-tax difference is $34,000. 3. a. Yes. b. No. Inventory does not qualify as productive use or investment property. c. No. An exchange of investment realty for a personal residence does not qualify. d. No. Securities do not qualify as productive use or investment property. e. Yes. f. No. Although the truck and the computer both are business personalty, they are not in the same general business asset class. g. Yes. h. No. Stock in different corporations does not qualify as like-kind property under § 1031. i. Yes. The office furniture and office equipment both are personalty and they are in the same general business asset class. j. No. Real property located in the United States exchanged for foreign real property (and vice versa) does not qualify as like-kind property. 7-20 2003 Entities Volume/Solutions Manual pp. 7-22 and 7-23 RESEARCH PROBLEMS 1. Beverly’s recognized gain on the sale of the 6,000 shares of Color, Inc. is $90,000. She may use the specific identification method to identify the shares sold. Concord Instruments Corporation, 67 TCM 3036, T.C. Memo. 1994-248, in a similar fact pattern, concluded that the oral instructions to the broker to sell the stock with the highest cost basis constituted adequate identification of the shares. Reg. § 1.107-1(c)(3) provides that stock is adequately identified if (1) the taxpayer specifies the particular stock to be sold at the time of the sale, and (2) the broker confirms in writing the taxpayer's instructions within a reasonable period of time. The IRS position, in Concord, was that the broker did not provide a written confirmation of the taxpayer's instructions as required by this regulation. Therefore, in determining the amount of the recognized gain, the FIFO basis must be used to determine the cost basis of the shares sold. The taxpayer's response was to admit the regulation requirement was not satisfied, but to take the position that alternatives exist to the method prescribed in the regulations for identifying shares of stock sold. The taxpayer's position was based on alternatives provided in case law which preceded Reg. § 1.107-1(c)(3). The Tax Court accepted the taxpayer's argument. It concluded that the current regulations do not state that they provide the exclusive means for identifying the shares of stock sold. Instead, the regulations merely provide a safe harbor. Adequate identification can occur in other ways. Therefore, the Tax Court permitted the taxpayer to use the specific identification method. 2. Amos’ realized gain is calculated as follows: Amount realized – Basis = Realized gain $100,000 (10,000) $ 90,000 Since the stock that Amos sold is qualified small business stock and since he held the stock for over six months, Amos is eligible to elect § 1045 deferral treatment. To comply under § 1045, he must reinvest the $100,000 net proceeds in qualified small business stock within 60 days of the sale. Rev. Proc. 98-48, 1998-2 C.B. 367, contains the mechanics for making the election. Amos must make the election by his tax return due date (including extensions) for the year in which the qualified small business stock is sold. The election is made by: Reporting the entire gain from the sale of the qualified small business stock on Schedule D. Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges 7-21 Writing “Section 1045 rollover” directly below the line on which the gain is reported. Entering the amount of the gain deferred under § 1045 on the same line on which “section 1045 rollover” appears as a loss in accordance with the instructions for Schedule D. If Amos should decide not to make the § 1045 deferral election, his recognized gain would be $90,000 and the basis for his new stock would be its § 1012 cost of $100,000. If Amos does make the election, his recognized gain is $0 (i.e., he has no reinvestment deficiency since he reinvested the $100,000 amount realized from the sale of the qualified small business stock). His basis for the new stock would be $10,000 ($100,000 amount realized - $90,000 deferred gain). 3. Section 1031 provides that a deferred exchange of like-kind property is eligible for postponement of gain if the following requirements are satisfied: The property to be received is identified within 45 days of the date the taxpayer transfers his or her property to the other party to the exchange. The identified property is received by the taxpayer by the earlier of the following: 180 days of the date the taxpayer transfers his or her property to the other party to the exchange. The due date for the tax return (without extensions). In a case (David A. Knight, 75 TCM 1992, T.C. Memo. 1998-107) with facts similar to those for Fran and Bob, the Tax Court applied a strict interpretation to the statutory language for deferred exchanges under § 1031. Thus, Fran and Bob will have recognized gain calculated as follows: Amount realized Adjusted basis Realized gain Recognized gain $75,000 (20,000) $55,000 $55,000 Their basis for the Houston parcel will be its fair market value of $75,000. 7-22 4. 2003 Entities Volume/Solutions Manual The Internet Activity research problems require that the student access various sites on the Internet. Thus, each student’s solution likely will vary from that of the others. You should determine the skill and experience levels of the students before making the assignment, coaching them where necessary so as to broaden the scope of the exercise to the entire available electronic world. Make certain that you encourage students to explore all parts of the World Wide Web in this process, including the key tax sites, but also information found through the web sites of newspapers, magazines, businesses, tax professionals, government agencies, political outlets, and so on. They should work with Internet resources other than the Web as well, including newsgroups and other interest-oriented lists. Build interaction into the exercise wherever possible, asking the student to send and receive e-mail in a professional and responsible manner. 5. See the Internet Activity comment above.