GSA 548

advertisement

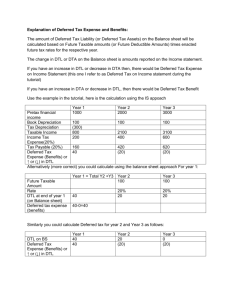

GSA 548 Provision for Income Tax Expense Oct. 9, 2103 Why is this in GSA 548? Why is this important? • ASC 740 • FAS 109 • FIN 48 • Schedule M schedule M 20x1 Gross revenues Cost of goods sold Total income (loss) items U.S. current income tax expense U.S. deferred income tax expense Fines and penalties Deferred compensation Depreciation Bad debt exense Total expense/deduction items Net income to taxable income Income(Loss) per Temporary Permanent Income(Loss) per Income Statement Difference Difference Tax Return 8,000.00 -6,075.00 1,925.00 -266.67 -63.33 -50.00 0.00 -1,000.00 -100.00 -1,480.00 445.00 75.00 75.00 0.00 266.67 8,000.00 -6,000.00 2,000.00 63.33 50.00 0.00 -333.33 100.00 -170.00 -95.00 316.67 316.67 0.00 0.00 -1,333.33 0.00 -1,333.33 666.67 Objective 1. To recognize the amount of taxes payable or refundable for the current year 2. To recognize deferred tax liabilities and deferred tax assets for the future tax consequences of events that have been recognized in an entities financial statements or tax returns Financial Statement Presentation • Current • Non current • Different jurisdictions mechanics Book Accounts receivable less Inventory less Machine less Bonus payable DIFFERENCE from book to Tax debit credit Tax Basis DTA 500.00 100.00 400.00 100.00 500.00 40.00 1,000.00 75.00 925.00 75.00 1,000.00 30.00 4,000.00 1,000.00 3,000.00 333.33 2,666.67 < 0.00 > 0.00 deferred income tax expense DTL 133.33 0.00 70.00 63.33 133.33 Book Accounts receivable less Inventory less Machine less Bonus payable DIFFERENCE from book to Tax debit credit Tax Basis DTA 325.00 105.00 220.00 105.00 325.00 42.00 910.00 85.00 825.00 85.00 910.00 34.00 4,000.00 2,000.00 2,000.00 < 150.00 > 1,111.11 150.00 888.89 0.00 DTL 444.44 60.00 136.00 444.44 Book Accounts receivable less Inventory less Machine less Bonus payable DIFFERENCE from book to Tax debit credit Tax Basis DTA 400.00 130.00 270.00 130.00 400.00 52.00 820.00 95.00 725.00 95.00 820.00 38.00 4,000.00 3,000.00 1,000.00 < 350.00 > 703.70 350.00 296.30 0.00 DTL 281.48 140.00 230.00 281.48 Book Accounts receivable less Inventory less Machine less Bonus payable DIFFERENCE from book to Tax debit credit Tax Basis DTA 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 4,000.00 4,000.00 0.00 < 0.00 > 0.00 0.00 0.00 0.00 DTL 0.00 0.00 0.00 0.00 Valuation Allowance 740-10-30-5(e) • Reduce DTA by a valuation allowance if, …, it is more likely than not (…) that some portion or all of the DTA will not be realized. The valuation allowance shall be sufficient to reduce the DTA to the amount that is more likely than not to be realized. Valuation Allowance Deferred Tax Asset Accounts receivable (net) Inventory (net) Bonus payable Deferred Tax Liabilities Accelerated depreciation Deferred Tax Asset valuation allowance 100.00 125.00 150.00 375.00 250.00 125.00 Valuation Allowance Possible Outcome $125.00 $100.00 $75.00 $50.00 $25.00 Probability of Occurring 25% 20% 20% 20% 15% Cumulative Probability 25% 45% 65% 85% 100% Valuation Allowance 740-10-45-5 • The valuation allowance for a particular tax jurisdiction shall be allocated between current and noncurrent deferred tax assets …. On a pro rata basis. Uncertain Tax Position FIN 48 Uncertain Tax Position FIN 48 740-10-25-6 An entity shall initially recognize the financial statement effects of a tax position when it is more-likely-than-not, based on the technical merits, that the position will be sustained upon examination. Uncertain Tax Position FIN 48 740-10-30-7 A tax position that meets the morelikely-than-not recognition threshold shall initially and subsequently be measured as the largest amount of the tax benefit that is greater than 50% likely of being realized upon settlement Possible Outcome $100.00 $80.00 $60.00 $40.00 $20.00 Probability of Occurring 25% 20% 20% 20% 15% Cumulative Probability 25% 45% 65% 85% 100%