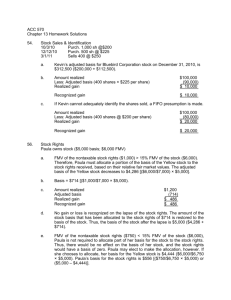

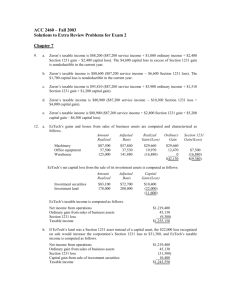

Chapter 12

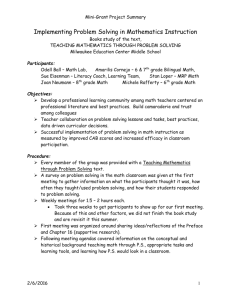

advertisement