Explanation of Deferred Tax Expense and Benefits: The amount of

advertisement

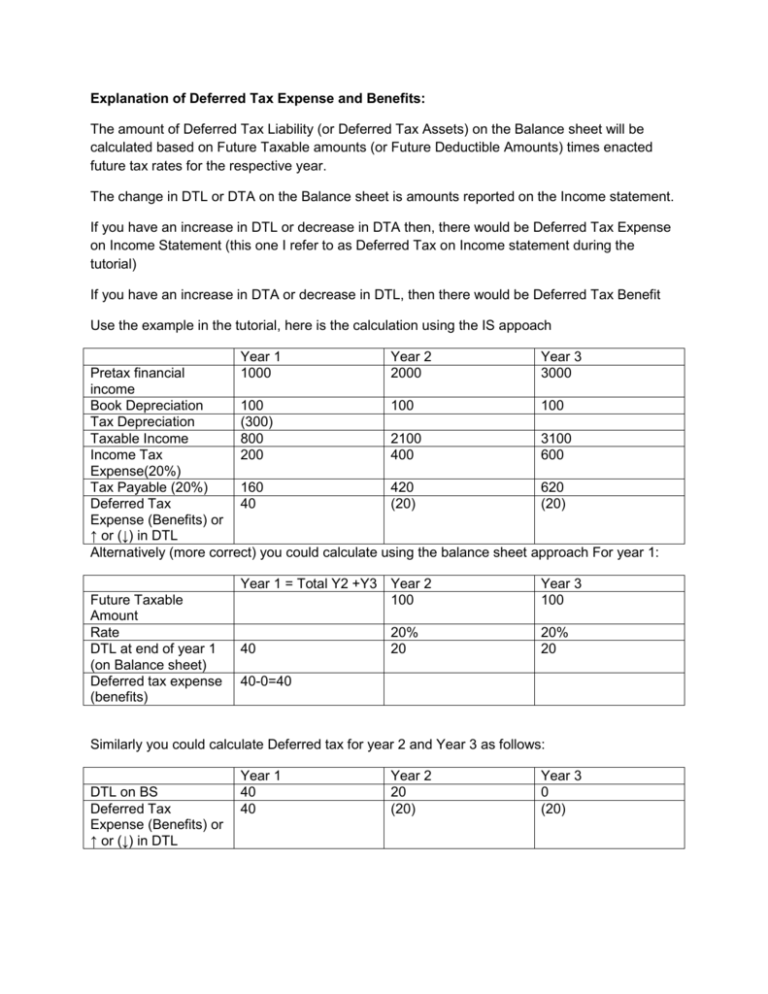

Explanation of Deferred Tax Expense and Benefits: The amount of Deferred Tax Liability (or Deferred Tax Assets) on the Balance sheet will be calculated based on Future Taxable amounts (or Future Deductible Amounts) times enacted future tax rates for the respective year. The change in DTL or DTA on the Balance sheet is amounts reported on the Income statement. If you have an increase in DTL or decrease in DTA then, there would be Deferred Tax Expense on Income Statement (this one I refer to as Deferred Tax on Income statement during the tutorial) If you have an increase in DTA or decrease in DTL, then there would be Deferred Tax Benefit Use the example in the tutorial, here is the calculation using the IS appoach Year 1 Year 2 Year 3 Pretax financial 1000 2000 3000 income Book Depreciation 100 100 100 Tax Depreciation (300) Taxable Income 800 2100 3100 Income Tax 200 400 600 Expense(20%) Tax Payable (20%) 160 420 620 Deferred Tax 40 (20) (20) Expense (Benefits) or ↑ or (↓) in DTL Alternatively (more correct) you could calculate using the balance sheet approach For year 1: Future Taxable Amount Rate DTL at end of year 1 (on Balance sheet) Deferred tax expense (benefits) Year 1 = Total Y2 +Y3 Year 2 100 40 20% 20 Year 3 100 20% 20 40-0=40 Similarly you could calculate Deferred tax for year 2 and Year 3 as follows: DTL on BS Deferred Tax Expense (Benefits) or ↑ or (↓) in DTL Year 1 40 40 Year 2 20 (20) Year 3 0 (20) Correction for Problem 15.14 Diclosure of the Deferred Tax Asset and the Allowance to Reduce DTA to Expected Realizable Value would be as follows as at the end of 2008: Balance sheet Assets: Deferred Tax Assets 180,000 (This is corrected figure) Less Allowance tor Reduce DTA to ERV (30,000) Deferred Tax Assets (net) 150,000