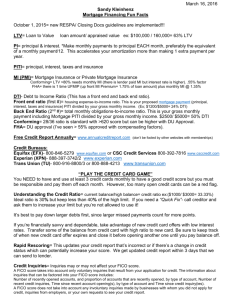

Your Credit Report

advertisement

FIN 200: Personal Finance Topic 8-Credit I Lawrence Schrenk, Instructor 1 (of 37) Learning Objectives 1. 2. 3. Discuss the sources and uses of credit in personal finance.▪ Explain how your credit score is calculated and how you maintain a good credit rating. Describe how to avoid identity theft.▪ 2 (of 37) Types of Borrowing 3 (of 37) Types and Sources of Credit Three Types Specific Type Purchase Non-Installment ■ Installment ■ Revolving Long Term Multiple Payments ■ ■ ■ ■ Time Limit ■ ■ 4 (of 37) Payments Patterns Interest then Principal $1,600 $1,400 $1,200 $1,000 $800 $600 $400 $200 $0 1 2 3 4 5 6 5 (of 37) Payments Patterns Interest and Principal Simultaneously Amoritization Schedule $1,600 $1,400 $1,200 Value $1,000 $800 $600 $400 $200 $0 1 27 53 79 105 131 157 183 209 235 261 287 313 339 Months Monthly Interest Principal Repayment 6 (of 37) Possible Advantages of Credit 1. 2. 3. 4. 5. 6. 7. 8. Purchase of expensive items Emergency funds Tax savings Anticipate a price increase Convenience Delay payment without interest Avoid carrying cash Spending record 7 (of 37) Possible Disadvantages of Credit 1. 2. 3. 4. 5. Excess spending Increased cost of purchase Excessive debt Increased monitoring Identity theft 8 (of 37) ‘Good’ versus ‘Bad’ Debt Good Debt–Investment Home Education Car Improvements increasing value of home Borrowing at lower interest rate to reduce credit card debt Bad Debt–Consumption 9 (of 37) Credit Bureaus, Ratings and Reports 10 (of 37) Credit Bureaus Central Collection of Credit Information Three Main Credit Bureaus Experian Equifax, and TransUnion (Credit Report Guide) Independent May have different information and provide different scores 11 (of 37) Example Credit Report 12 (of 37) Credit Report, Part I Identifying Information includes: Name Alias or AKA (Also Known As) Current and previous addresses Social Security number Telephone number Date of birth Current and previous employers 13 (of 37) Credit Report, Part 2 Credit History provides an ongoing historical and current record of a consumer's buying and payment activities, including accounts such as: Retail stores Banks Finance companies Mortgage companies 14 (of 37) Credit Report, Part 3 Public Records include: Tax liens Court judgments (including child support judgments) Bankruptcies 15 (of 37) Credit Report, Part 4 Inquiries include: Regular inquiries: Credit grantors and other authorized parties who have requested a copy of the consumer's credit report with a legally permissible purpose. Account review inquiries: Credit grantors with whom a consumer has an existing relationship and who are permitted to periodically review the information. Promotional Inquiries: Companies, with a legally permissible purpose, that have obtained certain limited information about a consumer, such as name and address, in order to send targeted, mutually beneficial firm offers of credit or insurance. 16 (of 37) Credit Score–FICO Credit Score–FICO Median US score is 723 Range 300-850 17 (of 37) FICO–Payment History Account payment information Presence of adverse public records Credit cards, retail accounts, installment loans, etc. Bankruptcy, judgments, suits, liens, wage attachments, etc. Severity of delinquency Amount past due Time Number of past due items on file Number of accounts paid as agreed 18 (of 37) FICO–Amounts Owed Amount owing on accounts Amount owing on specific types of accounts Lack of a specific type of balance, in some cases Number of accounts with balances Proportion of credit lines used Proportion of installment loan amounts still owing 19 (of 37) FICO–Length of Credit History Time since accounts opened Time since accounts opened by specific type of account Time since account activity 20 (of 37) FICO–New Credit Number of recently opened accounts, ... Number of recent credit inquiries Time since recent account opening(s)... Time since credit inquiry(s) Re-establishment of positive credit history following past payment problems 21 (of 37) FICO–Types of Credit Used Number of (presence, prevalence, and recent information on) various types of accounts Credit cards, Retail accounts, Installment loans, Mortgage, Consumer finance accounts, etc. 22 (of 37) Financial Impact of FICO Score Calculator 23 (of 37) Your Credit Report Get and check your free credit report from each agency at AnnualCreditReport.com. Each credit report; one per year Do not use any other web site; do not get it from the guy playing the guitar on the TV commercial! 24 (of 37) Further Information Web Pages MyFICO.com Pamphlets Understanding your FICO® score (MyFICO.com) Your Credit Scores (MyFICO.com) Credit Report Guide (TransUnion) 25 (of 37) Identity Theft 26 (of 37) Identity Theft–Why Worry? Loss of Money Credit Score Weakened Difficulty Opening New Accounts Fraudulent Criminal Record 27 (of 37) Some Key Information Social Security Number Driver’s License Number Bank/Credit Card Account Numbers PIN Numbers/Passwords Date of Birth 28 (of 37) Weak Points–Your Mail Mailbox with Lock Outgoing Mail in Postal Box Shredder (Cross-Cut or Micro) Mail with Personal Information ‘Pre-Approved’ Credit Applications 29 (of 37) Weak Points–Personal Information Don’t Give Out Social Security Number Don’t Carry Social Security Card or Use it on Checks, IDs, etc. Outgoing Mail in Postal Box Shredder (Cross-Cut) Documents with Personal Information Keep List of Important Data Account Numbers Telephone Numbers, etc. 30 (of 37) Weak Points–Computer Avoid Obvious Passwords, e.g., Birthday Don’t Send Sensitive Information in E-Mails Especially if Requested Suspect Links in E-Mail and Attachments Don’t Keep Passwords on your Computer Password Protect Laptop, Flash Drives, Back-Up Drives Sensitive Documents 31 (of 37) Computer Software Anti-Virus Anti-Spyware Anti-Spam Firewall MyIDProtector 32 (of 37) Active Measures Check Credit Card/Bank Account Statements Check Credit Reports www.AnnualCreditReport.com Consider Credit Monitoring Consider Identity Theft Insurance Regularly Online NOTE: Terms, Coverage and Reimbursement Varies Watch for the Unexpected: Credit Cards, Account Statements, Denials of Credit, etc. 33 (of 37) Further Information Federal Trade Commission Identity Theft Resource Center (non-profit) Identity Theft and You (MyFICO.com) 34 (of 37) Project Notes 35 (of 37) Ethical Dilemma Rita is a medical office manager, and her brother, Juan has recently begun work for a health insurance company. Juan asks Rita if she will provide him with a list of all the doctors' patients who do not currently have health insurance, and she runs the list that includes names, addresses, telephone numbers, Social Security numbers, and brief medical histories. a. Is Rita acting ethically? Explain. b. What problems could Rita be creating for the practice's patients? 36 (of 37)