Credit Card Exercise - High Point University

advertisement

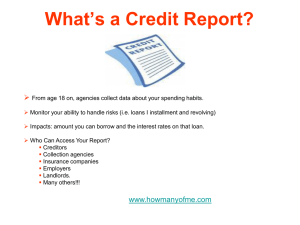

Credit Card Exercise For each scenario, answer the following questions: 1. What card would you recommend (e.g., grace period, annual fee, APY)? Why? 2. What other financial advice do you have for the individual? Scenario 1: Jane 1. average credit—tends to pay bills on time but occasionally late; credit score of 600; 620-650 is average. 2. Current card: 18% annual, credit limit of $12,000 3. Typically, carries a credit card balance of $10,000 4. Rents- $700 per month 5. Car payment of $300, 2 years remaining, 6% interest rate 6. Income: $30,000 per year 7. Average annual purchases on a credit card: $7,000 Scenario 2: Fred 1. 2. 3. 4. excellent credit—always pays bills on time; credit score of 750 Current card: credit limit $7,000 Always pays off credit card debt every month Owns home: mortgage payment, $750 per month; home equity of $30,000, no balance at this time, interest rate at prime + 1% (6.5%). Prime is 5.5% now. 5. Car payment of $450, 3 years remaining, 6.5% interest rate 6. Income: $90,000 per year 7. Average annual purchases on a credit card: $40,000 Scenario 3: George 1. poor credit—credit score of 400 2. 10 visa/master card credit cards: Seven have no balances. Credit limits average $5,000. Three cards have average balances of $4,000 with limits of $10,000. All cards have a 16% rate. One card is over 30 days late; two cards are 75 days late. 3. Every time there is a good deal for a credit card at a retailer, George applies. He has 13 retail credit cards. The retail credit cards have average balances of $100. 4. Move every year—current rent $450 5. No car payment 6. Income: $45,000 per year 7. Average annual purchases on a credit card: $12,000 1. You are applying for a $10,000, 48 month auto loan. If you have a FICO/credit score of 730, rate = 4.96%. If FICO score equals 719, rate = 5.64%. How much less will your payment be with the lower FICO score? If you are in the 25% marginal tax bracket, how much will you save on a monthly basis? Assume state income taxes = 0. 2. How can you reduce the chance of identity theft?